- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

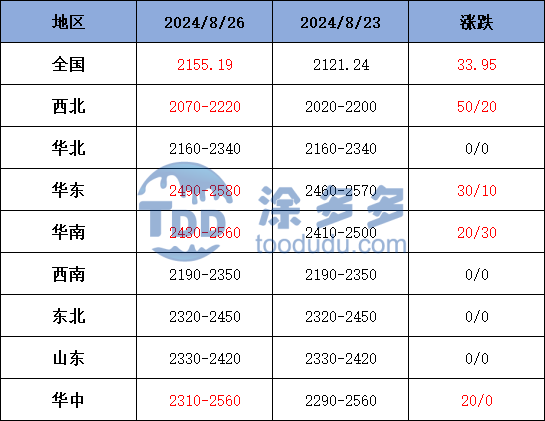

On August 27th, the methanol market price index was 2155.19, up 33.96 from the previous working day and 1.6 per cent higher than the previous working day.

Outer disk dynamics:

Methanol closed on August 23:

China's CFR ranges from US $291 to US $293 per ton, down US $3 per ton.

Us FOB 105-106cents per gallon, flat

CFR in Southeast Asia: us $345-346 per ton, Ping

European FOB 336-337 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2180-2220 (10), North: 2070-2110 (50), South: 2110 (60), Lunan: 2370-2380 (0), Henan: 2310-2350 (20), Shanxi: 2160-2270 (0), Port: 24902500 (30)

Freight:

North Route-Northern Shandong 230-270 (- 15 Uniqure 20), Northern Route-Southern Shandong 320-340 (0amp 0), Southern Route-Northern Shandong 230-250 (- 20 amp Mueller 20), Guanzhong-Southwest Shandong 160-240 (0max 0)

Spot marketToday, methanol futures are up synchronously. With the improvement of downstream market demand, most operators in the market are more willing to hold goods, and the main contract price of methanol is fluctuating upward, supporting the mentality of the manufacturers to improve to a certain extent. The bidding situation of manufacturers in China's main producing areas is getting better, mostly at a premium. Specifically, the market prices in the main producing areas are fluctuating upstream, with the quotation on the south line around 2110 yuan / ton, and the price on the north line around 2070-2110 yuan / ton, with a low-end increase of 60 yuan / ton. with the improvement of downstream market demand, the market transaction atmosphere is good, and the futures market is strong and volatile, some downstream and traders store low-price replenishment operations, and the main enterprises are mainly auctioned at a premium. The market prices in Shandong, the main consumer area, are arranged in a narrow range, with 2370-2380 yuan / ton in southern Shandong and 2330-2350 yuan / ton in northern Shandong. The futures market is strong and volatile, and the mentality of the operators in the market is supported, but the rigid demand for transactions in the downstream market continues mainly, and the shipments of some manufacturers are slightly general. North China market quotation arrangement and operation, Hebei quotation today 2260-2340 yuan / ton, most enterprises inventory is not high, low warehouse support under the strong desire to raise the price; Shanxi quotation today 2160-2270 yuan / ton, maintain yesterday, the regional market negotiable supply has been reduced, the supply side is good to support manufacturers to raise the price mentality.

Port marketToday, methanol futures are on the strong side. There are few spot negotiations. Month on-demand procurement, long-term arbitrage negotiations, some high shipments, the basis is slightly weaker. The overall deal was average. Taicang main port transaction price: 8 under deal: 2490-2500, base difference 01-30 pictures25 position 9 on deal: 2500-2510, base difference 01-25 picturesque 20 position 9 transaction: 2520-2530, base difference 01-5 Maxima 2 cross 10 deals: 2550-2560, basis difference 01-2560.

Future forecast:Recently, the strong operation of the main contract price of methanol has led to an improvement in the mentality of the market operators to a certain extent, the quotation in the Chinese market has gone up synchronously, and olefin units such as Jiutai and Nanjing Chengzhi have been restarted smoothly, and the downstream demand of the main force has been supported to a certain extent. And with the arrival of the "Golden Nine Silver 10", some traditional downstream markets are slowly recovering, and the terminal demand is OK for the overall performance. At present, the strong operation of the international crude oil price has led to the strong operation of the main contract price of methanol, and the Chinese and spot prices have risen at the same time. It is expected that the methanol market price will fluctuate at a high level in the short term, but we should pay attention to the coal price in the later stage, the operation of the plant in the field and the follow-up of the downstream demand.