- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5542, highest price: 5676, lowest price: 5527, position: 813932, settlement price: 5594, yesterday settlement: 5561, up 33, daily trading volume: 1062106 lots, precipitated capital: 6.225 billion, capital inflow: 56.45 million.

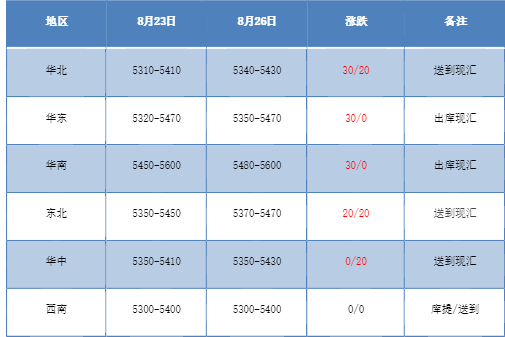

List of comprehensive prices by region: yuan / ton

PVC spot market:Mainstream transaction prices in China's PVC market rose slightly, especially in the afternoon. Compared with the valuation, the low end of North China rose 20-30 yuan / ton, the low end of East China increased 30 yuan / ton, the low end of South China rose 30 yuan / ton, the northeast region rose 20 yuan / ton, the high end of Central China rose 20 yuan / ton, and the southwest region was stable. The ex-factory prices of upstream PVC production enterprises mostly remained stable, with a small drop of 30 yuan / ton in individual enterprises. The trend of the futures price is good, and there is a situation that continues to rise throughout the day. The morning offer in the spot market has not changed much compared with last Friday, and there is even a low yield, and the spot price and spread offer coexist. Among them, the base difference offer 01 contract in East China-(150-250), the 01 contract in South China-(0-50), the 01 contract in the North-(330-400), and some low-price supply in Southwest China-01 contract-(510). After the afternoon price upward, the spot market merchants tentatively overstated the price, but the downstream feedback was relatively insipid, and the wait-and-see heart was strong, and the spot market transaction began at the beginning of the week to maintain rigid demand.

From the perspective of futures:The night price of PVC2501 contract opened slightly volatile and rose slightly in late trading. Futures prices continued to be sorted out in a small range after the start of morning trading on Monday, and the price rose in the morning, rose in the afternoon and closed higher in late trading. 2501 contracts fluctuated from 5527 to 5676 throughout the day, with a spread of 149. 01 contracts reduced their positions by 2926 lots, with 813932 positions so far, 2409 contracts closing at 5491 and 189279 positions.

PVC Future Forecast:

In terms of futures:PVC2501 contract prices performed well on Monday, with overall prices rising slightly, especially in late afternoon trading. The volatility range of futures prices has also expanded. In terms of transactions, the opening rate of 23.8% is higher than that of empty opening of 23.5%, but the empty level is increasing, of which 24.8% is higher than 23.3%. The all-day price closed at the positive pillar, the technical level shows that the Bollinger belt (13, 13, 2) three tracks narrowed, the recent price fluctuations have been repeated. However, the KD line and MACD line of the 2501 contract daily line level show a golden fork trend. from the current time node, there is still a certain expectation about the trend of the disk futures price. In the short term, the operation of the futures price continues to observe the performance of the mid-track 5550-5750 range.

Spot aspect:In view of the expansion of the volatility range of the futures price and the lack of follow-up of the feedback in the spot market, the futures are now out of touch. It can also be seen from the increase that the increase in the futures market is far ahead of the spot market, and the trading volume in the spot market is light after the price increase, and the enthusiasm of inquiry has declined. From the midline point of view, the current time node gold nine silver ten is coming, but the current response of commodities is insufficient, especially the PVC plate does not show obvious factors. Therefore, whether it is the rise of the futures market or the spot market has always been lack of sufficient support, resulting in repeated prices. PVC fundamentals calcium carbide prices rose slightly, VCM monomer Taixing Xinpu down300 today factory 5150-5250 acceptance week pricing, supply and demand level does not see new ideas. On the whole, the spot market will still be mainly sorted out on a small scale in the short term, but we think there are certain expectations in the midline market.