- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2501 contract opening price: 5601, highest price: 5712, lowest price: 5591, position: 722576, settlement price: 5629, yesterday settlement: 5579, up 50, daily trading volume: 647059 lots, precipitated capital: 2.888 billion, capital inflow: 191 million.

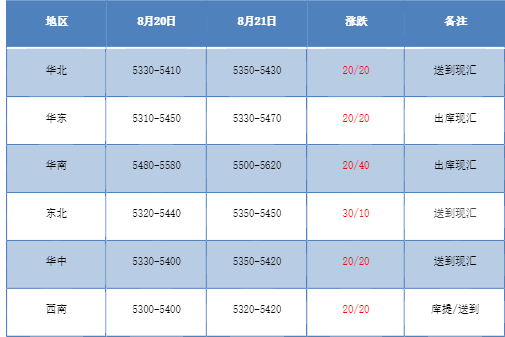

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price in China's PVC market showed a rising performance, running upward from the low point. Compared with the valuation, it rose 20 yuan / ton in North China, 20 yuan / ton in East China, 20-40 yuan / ton in South China, 10-30 yuan / ton in Northeast China, 20 yuan / ton in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprises part of the factory price increase 20-30 yuan / ton, some maintain wait-and-see. The trend of the futures market closed higher in the afternoon, so the early quotation in the spot market was maintained, and the merchants basically adjusted the quotation in the afternoon. At present, the spot price and the mouthful price coexist, but after the futures price goes up, the spot price advantage has declined. Among them, East China base offer 01 contract-(250), South China 01 contract-(0-50), North 01 contract-(430), some low-priced sources in Southwest China heard 01 contract-(570). On the whole, the volatility range of today's spot market is slightly higher than that of yesterday, and the price offer of traders has been slightly raised, but the transaction is light, and the purchasing enthusiasm in the lower reaches is not high.

From the perspective of futures:The night price of the PVC2501 contract is arranged in a narrow range, and the fluctuation range of the futures price is narrowed. After the beginning of morning trading, the futures price is still mainly in a small range, and the price trend in the afternoon rose, especially in the late afternoon. 2501 contracts fluctuated in the range of 5591-5712 throughout the day, with a spread of 121. 01 contracts with an increase of 34886 positions, with 722576 positions so far, 2409 contracts closing at 5539 and 300481 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2501 contract closed higher at the end of the day, and the market showed a rare uptrend, with 25.3% more than the short opening of 24.5%. The position of the contract continued to decrease significantly, and the market continued to change positions and change positions. 2501 contracts in the depressed operation, the recent continuous multi-single than empty single state, the technical level shows that the Bollinger belt (13, 13, 2) three tracks narrowed, the high price also successfully crossed the mid-track position upward. From the recent operation of futures prices, there has been a small continuous upward trend since the low point, and 2501 contract positions have also begun to increase significantly. There are certain repair expectations on the disk, as a whole, the short-term operation of the futures price is observed in the winding performance of rail 5650-5750.

Spot aspect:Today, there has been a comprehensive slight increase in spot market prices, especially in the afternoon, but there has been no obvious change in the trading atmosphere in the spot yard, and downstream product enterprises are still mainly purchasing with rigid demand. and after the price goes up, the enthusiasm of inquiry is reduced. From the perspective of PVC supply and demand, there are not many variables, the start-up load of the PVC plant is maintained, some devices are still being overhauled, and the downstream demand is lukewarm, although the current price adjustment in the two cities, but the current spot market has not shown the expectation of gold, silver and silver. The price of calcium carbide at the cost port has been further reduced. At present, the low price of calcium carbide has been quoted at 2350 yuan / ton. In the outer disk, the price of the international crude oil futures market fell for the third day in a row, dragged down by concerns about a slowdown in global oil demand and a decline in geopolitical risk premium. On the whole, the spot market may operate within the range after a small rise in the short term.