- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2409 contract opening price: 5489, highest price: 5503, lowest price: 5384, position: 707904, settlement price: 5444, yesterday settlement: 5497, down 53, daily trading volume: 669608 lots, precipitated capital: 2.673 billion, capital outflow: 786 million.

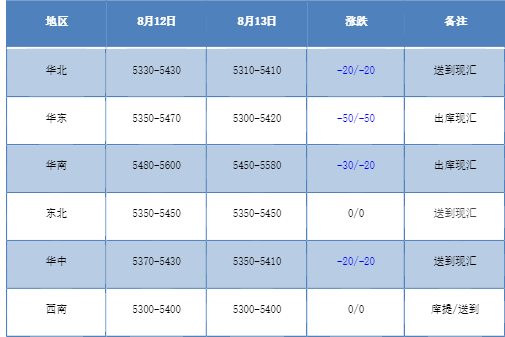

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market continued to decline, and the performance in the spot market was weak. Compared with the valuation, it fell by 20 yuan / ton in North China, 50 yuan / ton in East China, 20-30 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and stable in Southwest China. The ex-factory price of upstream PVC production enterprises is mostly reduced by 50 yuan / ton, and the contract signing is mainly based on the basic quantity. Futures futures prices weakened further, the spot market price continued to decline yesterday, the basis offer began to tend to 01 contract, of which East China spread offer 09 contract-(50-100-150), South China 01 contract-(80-150), North 01 contract-(400-500), Southwest 09 contract-480 or 01 contract-620. At present, the spot market quotation is relatively chaotic, in such a weak market, there is more room for profit negotiation, but even so, the downstream procurement enthusiasm has not been significantly improved, multi-rigid demand low order-based, transaction feedback is not good.

From the perspective of futures:PVC2409 contract night trading price opening small shock finishing, intraday range adjustment is not much. After the start of morning trading, the futures price even rose slightly, but the strength was not strong enough to fall, and the afternoon futures price weakened further and fell endlessly. 2409 contracts range from 5384 to 5503 throughout the day, with a spread of 119009 contracts reducing positions by 37790 lots, with positions so far of 707904 lots, 2501 contracts closing at 5575 and positions of 472558 hands.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract continued to refresh the low. The lowest point of the 09 contract, 5384, fell below the 5400 mark, and the 01 contract also hit a low of 5567 as we expected, approaching the low target of 5500. We have already mentioned the low point of the 01 contract in yesterday's forecast. Judging from the current trend of futures prices, the price of both reducing positions and increasing positions is in a continuous downward trend. Today, 37790 positions have been reduced in 09 contracts, but the futures price is still weak. in terms of transaction, the short opening is 22.7% compared with 18.7% more. in the market that continues to be weak, even if the futures price is low and refreshes the market, there is no multiple resistance, so we still maintain our early point of view in the short term. Observe the performance of 2501 contract low 5500 and 09 contract 5300-5400 range.

Spot aspect:The performance of the two cities continues to fall. First of all, the trend of the futures price continues to fall. In the overall plasticizing plate, the 3P basis is further expanded, and the role of PVC air distribution is unusually obvious. The spot market part of the factory price is less than 5000 yuan / ton, and the transaction has not improved significantly. It is difficult to stimulate a better transaction in the weakening market. From the supply and demand point of view, the start-up load of the PVC plant is stable, but in such a weak and falling market, there is no obvious reduction in start-up self-rescue, but if the market continues to perform like this, it is only a matter of time before the expected start-up rate drops. In addition, with the passage of time to change positions for months, but the current performance of the two cities, 09 contracts will be weak before the end, even if there is a certain repair market is expected not to be too large. Therefore, as a whole, the PVC spot market will still run in a low and weak market in the short term.