- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

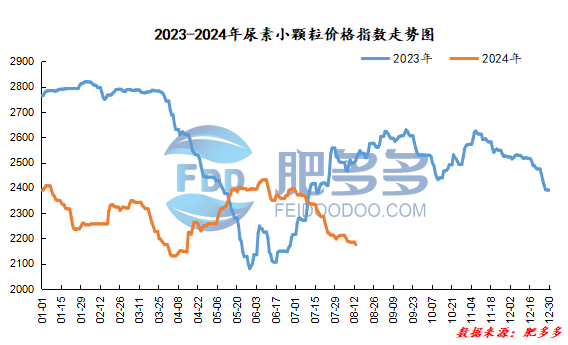

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on August 13 was 2,175.45, a decrease of 10.45 from yesterday, a month-on-month decrease of 0.48% and a year-on-year decrease of 13.24%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2052, the highest price is 2078, the lowest price is 2049, the settlement price is 2065, and the closing price is 2062. The closing price has increased by 14 compared with the settlement price of the previous trading day, up 0.68% month-on-month. The fluctuation range of the whole day is 2049-2078; the basis of the 09 contract in Shandong region is 58; the 09 contract has reduced its position by 7806 lots today, and so far, it has held 83445 lots.

Today, urea futures prices are mainly strong and volatile. Recently, the futures market has had a strong emotional reaction due to the impact of the seal mark and geopolitical risks in the Middle East, compounded by the problem of repairing the deposit basis for imminent delivery. However, in view of the weak fundamentals at the top and the relative restraint in policy suppression, the spot market has not yet formed excessive positive feedback, and the urea futures market may maintain a narrow range of shocks in the short term.

Spot market analysis:

Today, the domestic urea market price fell, the market's low-priced goods were traded well, and companies 'quotations were loose and orders were lowered. The overall market transaction activity was still low, and the market operation was deadlocked.

Specifically, prices in Northeast China fell to 2,130 - 2,170 yuan/ton. Prices in East China have stabilized at 2,100 - 2,150 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,110 - 2,300 yuan/ton, and the price of large particles has stabilized at 2,160 - 2,230 yuan/ton. Prices in North China fell to 2010- 2,160 yuan/ton. Prices in South China fell to 2,240 - 2,300 yuan/ton. Prices in the northwest region are stable at 2,170 - 2,230 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, the deals on new orders from manufacturers were average, and the deals on some low-end goods were still good. The company's quotations continued to be loose and lowered, and the offers were mixed. However, partly supported by pending orders, the offers tended to be firm, mostly pre-shipment orders. In terms of the market, market transaction activity is still limited, there is insufficient motivation for price increases, the atmosphere for new orders on the market is flat, operators are cautious in trading, and the short-term market is mainly weak and volatile, making it difficult to move upwards. On the supply side, the number of industry failures and maintenance equipment has increased since this week, and the daily output has dropped below 170,000 tons. In the short term, the supply side has shown a tightening trend, but corporate inventories still remain high. On the demand side, the demand side is increasing slowly, and the capacity utilization rate of downstream compound fertilizer factories is gradually increasing. The enthusiasm for purchasing raw material urea is average, and they are waiting for further improvement in demand. Procurement is just needed to be followed up, and demand is expected to increase in the later period.

On the whole, the current increase in transactions of low-cost sources in the urea market is cautious, with limited purchases, and the market situation is deadlocked. It is expected that the urea market price will be stable and weak in the short term.