- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2409 contract opening price: 5543, highest price: 5556, lowest price: 5460, position: 745694, settlement price: 5497, yesterday settlement: 5575, down 78, daily trading volume: 615584 lots, precipitated capital: 2.859 billion, capital inflow: 44.11 million.

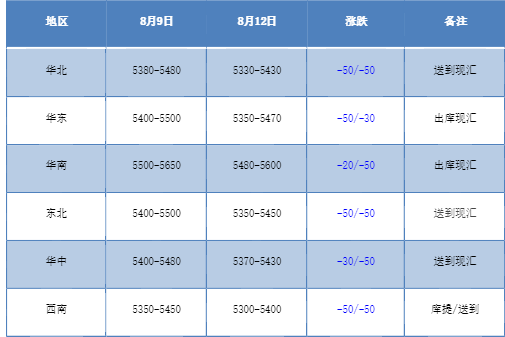

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market began to fall at the beginning of the week, and the market became more and more weak. Compared with the valuation, it fell by 50 yuan / ton in North China, 30-50 yuan / ton in East China, 20-50 yuan / ton in South China, 50 yuan / ton in Northeast China, 30-50 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprise factory price part of the reduction of 50 yuan / ton, some maintain a stable quotation, but the contract signing is not much. The futures price weakens again, and the downward trend shows weakness. After the futures price went down, the price quotation was also lowered, and the base offer had obvious advantages, and some areas began to turn to 01 contract offer, including 09 contract (50-100-150) in East China, 09 contract + 70 or 01 contract-130 in South China, 09 contract-300 or 01 contract-490 in North China, 09 contract-480 or 01 contract-670 in Southwest China. On the whole, traders offer a high price and there are few deals, the basis offer is strong, the point price is mainly, the downstream purchasing enthusiasm is general, and the spot transaction is mediocre.

From the perspective of futures:The night price of PVC2409 contract opened with a slight shock, and there was no sign of improvement in the market. Early trading began after the price continued to increase positions down, obvious weakness, afternoon low narrow finishing to the end. 2409 contracts fluctuated in the range of 5460-5556 throughout the day, with a spread of 96. 09 contracts with an increase of 20113 positions, with 745694 positions so far, 2501 contracts closing at 5663 and 429437 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract broke the track and fell deeply. First of all, the low point of the futures price fell through the undertrack support level, falling below the expected target position of 5460, and the price of increasing positions on the disk was weak. in terms of transactions, the short opening of 25.0% was higher than that of 23.5%. In the current market of changing positions and changing months, the short price of the next city not only refreshes the early-stage low of the year, but even became a new low in the past five years. And the 5460 point is lower than the low during the epidemic. The main futures contract fell more than negative, and the technical level showed that the three-track openings of the Bollinger belt (13, 13, 2) were all downward, and the short trend was unusually obvious. the downward trend of futures prices led to an empirical deviation in the market, and the current market was cautiously participated. observe the performance of the low position 5500 of the next main force 2501 contract.

Spot aspect:At present, the futures price of the futures market is further downward, and the market operation continues to be weak. The 09 contract has dropped significantly in the market of changing positions and changing months. After breaking the track, the technical closing line has lost its auxiliary role, and the current time node under 09 contracts is about to end. Therefore, in the case of increasing positions and downside, observe more 2501 contract trends and the support performance of the low position. The spot market has fallen continuously. In such a weak market, on the one hand, the spot transaction is not good. Although the spot transaction is mainly done at a low price, it is difficult to digest more goods in such a weak market. Relying on rigid demand, it is difficult to consume high social inventory. On the outer disk, international oil prices closed higher as optimistic economic data and signals from Fed policy makers that interest rates could be cut as early as September eased demand concerns, while concerns about the widening conflict in the Middle East continued to increase supply risks. On the whole, the PVC market continues to be low and weak in the short term.