- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

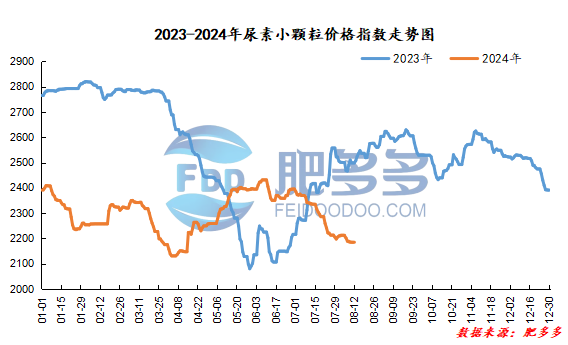

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on August 12 was 2,185.91, an increase of 1.36 from last Friday, a month-on-month increase of 0.06% and a year-on-year decrease of 12.51%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2037, the highest price is 2062, the lowest price is 2033, the settlement price is 2048, and the closing price is 2047. The closing price has increased by 10 compared with the settlement price of the previous trading day, up 0.49% month-on-month. The fluctuation range of the whole day is 2033-2062; the basis of the 09 contract in Shandong region is 73; the 09 contract has reduced its position by 5141 lots today, and so far, the position is 91061 lots.

Today, urea futures prices mainly fluctuated within a narrow range. The rumored press news in the market last week has driven market speculation to a certain extent, and there are certain signs of positive feedback in the spot market. However, the actual impact on urea is temporarily limited, and the short-term is dominated by emotional shocks.

Spot market analysis:

Today, the domestic urea market price fluctuated and consolidated. The number of remaining orders of companies was different, and the quotations were mixed. However, the overall price adjustment was small, and the market was mainly deadlocked for a short period of time.

Specifically, prices in Northeast China have stabilized at 2,150 - 2,190 yuan/ton. Prices in East China rose to 2,100 - 2,150 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,110 - 2,300 yuan/ton, and the price of large particles stabilized at 2,160 - 2,230 yuan/ton. Prices in North China rose to 2010- 2,200 yuan/ton. Prices in South China fell to 2,240 - 2,320 yuan/ton. Prices in the northwest region are stable at 2,170 - 2,230 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction of new orders by manufacturers slowed down, continued to reduce prices and collect orders, supported by short-term early orders, prices were deadlocked, and offers continued to be firm. In terms of the market, demand follow-up was slow, the trading atmosphere of operators was cautious, and transaction activity was average. The market once again fell into a deadlock, and the market was in turmoil and consolidation. In terms of supply, some enterprises have recently had maintenance plans for equipment. Although newly put equipment into production in the industry have been released one after another, due to the increase in equipment maintenance, the industry's supply has been slow. The current market supply is still sufficient, and long-term supply pressure will be highlighted. On the demand side, downstream demand is slowly following up, autumn fertilizer production time is advancing, the operating rate of compound fertilizer factories continues to increase, and procurement demand is expected to increase. The current procurement wait-and-see mentality is still strong, and purchases are appropriately purchased on dips. Demand is recovering slowly, and the mentality is more cautious.

On the whole, the current urea market price lacks substantial positive factors and continues to support it. The fundamentals of supply and demand are in a game, and prices are difficult to move upwards. It is expected that the urea market will be weak and deadlocked in a short period of time, and the price range will be consolidated.