- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

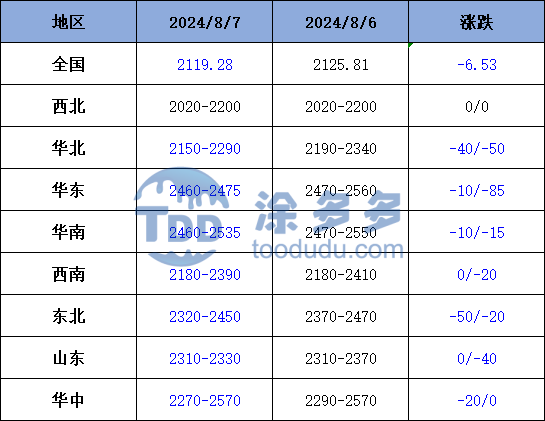

On Aug. 7, the methanol market price index was 2119.28, down 6.53 from yesterday, down 0.31% from the previous month.

Outer disk dynamics:

Methanol closed on August 6:

China CFR 293-296 US dollars / ton, down 2 US dollars / ton

Us FOB 100,101cents per gallon, flat

Southeast Asian CFR 346-34 US dollars / ton, up 1 US dollars / ton

European FOB 318-319 euros / ton, up 2 euros / ton.

Summary of today's prices:

Guanzhong: 2200 (0), North Route: 2020-2070 (0), Lunan: 2330 (0), Henan: 2270-2295 (- 20), Shanxi: 2150-2260 (- 40), Port: 2460-2475 (- 15)

Freight:

Northern Route-Northern Shandong 210-280 (0ram 0), Northern Route-Southern Shandong 280-330 (0Universe Muth5), Southern Route-Northern Shandong 250-270 (0Uniqmer 10), Guanzhong-Southwest Shandong 170-220 (0max 0)

Spot marketToday, the price of methanol market continues to decline, and the futures market continues to run weakly, which to a certain extent aggravates the bearish sentiment of the industry on the future market, and the demand performance of the downstream market is poor, and some companies purchase more and lower prices and other operations. Specifically, the market price in the main producing areas is adjusted narrowly, with the quotation on the southern route around 2070 yuan / ton and the northern line around 2020-2070 yuan / ton. with the return of some methanol plants to production, the market supply increases narrowly, and some manufacturers have a certain demand for shipments. however, the downstream market demand is limited, and the market trading atmosphere is low. The market prices in Shandong, the main consumer area, are arranged in a narrow range, with 2330 yuan / ton in southern Shandong and 2310-2320 yuan / ton in northern Shandong. The volatility of the main futures market is weak, the wait-and-see mood of the industry is strong, the downstream remains in a depressed state, and the mentality of restocking in the market is cautious. The trading atmosphere on the market weakens. The market quotation in North China has been lowered along with it. Today, Hebei quotation is 2270-2290 yuan / ton, and the low end is reduced by 30 yuan / ton. recently, the bidding situation of methanol enterprises in the surrounding area is not good, which is bad for the methanol market price in Hebei area. the enthusiasm of the operators to enter the market to replenish the stock is not high, and the market wait-and-see mood is strong. Shanxi quotes 2150-2260 yuan / ton today, the futures market trend is not good, operators buy up or not buy down sentiment highlighted, market transactions are mainly rigid demand.

Port marketToday, methanol futures range fluctuates. Spot demand is limited. In the early months, arbitrage shipments are active, the buying market is cautious, and the basis is slightly weaker; the long-term part of the high shipments, the basis to maintain stability. Discuss the standoff in the afternoon. The overall deal is OK. Taicang main port transaction price: spot transaction: 2460-2465, basis 09: 5: 8 deal: 2470-2475, basis: 09: 8: 2475: 2480, basis: 09: 15: 18: 8: 2485-2495, basis: 09: 25: 279: 2505-2510, basis: 09: 45.

Future forecast:Recently, methanol futures continued a weak trend, port spot market prices fell with the market, and the current performance of methanol fundamentals is poor, the overall trading atmosphere of the market is light, the rigid demand of terminal downstream and traders is dominated by rigid demand replenishment, the market maintains a pattern of both supply and demand, some operators have a certain wait-and-see mood for the future, coupled with the late arrival of imported shipments or still maintain a relatively high level, the market supply is still abundant in the short term. At present, the fundamental performance of methanol is poor, and it is expected that the short-term methanol market price will continue to be weak and volatile, but in the later stage, we need to pay close attention to the operation of the plant in the field and the recovery of downstream demand.