- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Domestic urea price index:

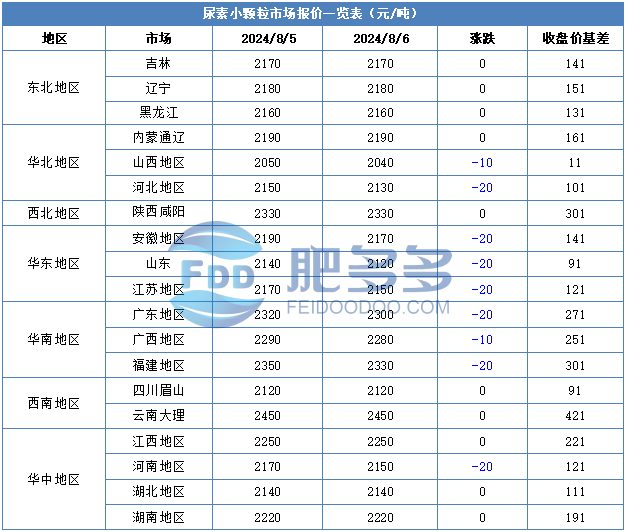

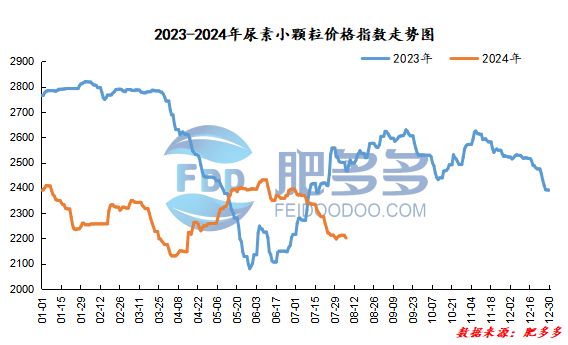

According to Feiduo data, the urea small pellet price index on August 6 was 2,201.36, a decrease of 7.73 from yesterday, a month-on-month decrease of 0.35% and a year-on-year decrease of 10.80%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2057, the highest price is 2064, the lowest price is 2020, the settlement price is 2039, and the closing price is 2029. The closing price is 28% lower than the settlement price of the previous trading day, down 1.36% month-on-month. The fluctuation range of the whole day is 2020-2064; the basis of the 09 contract in Shandong is 91; the 09 contract has reduced its position by 10281 lots today, and so far, the position is 114505 lots.

Today, urea futures prices are mainly operating with the weak market environment. At present, when the urea market lacks its own driving force, more emotional fluctuations follow the overall commodity market environment. The main logic of strong supply and weak demand in the short term has not yet been broken, making it difficult for the market to form a sustained rebound and positive feedback to the spot market.

Spot market analysis:

Today, the domestic urea market price dropped slightly, the transaction situation of new orders was average, the downstream trading mentality was cautious, and companies were waiting for a small amount of support. The market continued to be under pressure, and some fell slightly. Low prices attracted downstream purchases to increase.

Specifically, prices in Northeast China have stabilized at 2,150 - 2,190 yuan/ton. Prices in East China fell to 2,110 - 2,180 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,140 - 2,300 yuan/ton, and the price of large particles stabilized at 2,180 - 2,230 yuan/ton. Prices in North China fell to 2,040 - 2,200 yuan/ton. Prices in South China fell to 2,270 - 2,310 yuan/ton. Prices in Northwest China fell to 2,220 - 2,310 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have a limited number of new orders transactions, and the accumulated orders to be issued in the early period have some support. Today's report is stable and slightly loose, and the order is lowered, but the overall downward trend is limited. In terms of the market, the transaction of new orders on the market was flat, the trading atmosphere was poor, and there were no obvious signs of improvement. Traders were cautious in buying, wait-and-see, and had a certain resistance to high prices. The market continued to loosen slightly downward. In terms of supply, the industry's Nissan continues to adjust fluctuations, with equipment maintenance and restart alternating. The supply side has not changed much, and the short-term supply continues to be sufficient. On the demand side, the demand for agricultural topdressing has entered a gap period, with reduced purchases and limited follow-up; downstream compound fertilizer factories have limited needs, and demand follow-up is slow, and cautious follow-up is the main focus. The wait-and-see attitude is still strong, and there has been no concentrated buying. phenomenon.

On the whole, the current urea market supply continues to be sufficient, the follow-up situation of new downstream orders is average, company quotations have stabilized and declined, and the market is deadlocked and weak. It is expected that the urea market price will continue to drop slightly in a short period of time, attracting downstream purchases to follow up.