- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:V2409 contract opening price: 5679, highest price: 5714, lowest price: 5629, position: 787012, settlement price: 5679, yesterday settlement: 5691, down 12, daily trading volume: 602031 lots, precipitated capital: 3.126 billion, capital outflow: 57.71 million.

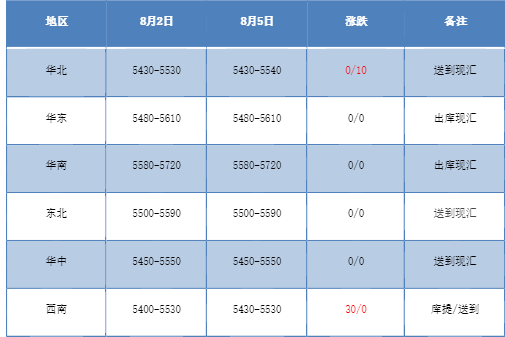

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in the domestic PVC market basically maintain the previous quotation, with small and flexible adjustments in some areas. Compared with the valuation, the high end of North China rose 10 yuan / ton, East China was stable, South China was stable, Northeast China was stable, Central China was stable, and the southwest region rose 30 yuan / ton. There is no obvious adjustment in the ex-factory price of upstream PVC production enterprises, and most stable price shipments actively digest factory inventory. Futures are adjusted in a narrow range, falling first and then rising. The price offered by traders in the spot market has little change compared with last Friday, the basis offer is basically stable, and the point price has a price advantage in the morning, of which the East China basis offer 09 contract-(100-180-200), South China 09 contract-(50-100 and Pingshui, + 30), North 09 contract-(300-350-400), Southwest 09 contract-(280). The spot market opened at the beginning of the week, there is no obvious adjustment trend, coupled with the lack of futures market volatility, so the two cities lack sufficient direction, downstream procurement enthusiasm is low, the overall transaction atmosphere is weak.

From the perspective of futures:The night price of PVC2409 contract fluctuated slightly at the beginning of the night trading, then fell relatively sharply in late trading, and then bottomed out after the start of morning trading on Monday. The futures price rose slightly and returned to above the opening price, and the volatility narrowed in the afternoon. 2409 contracts range from 5629 to 5714 throughout the day, with a spread of 85. 09 contracts reducing 11012 positions to 787012 positions so far, 2501 contracts closing at 5861 and 305562 positions.

PVC Future Forecast:

In terms of futures:Compared with the earlier period, the operation of the futures price of PVC2409 contract is still in a state of narrow adjustment, and the overall fluctuation range of the futures price is not obviously new. Secondly, the futures price still hovers at the low level. The technical level shows that the opening of the three tracks of the Bollinger belt (13,13,2) narrows, the KD line of the daily line shows a golden fork trend, and the MACD line crosses the two lines. However, at present, the change of the closing line at the technical level is less indicative to the futures price. On the one hand, it begins to change positions and change the month after entering August, and the 09 contract gradually withdraws from the stage with the passage of time. On the other hand, under the current time node, whether it comes from the fundamentals or the policy level, the guidance is relatively small. In the short term, the operation of futures prices continues to test the performance of the low range of 5620-5750.

Spot aspect:First of all, the futures market gradually reduced positions, from the cultural commodity index trend, also experienced a continuous decline, recently in a low consolidation trend, while PVC follows the overall macro commodity trend, in the fundamentals there is no exception, it is more difficult to get out of the separate market, and the current fundamentals are still weak, the long adjustment cycle of real estate, the operating rate of PVC terminal products is low, it is difficult to accept high prices The restriction of demand has a relatively obvious effect on price. And there is not much guidance from the macro level and the news level. In the outer disk, oil prices fell to close at their lowest level since January, as data showed that the US economy created fewer jobs than expected in July and Chinese economic data were weak. In addition, economic data from China, the world's largest oil importer, and surveys showing weak manufacturing activity in Asia, Europe and the US raise the risk that the global economic recovery will be underpowered, which could be a drag on oil demand. On the whole, the PVC spot market will continue to be low and narrow in the short term.