- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

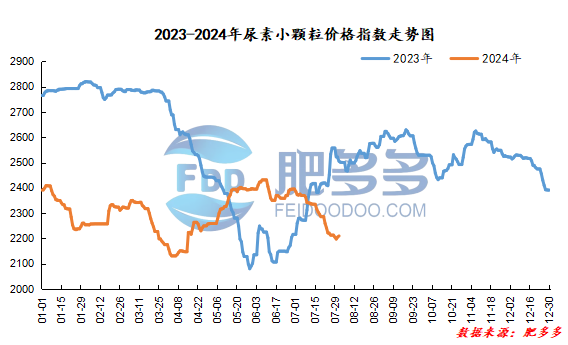

Domestic urea price index:

According to calculations from Feiduo data, the urea small pellet price index on August 1 was 2,209.55, an increase of 4.55 from yesterday, a month-on-month increase of 0.21% and a year-on-year decrease of 11.79%.

Urea futures market:

Today, the opening price of urea UR409 contract is 2051, the highest price is 2066, the lowest price is 2043, the settlement price is 2056, and the closing price is 2060. The closing price has increased by 20 compared with the settlement price of the previous trading day, up 0.98% month-on-month. The fluctuation range throughout the day is 2043-2066; the basis of the 09 contract in Shandong is 100; the 09 contract has reduced its position by 5684 lots today, and so far, the position has been held by 126323 lots.

Today, urea futures prices continued to operate strongly. The emotional rebound in the futures market in the past few days has driven downstream demand to a certain extent. Transactions of low-priced goods have continued to improve, and spot prices have also rebounded, forming a periodic positive feedback market. Coupled with the recent reduction in urea supply, the rebound in downstream start-ups, and the impact of declining inventories of urea companies have also provided certain support for prices. However, the main logic of the mid-term off-season still exists. In the short term, we can wait and see the sustainability of the positive market feedback and whether new stories emerge in the market news.

Spot market analysis:

Today, the domestic urea market price continues to rise slightly. After a round of low-price orders, companies are expected to accumulate, inventories are reduced, and quotations are rising steadily to a small margin. Short-term execution is mainly expected to be carried out.

Specifically, prices in Northeast China have stabilized at 2,150 - 2,190 yuan/ton. Prices in East China rose to 2,130 - 2,190 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,140 - 2,300 yuan/ton, and the price of large particles rose to 2,180 - 2,230 yuan/ton. Prices in North China rose to 2,050 - 2,200 yuan/ton. Prices in South China rose to 2,280 - 2,350 yuan/ton. Prices in the northwest region are stable at 2,240 - 2,330 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, the transactions of new orders from manufacturers have weakened, and low-priced orders are still pending in the early stage. The company is executing, and the shipping atmosphere is improving. In the short term, the quotation is stable and firm, and some small restrictions on orders are imposed. In terms of the market, after a round of low-price transactions, orders were getting better. The current transaction of new orders is gradually weakening. The sentiment of operators has turned to wait-and-see, and the market is stable and consolidated within a narrow range. On the supply side, the industry's operating rate dropped slightly this week, but the spot supply situation in the market remained loose, and prices continued to rise. During the week, market trading sentiment improved, downstream demand followed up, and companies went to warehouses. On the demand side, after a round of replenishment, downstream high prices will continue to follow up with limited limits. Downstream compound fertilizer factories will start to increase, and raw material replenishment and storage expectations will increase. In the future, they may follow up on dips. The overall pursuit of high prices will be cautious and wait-and-see.

On the whole, the current quotations of urea companies have increased slightly after receiving orders at low prices, and the downstream continues to follow up with a small amount. Under the support of waiting, it is expected that the urea market price will stabilize and move upwards in a short period of time. Under the conditions of sufficient supply, it will be difficult for prices to continue to rise.