- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Domestic urea price index:

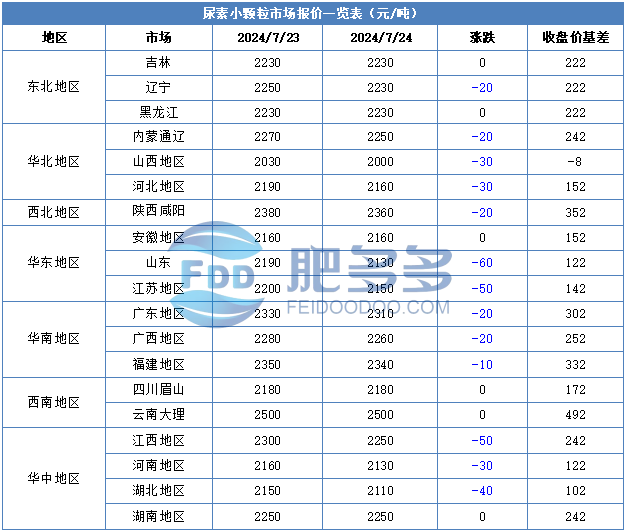

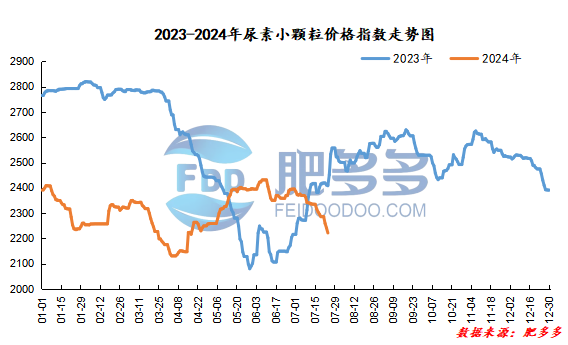

According to Feiduo data, the urea small pellet price index on July 24 was 2,221.36, a decrease of 19.82 from yesterday, a month-on-month decrease of 0.88% and a year-on-year decrease of 7.75%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 1991, the highest price is 2017, the lowest price is 1986, the settlement price is 2001, and the closing price is 3.3 higher than the settlement price of the previous trading day, up 0.15% month-on-month, and the fluctuation range throughout the day is 1986-2017; the basis of the 09 contract in Shandong is 122; the 09 contract has reduced its position by 5044 lots today, and so far, it has held 156993 lots.

Today, urea futures prices showed signs of recovering slightly, mainly due to the influence of related commodities and market sentiment. In addition, although the inventory in the urea plant is still accumulating this week, the accumulation has narrowed to a certain extent compared with last week, and market sentiment has to replenish. However, in the short term, it is temporarily difficult to see effective improvement in urea fundamentals. There is a temporary lack of upward drive, and in the short term, it may remain volatile with market sentiment.

Spot market analysis:

Today, the domestic urea market price continues to decline. Prices have been falling continuously in recent days, but the market follow-up situation has fallen short of expectations. The order volume of enterprises remains low, the supply and demand side continues to be loose, and corporate quotations continue to be low to attract orders.

Specifically, prices in Northeast China fell to 2,210 - 2,240 yuan/ton. Prices in East China fell to 2,120 - 2,160 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,110 - 2,350 yuan/ton, and the price of large particles stabilized at 2,180 - 2,210 yuan/ton. Prices in North China fell to 2,000 - 2,260 yuan/ton. Prices in South China fell to 2,250 - 2,350 yuan/ton. Prices in Northwest China fell to 2,300 - 2,360 yuan/ton. Prices in Southwest China are stable at 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories,After manufacturers cut prices, new orders followed up, but the overall small amount was limited. They continued to face shipping and inventory pressure, and the quotation continued to be lowered to attract orders.。In terms of market,Some low-priced goods in the venue are better, while operators are weak in purchasing at high prices, and their emotions are weak and downward. They replenish goods at low prices.Market prices continue to fall,In a short period of time, the market was weak and stable, and transactions were mainly low。On the supply side,Industry start-up continues to be high, supply continues to remain loose, and support for market prices is weak。On the demand side,The demand of downstream workers and farmers continues to be weak. Under the influence of the off-season, the intention to replenish goods is not high. Be cautious and wait and see, and follow up on replenishment at low prices and appropriate amounts. Some industrial demand is expected to increase. However, prices continue to be tested downward in the short term, and downstream follow-up is relatively cautious. The wait-and-see atmosphere on the demand side remains unchanged, and the market is weak and stable.。

Overall, current ureaCorporate quotations continue to decline, some low-end transactions in the market have improved, and manufacturers continue to be in a stalemate., it is expected that the market price of urea will continue to decline in a short period of time, with some small amounts of low-priced goods being sold.