- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

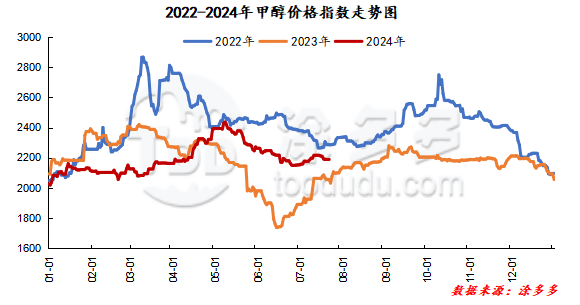

On July 22nd, the methanol market price index was 2187.14, down 1.06% from the previous working day and 0.05% lower than the previous working day.

Outer disk dynamics:

Methanol closed on July 19:

China's CFR ranges from US $290 to US $294 per ton, down US $2 per ton

Us FOB 104-105 cents per gallon, flat

Southeast Asia 349-350 US dollars / ton, down 1 US dollars / ton

European FOB 321.75-322.75 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2200-2240 (- 60), North Route: 2100-2110 (0), Lunan: 2340 (0), Henan: 2310-2330 (10), Shanxi: 2230-2300 (0), Port: 2495-2500 (- 5)

Freight:

North Route-North Shandong 210-270 (0ax 0), North Line-South Shandong 300-330 (0ax 0), South Line-Northern Shandong 240-260 (0ax 0), Guanzhong-Southwest Shandong 150-230 (0max 0)

Spot marketToday, methanol market prices have moved steadily, futures market volatility has fallen, port spot market prices have fallen with the market, and the basis has remained low, but the mainland market has adjusted narrowly. Although the supply side has some support for the market, the follow-up of terminal downstream demand is limited, some operators in the market still have a certain wait-and-see mood in the future, and the overall trading atmosphere in the market is limited. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with quotations on the southern route around 2130 yuan / ton and the northern line around 2100-2110 yuan / ton, with a stable low end, a strong wait-and-see mood in the market at the beginning of the week, and the new prices of most enterprises have not yet been issued. Market prices in Shandong, the main consumer area, fell in a narrow range, with 2340 yuan / ton in southern Shandong and 2340-2360 yuan / ton in northern Shandong, while the low end was lowered by 10 yuan / ton. the main methanol futures market vibrated downwards, and the downstream was in the off-season, the demand remained depressed, and the market trading atmosphere was general. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2300 yuan / ton today, the low end is stable, and the wait-and-see mood in the market at the beginning of the week is relatively strong. Shanxi quotes 2230-2300 yuan / ton today, and the auction transaction situation of enterprises in the region is not good. In addition, the methanol futures market is weak, and the market sentiment is lack of confidence.

Port marketToday, methanol futures consolidation. Spot trading is light. Within the month rigid demand replenishment, price follow-up, the basis is strong. Forward arbitrage and exchange purchase are the main, and the basis is stronger at the same time. It's a good deal. Taicang main port transaction price: spot transaction: 2495-2500, basis 09: 5: 7 transaction: 2500-2515, basis: 09: 10, margin: 13: 8, transaction: 2510-2515, basis: 09: 20, margin 25: 8: 2515-2530, basis: 09: 28: 30: 9: 2525-2535, basis: 09: 40.

Future forecast:Recently, the equipment overhaul and restart coexist in the mainland market. The 1.2 million-ton methanol plant in Shanxi Huayu has stopped for routine maintenance on July 19th, the manufacturers still have stocks that have not stopped being sold out, and the circulation of spot cocoa in the region has not been significantly reduced. and some manufacturers must ship demand, market supply has not significantly improved, and downstream market demand is limited, most operators in the field still have a certain wait-and-see mood for the future. Generally speaking, the short-term methanol fundamentals are still in the state of supply and demand game, and the short-term methanol market price is expected to be weak and volatile, but in the later stage, we should pay attention to the coal price, the operation of the plant and the operation of the olefin plant.