- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

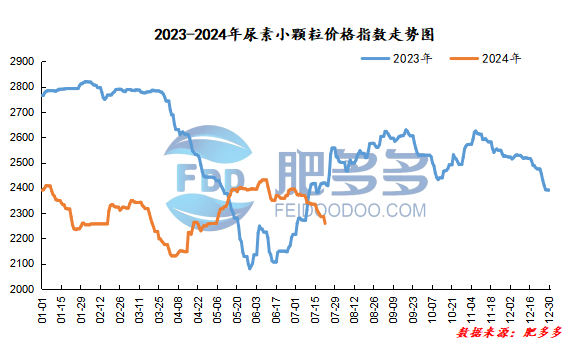

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 22 was 2,258.91, a decrease of 26.82 from last Friday, a month-on-month decrease of 1.17% and a year-on-year decrease of 6.62%.

Urea futures market:

Today, the opening price of urea UR409 contract is 2023, the highest price is 2027, the lowest price is 2007, the settlement price is 2016, and the closing price is 2021. The closing price is 18 lower than the settlement price of the previous trading day, down 0.88% month-on-month. The fluctuation range of the whole day is 2007-2027; the basis of the 09 contract in Shandong is 199; the 09 contract has reduced its position by 4188 lots today, and so far, the position is 165070 lots.

Today, urea futures prices remained mainly volatile in a narrow range after opening lower. On the one hand, it is still affected by related commodities and overall market sentiment, and the speculation of urea bulls continues to weaken. On the other hand, weak expectations for urea itself are gradually confirmed. Under the premise of loose supply, downstream demand will remain cautious and wait and see, making it difficult to form a strong driver, and may remain weak and volatile in the short term.

Spot market analysis:

Today, the domestic urea market price continues to be weak, the market demand is weak, the willingness to buy is weak, and the company's order acquisition situation is not good. It is expected to gradually reduce the amount and reduce the price more to collect orders.

Specifically, prices in Northeast China fell to 2,240 - 2,280 yuan/ton. Prices in East China fell to 2,180 - 2,250 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,170 - 2,350 yuan/ton, and the price of large particles fell to 2,180 - 2,240 yuan/ton. Prices in North China fell to 2,050 - 2,300 yuan/ton. Prices in South China fell to 2,270 - 2,370 yuan/ton. Prices in the northwest region are stable at 2,350 - 2,380 yuan/ton. Prices in Southwest China fell to 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers are issuing small quantities, acquiring new orders is average, sales pressure is gradually increasing, offers continue to move downward to collect orders, and price adjustment mentality is cautious. In terms of the market, the market situation is weak and downward, with a small number of new orders being traded, and some orders being traded at low prices. Operators lack confidence in the market outlook, and the bearish sentiment is becoming more and more obvious. The overall trading atmosphere is weak, and downstream are mainly following up on dips. In a short period of time, the market continues to explore downward. In terms of supply, starting this week, new equipment in the industry has been put into production one after another. Coupled with the continued recovery of pre-maintenance equipment, Nissan continues to increase steadily. Currently, corporate inventories are accumulating, market supply pressure is high, and supply is loose. On the demand side, the follow-up demand for agricultural topdressing has been slow, falling short of expectations, and weak consolidation continues; the replenishment of compound fertilizer raw materials in autumn is still in a wait-and-see period, with slow follow-up and cautious mentality, and the overall willingness to purchase is low, but there are still expectations for production replenishment.

On the whole, the current supply side of the urea market is loose, while the follow-up on the demand side is not good. Companies are preparing to reduce their sales, and there is still room for decline in the quotation. It is expected that the urea market price will continue to be weak and lowered in a short period of time. Specific attention needs to be paid to downstream fertilizer purchases. Follow up situation.