- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

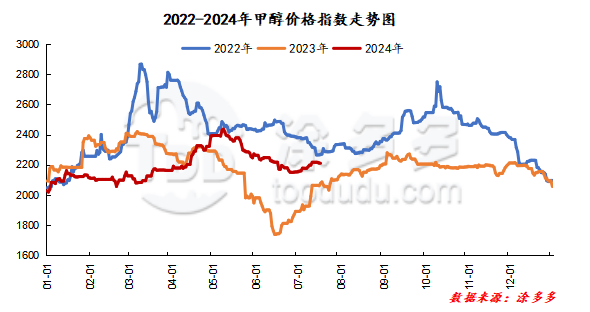

On July 17, the methanol market price index was 2207.39, down 1.97 from yesterday and 0.09 per cent from the previous month.

Outer disk dynamics:

Methanol closed on July 16:

China CFR 297-300USD / ton, Ping

Us FOB 105-106cents per gallon, flat

Southeast Asia 352-353 US dollars per ton, Ping

European FOB 327.75-328.75 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2260-2290 (0), North Route: 2120-2140 (0), Lunan: 2410-2420 (0), Henan: 2330-2365 (- 15), Shanxi: 2230-2310 (0), Port: 25352560 (- 15)

Freight:

Northern Route-Northern Shandong 210-260 (10thumb 0), Northern Route-Southern Shandong 300-330 (0thumb 0), Southern Route-Northern Shandong 230-250 (10mp 0), Guanzhong-Southwest Shandong 150-220 (0max 20)

Spot marketThe volatility of the futures market has dropped, and the price in the spot market has been adjusted in a narrow range. With the high prices in the previous period, downstream operators hold certain resistance to the current high prices, and the trading atmosphere in the market is limited. Some manufacturers sell goods in order to reduce inventories, but the volume of transactions is still average. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with the quotation on the southern line around 2130-2160 yuan / ton and the northern line around 2120-2140 yuan / ton, maintaining yesterday. Although methanol maintenance equipment has been added in Shaanxi, there is still a demand for storage and delivery in some factories, and some manufacturers have taken the initiative to reduce prices for shipment, but the transaction volume has not increased significantly. Market prices in Shandong, the main consumer area, fell in a narrow range, with 2410-2420 yuan / ton in southern Shandong and 2380-2400 yuan / ton in northern Shandong. Methanol futures fluctuated downward, and the industry had a strong wait-and-see mood. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2330-2350 yuan / ton today, and the low end is stable. at present, the profit situation of the downstream industry is not good, the demand side still has a negative feedback impact on the market, and the promotion of methanol price is limited; Shanxi quotes 2230-2310 yuan / ton today, downstream operators continue to take goods with rigid demand, and most methanol enterprises have no inventory pressure for the time being.

Port marketToday, methanol futures range fluctuates. Spot offers are few, paper arbitrage buying is active, and the basis is strong. The idea of replacement continues, and the monthly difference narrows. There was a stalemate in the afternoon and the deal was all right. Taicang main port transaction price: spot / 7 in deal: 2550-2570, base difference 09: 5 Universe 10: 7 transaction: 2555-2580, base difference 09: 8 Universe 10 transaction 8 transaction: 2575, base difference 09: 10 cross 8 transaction: 2570-2595, base margin 09: 25 position 9: 2590-2595, base difference 09: 35.

Future forecast:With the scheduled parking of the plant in the field, the start of the market in the region has declined, but the performance of the demand side of the downstream market is poor, some manufacturers in the main producing areas still have demand for shipments, the attitude of operators is unstable, and they choose to reduce prices in order to reduce inventory. however, downstream resistance to high-price methanol is growing, and there is no obvious volume in the market transaction. From the point of view of the port market, there are recent plans to restart some olefin units in East China. Affected by the news, the coastal base difference is slightly stronger, but it is still maintained at a low level. At present, weak demand is still the main factor to restrain the upward price of methanol, and the short-term methanol market is expected to adjust narrowly, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.