- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:July 16 V2409 contract opening price: 5830, highest price: 5858, lowest price: 5787, position: 930709, settlement price: 5821, yesterday settlement: 5874, down 53, daily trading volume: 661728 lots, precipitated capital: 3.808 billion, capital outflow: 188 million.

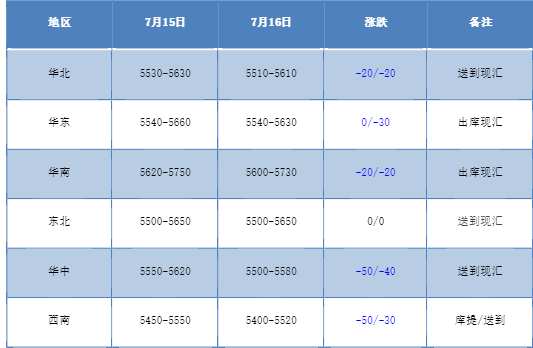

List of comprehensive prices by region: yuan / ton

PVC spot market:The domestic PVC market mainstream transaction price is mainly adjusted in a narrow range, and the market operation is weak. Compared with the valuation, it fell by 20 yuan / ton in North China, 30 yuan / ton in East China, 20 yuan / ton in South China, stable in Northeast China, 40-50 yuan / ton in Central China and 30-50 yuan / ton in Southwest China. The factory prices of upstream PVC production enterprises are mostly reduced by 50 yuan / ton, including simultaneous downward quotation from other places, but spot orders are not active. The futures price is arranged in a narrow range on the basis of yesterday's low, and the price quoted by traders in the spot market is slightly and flexibly adjusted relative to yesterday afternoon, but after the futures price has gone down, the basis has narrowed further and obviously, although the point price and the one-mouth price coexist. However, the reference significance of one price is not great, and most of them are inquiry, including 09 contracts in East China-(200-250) and 09 contracts in South China-(100-150). 09 contracts in the North-(380-450) and 09 in the Southwest-(400-420). Spot market transactions are also more inclined to point prices, but hanging order points are generally on the low side.

From the perspective of futures:The price of PVC2409 contract opened slightly lower in night trading, and then rebounded slightly after falling further below the lowest point of 5787. After the start of morning trading, futures prices rose slightly and then rose slightly, while afternoon prices fluctuated within a narrow range on the basis of small gains. 2409 contracts fluctuate from 5787 to 5858 throughout the day, with a spread of 71. 09 contracts reducing positions by 50020 lots, with positions so far of 930709 lots, 2501 contracts closing at 6025, and positions of 158230 hands.

PVC Future Forecast:

In terms of futures:PVC2409 contract futures prices refresh low, a recent low of 5787, so 09 contract has returned to the low range for adjustment, compared to the end of the 05 contract is nothing new, are constantly hovering in the low finishing. The disk shows a significant reduction of hot money leaving the market, the technical level shows that the opening of the third rail of the Bollinger belt (13,13,2) expands obviously, the depth of the middle rail and the lower rail is downward, and the MACD line at the daily level continues to show a dead-forked trend. In terms of transactions, 26.9% is more flat than 25.2%, and Duoping tends to consider more than one stop loss, plus some empty orders take profits. In the short term, the operation of futures prices continues to observe the performance of the low range of 5780-5900.

Spot aspect:The operation of the two cities continues to be weak. Although the production enterprises did not bid yesterday, they have fallen one after another today, the reduced prices have not been exchanged for better transactions, and the base gap in the mainstream consumer areas has narrowed, but the enthusiasm for inquiry has declined compared with yesterday, and the single point is generally on the low side. PVC fundamentals, calcium carbide prices slightly increased by 50 yuan / ton within the week, PVC plant start-up load increased slightly with the end of maintenance, demand did not see a significant change, downstream products enterprises are still low start-up load, real estate constraints are relatively obvious, downstream enterprise orders are insufficient, the overall fundamentals of PVC are weak. In the outer disk, the international crude oil futures market closed lower for the second day in a row as the dollar was boosted by the prospect of Trump's victory and China's economic growth in the second quarter was lower than expected, raising concerns about the outlook for global oil demand. On the whole, the PVC spot market will continue to be low in the short term.