- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:July 10 V2409 contract opening price: 5970, highest price: 597,lowest price: 5881, position: 920901, settlement price: 5924, yesterday settlement: 5975, down 51, daily trading volume: 688605 lots, precipitated capital: 3.801 billion, capital inflow: 24.55 million.

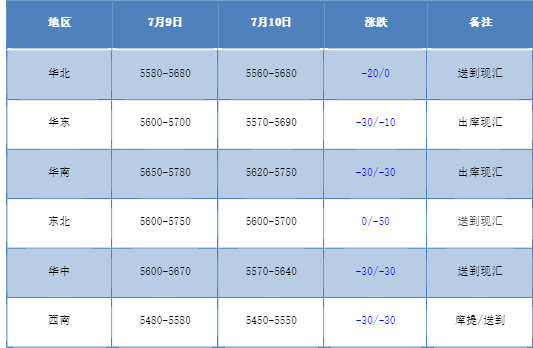

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market continues to decline, causing no rebound and obvious weakness. Compared with the valuation, it fell by 20 yuan / ton in North China, 10-30 yuan / ton in East China, 30 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 30 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices continue to reduce 20-30-50 yuan / ton, even if the factory price reduction also did not see a generation of contract volume. Futures continued to decline, the spot market price quotation fell compared with yesterday, but the advantage of point price was obvious, and the basis narrowed slightly, including 09 contract in East China (280-300-350), 09 contract in South China-(200-250), 09 contract in North China-(400-430-470), 09 contract in Southwest China-(400-480). Spot market transactions are also more inclined to point price transactions, but downstream rigid demand replenishment, the price downward spot market point price inquiry enthusiasm has been improved, there is room for negotiation.

From the perspective of futures:The night price of PVC2409 contract is mainly arranged in a narrow range, and the fluctuation range of the futures price is narrowed as a whole. After the start of morning trading, futures prices fell significantly, and the afternoon low was settled to the end. 2409 contracts fluctuated in the range of 5881-5977 throughout the day, with a spread of 96. 09 contracts with an increase of 17740 positions, with 920901 positions so far, 2501 contracts closing at 6072 and 142227 positions.

PVC Future Forecast:

In terms of futures:Although the trend of the futures price of PVC2409 contract is arranged in a narrow range at night, the decline during the daytime period is relatively obvious. In terms of trading, the short opening is 24.9% compared with 23.1% higher than that of 23.1%. The current trend of short opening is further deepened. Today's low of 5881 is even close to the low of 09 contract in April, although there is still a certain distance compared with the previous period of the main link. But the same weak market dampens the confidence of the overall industrial chain. The technical level shows that the middle rail and the lower rail opening of the Bollinger belt (13, 13, 2) are downward, the KD line and MACD line at the daily level have an obvious dead-fork trend, and the trend of the price in the short term may still be low to observe the performance in the range of 5850-5950.

Spot aspect:The price decline of the two cities in the term increases the enthusiasm of spot market inquiry, but on the one hand, the continuous negative decline of prices in the two cities leads to PVC items wandering back to the low level, and without external stimulus and policy guidance, it is difficult to support the strength of spot prices only by relying on the weak fundamentals of PVC. And the current trend of the two cities from the early May-June high prices began to continue to decline, the weakness is obvious, PVC fundamentals calcium carbide prices have increased slightly recently, the low-end prices of calcium carbide have decreased, other aspects have not changed much. In the outer disk, international oil prices fell as Hurricane Beryl caused less damage to an important oil production center in Texas than the market had expected, easing concerns about oil supplies. On the whole, the PVC spot market is still low and weak in the short term.