- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:July 8 V2409 contract opening price: 6015, highest price: 6026, lowest price: 5938, position: 938114, settlement price: 5970, yesterday settlement: 6043, down 73, daily trading volume: 920280 lots, precipitated capital: 3.909 billion, capital inflow: 23.88 million.

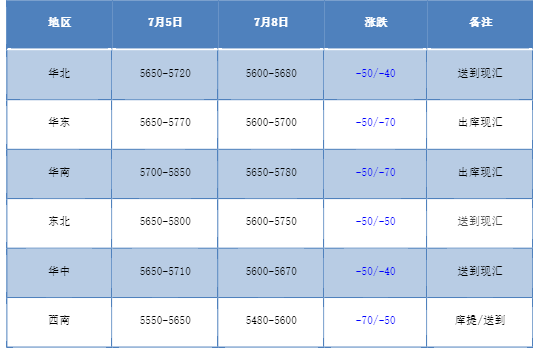

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price in the domestic PVC market declined and began to weaken at the beginning of the week. Compared with the valuation, it fell by 40-50 yuan / ton in North China, 50-70 yuan / ton in East China, 50-70 yuan / ton in South China, 50 yuan / ton in Northeast China, 40-50 yuan / ton in Central China and 50-70 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises continue to be reduced by 20-50 yuan / ton, including the simultaneous decline of prices in remote warehouses. Since the beginning of the week, the spot market atmosphere is not good, and the futures price is obviously weaker. The spot market quotation is lower than last Friday, and the higher offer price is more difficult to close the deal. Downstream, it tends to close the deal at a point price, but the hanging order point is generally low. The basis adjusted slightly, the low narrowed and the high became stronger, and the market offer was slightly chaotic, including 09 contracts in East China-(280-350), 09 contracts in South China-(200-250), 09 contracts in North China-(450-520), and 09 contracts in Southwest China-(400-480). Downstream procurement enthusiasm has been improved, spot transactions improved, single negotiation is the main.

From the perspective of futures:The price of PVC2409 contract fell slightly in night trading, falling below the prefix and continuing to fall. Futures prices rose slightly after the start of morning trading, but not strong enough and then continued to fall, and afternoon lows fluctuated in a small range. 2409 contracts fluctuated in the range of 5938-6026 throughout the day, with a spread of 885.09 contracts with an increase of 15190 positions, with 938114 positions so far, 2501 contracts closing at 6123 and 139230 positions.

PVC Future Forecast:

In terms of futures:The low point of the futures price of the PVC2409 contract fell through the lower track of the Bollinger belt, resulting in a further decline. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) are all downward, the KD line and MACD line at the daily line level show a dead-forked trend, the technical closing line shows an obvious empty trend, and the disk increases the position and downwards the empty opening is relatively suppressed, and secondly, the disk transaction is more active than in the early stage, and in terms of transaction, the blank opening is 24.6% and 22.2% more. The increase and decline of the futures price makes the PVC market return to a weak state, and the six-word prefix fell smoothly and did not encounter repeated point of view, the weakness of the futures price may continue. The performance of the low point range of 5920-6000 was observed in the short term.

Spot aspect:The downward price of the two cities has led to an improvement in spot transactions, thus it can be seen that there is rigid demand in downstream demand and replenishment demand at low prices. From the start-up rate of downstream products enterprises, the start-up of downstream profile sample enterprises is slow. Individual enterprises have export orders to support the start-up of 50-60%, most enterprises start 40-50%, a few small enterprises are in a state of phased shutdown because of insufficient orders. Subject to the constraints of real estate, downstream products enterprises do not run well, which is difficult to support the two cities in the future of PVC. On the supply side, the start-up load of PVC plant is high, although there is a certain supply loss in maintenance recently, but the impact on the price is less. The imbalance between supply and demand still leads to the emergence of high inventory, and there has always been no good activity in the spot market. Therefore, after the weakening of the two cities in the future, without the stimulation of policy ports, the spot market of PVC may continue to be weak in the short term.