- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

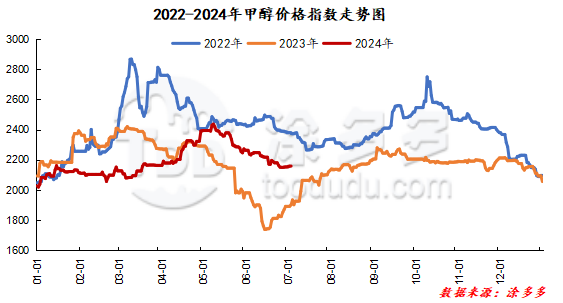

On July 3, the methanol market price index was 2161.75, up 4% from yesterday and up 0.19% from a month earlier.

Outer disk dynamics:

Methanol closed on July 2:

China CFR 294-296 US dollars / ton, up 2 US dollars / ton

Us FOB 107108 cents per gallon, flat

Us $355-356 per ton in Southeast Asia, Ping

European FOB 324.75-325.75 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2200-2070 (0), North Route: 2080-2120 (0), Lunan: 2400 (0), Henan: 2350-2370 (20), Shanxi: 2180-2300 (0), Port: 2540-2550 (10)

Freight:

North Route-Northern Shandong 240-290 (10max 0), Northern Route-Southern Shandong 300-340 (0amp 0), Southern Route-Northern Shandong 240-260 (20mp 0), Guanzhong-Southwest Shandong 140-180 (0max 0)

Spot marketToday, the price of methanol market has been raised by a narrow range, the price of crude oil is running at a high level, the market trend of methanol futures is strong, which forms a certain support for the mentality of the operators in the market, the overall trading atmosphere in the market is good, and the bidding of manufacturers in the main producing areas is smooth. The delivery rhythm of production enterprises is accelerated, and factory inventory is consumed smoothly. Specifically, the market price in the main producing areas is adjusted in a narrow range, the quotation on the southern line is around 2050-2060 yuan / ton, stable, and the price on the northern line is around 2080-2120 yuan / ton, and the low end is raised by 10 yuan / ton. The overall turnover of methanol auction enterprises is good. At present, the overall inventory level of manufacturers in the region is not high, coupled with the recent strong operation of methanol futures, the market mentality has a certain support. The market price in Shandong, the main consumer area, is adjusted in a narrow range, with 2400 yuan / ton in southern Shandong and 2390-2400 yuan / ton in northern Shandong. The recent futures trend is strong, downstream and traders are actively taking goods, the trading atmosphere is OK, and manufacturers are mainly pushing up prices under low inventory. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2280-2320 yuan / ton today. At present, the inventory pressure of most methanol enterprises in the market is not great, and the willingness of the manufacturers is obvious under the support of low storage, but the demand end of the methanol market has not improved obviously in a short period of time. It is difficult to sell volume in the market. Today, the price in Shanxi is 2180-2300 yuan / ton, and the low end is reduced by 20 yuan / ton. at present, the traditional downstream industry has entered the off-season of consumption, the rigid demand in the methanol market is reduced, the downstream manufacturers keep down the price operation, and most of the purchases are dominated by rigid demand.

Port marketToday, methanol futures fluctuate in a narrow range. Paper goods every high delivery, early morning near-end part of the rigid demand, long-term arbitrage buying, the basis is stable; afternoon selling increased, the basis weakened. The overall deal is OK. Taicang main port transaction price: 7 deal: 2540-2550, base difference 09-25 picture20 position 7 deal: 2540-2550, base difference 09-25 Maple 20 transaction 7 transaction: 2555-2565, base difference 09-12 hand 8 cross 8 transaction: 2585-2590, basis difference 09 million 15.

Future forecast:With the strong volatility of the futures market, the mentality of market operators has received a certain boost, and some downstream and traders have actively entered the market to replenish goods, which will support the market in the short term; but considering that some of the main downstream olefin units are still in a state of parking in the near future, and the start-up of the traditional downstream market affected by seasonal factors is also at a low level, the demand increment of the terminal downstream market is relatively limited, and the rigid demand for methanol is the main demand. At present, the terminal market demand is obviously increasing, and the short-term methanol market price is expected to adjust in a narrow range, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.