- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

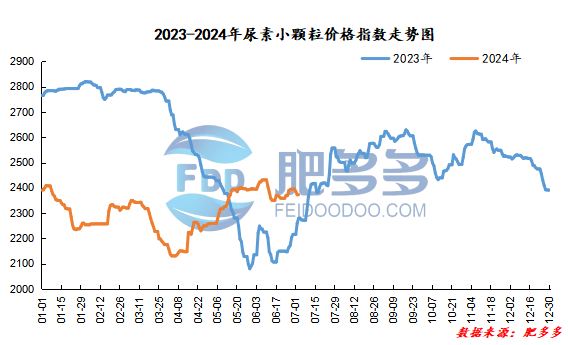

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 3 was 2,370.14, a decrease of 2.41 from yesterday, a month-on-month decrease of 0.10% and a year-on-year increase of 3.98%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2095, the highest price is 2168, the lowest price is 2087, the settlement price is 2138, the closing price is 2162, the closing price is 62 compared with the settlement price of the previous trading day, up 2.95% month-on-month, and the fluctuation range throughout the day is 2087-2168; the basis of the 09 contract in Shandong is 128; the 09 contract has increased its position by 19570 lots today, and so far, it has held 221167 lots.

Urea futures prices have rebounded sharply today. On the one hand, they are driven by the macro atmosphere of the overall commodity market. On the other hand, expectations of a weakening of urea's own fundamentals have been delayed. However, real-world supply disturbances and repeated demand have led to the continuous destocking of enterprises 'inventories and the expansion. As a result, it has become a good target for speculative funds at this stage. Given that the urea market is currently facing regulatory suppression at the top and supported by reality and international atmosphere at the bottom, it may remain mainly wide-ranging fluctuations in the short term.

Spot market analysis:

Today, domestic ureamarketPrices continued to fall, the market was sluggish in follow-up on new orders, manufacturers 'ex-factory quotations continued to be lowered, and some factory trade quotations in East and South China rose slightly, and the market fluctuated within a narrow range.

Specifically, prices in Northeast China fell to 2,440 - 2,470 yuan/ton. Prices in East China rose to 2,260 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,260 - 2,450 yuan/ton, and the price of large particles fell to 2,260 - 2,280 yuan/ton. Prices in North China fell to 2,170 - 2,480 yuan/ton. Prices in South China rose to 2,360 - 2,450 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,430 yuan/ton. Prices in Southwest China are stable at 2,250 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, the follow-up of new orders is still poor. Manufacturers are executing them, orders are gradually reduced, inventories are still at a low level, and factory quotations continue to loosen and lower under pressure on shipments. In terms of the market, the market trading atmosphere is deadlocked, new orders are slow to follow up, and the market is weak. However, there is not much room for downside in the market at present, and the market is mainly stable. In terms of supply, industry supply continues to be high, early maintenance equipment has been restored, and supply has gradually become abundant. In the later part of this month, some companies have put new equipment into production. Industry supply continues to be high, and market supply is sufficient. On the demand side, downstream demand is slow to follow up, the market is mainly in need of small orders, the purchasing mentality is cautious, the willingness to purchase at high prices is low, and demand support is weakened.

On the whole, the current demand in the urea market is weak, with limited follow-up, market trading is flat, and price upward is limited. It is expected that the urea market will continue to be weak in the short term, and prices will remain stable and gradually lower.