- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:July 3 V2409 contract opening price: 6129, highest price: 6134, lowest price: 6078, position: 868651, settlement price: 6108, yesterday settlement: 6093, up 15, daily trading volume: 734512 lots, precipitated capital: 3.724 billion, capital inflow: 73.09 million.

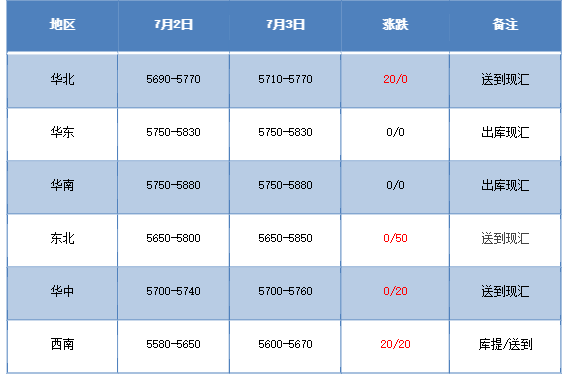

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in the domestic PVC market are mainly arranged in a narrow range, while spot prices are basically adjusted flexibly. Compared with the valuation, the low end of North China is increased by 20 yuan / ton, East China is stable, South China is stable, the high end of Northeast China is 50 yuan / ton, the high end of Central China is 20 yuan / ton, and the southwest region is 20 yuan / ton. The ex-factory prices of upstream PVC production enterprises have basically remained stable, and after two consecutive days of small increases, the performance of upstream enterprises in the spot market is calm today. The operation of futures is slightly strong, and the opening price is lonely compared with the closing price. Traders in the spot market are flexible in how small the offer is, but the low price in the spot market is reduced, the point price and the price still coexist, and the basis adjustment does not maintain much in the early stage. Among them, 09 contract in East China, 09 contract in South China, 09 contract in North China-(500-580) Southwest 09 contract-(400-450). On the whole, the spot market point price transaction price advantage is not obvious. The enthusiasm of purchasing downstream is low as a whole.

From the perspective of futures:The opening price of PVC2409 contract opened high and low, while the price fell slightly at night. After the start of morning trading, the futures price fluctuated first and then fell further on the basis of night trading, and the afternoon price rose in V-shaped reversal. 2409 contracts fluctuated from 6078 to 6134 throughout the day, with a spread of 56. 09 contracts with an increase of 16351 positions, with 868651 positions so far, 2501 contracts closing at 6293 and 132793 positions.

PVC Future Forecast:

In terms of futures:The trend of the futures price of the PVC2409 contract, first of all, from the opening price and closing price, almost little change, the overall V-shaped trend first fell and then rose, the market showed a certain trend of increasing positions, in terms of transaction, the opening of 23.7% more than the short opening of 23.6%, almost the same, there is a certain short-term short-opening and hedging policy after the relatively high operation, and there is a certain short-term small opening after the low price operation. The technical level shows that the opening of the third rail of the Bollinger belt (13, 13, 2) is still narrowed obviously, the fluctuation range of the futures price shows the state of the middle rail horizontal, and the shadow line continues to be longer, from the current trend, we think that in the short term, the fluctuation of the futures price continues to observe the performance of the range of 6070-6160 near the middle rail.

Spot aspect:Up to now, the low price in the spot market has decreased. After a slight rise yesterday, today's spot market is mainly a small flexible adjustment, but although the spot price has risen slightly recently, there has always been no obvious new idea in terms of transaction. Upstream factory first-generation contracts to maintain the early or basic volume, the middleman shipping rhythm also did not see a significant change And the range of price increases in the two cities is also difficult to stimulate speculative demand, or even enough to trigger the flow of goods between middlemen, and it is difficult to continue to support the spot market which only depends on rigid demand. Therefore, although the two cities have improved, they are not strong enough all the time. At present, the strong supply, weak demand and high inventory faced by PVC always restricts the trend of the two cities, and there is no obvious news about the policy port at present, so the spot market of PVC may still be running in a narrow range and a little strong in the short term.