- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:July 2 V2409 contract opening price: 6091, highest price: 6126, lowest price: 6066, position: 852300, settlement price: 6093, yesterday settlement: 6063, up 30, daily trading volume: 785481 lots, precipitated capital: 3.651 billion, capital inflow: 5.27 million.

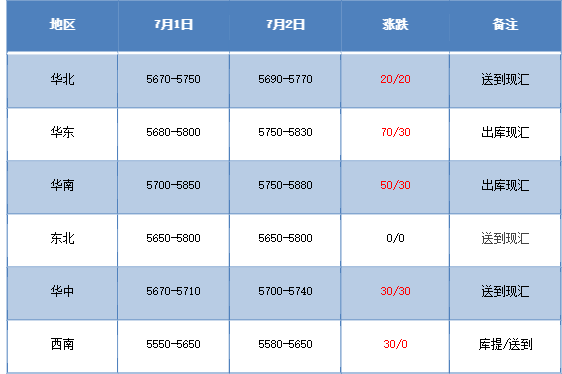

List of comprehensive prices by region: yuan / ton

PVC spot market:Mainstream transaction prices in the domestic PVC market continued to rise, rising again on Monday. Compared with the valuation, North China rose 20 yuan / ton, East China increased 30-70 yuan / ton, South China rose 30-50 yuan / ton, Northeast China was stable, Central China rose 30 yuan / ton, Southwest China increased 30 yuan / ton. The ex-factory prices of upstream PVC production enterprises tentatively continue to rise slightly, with factory quotations ranging from 20-30-50 yuan / ton, the market atmosphere has improved, and futures highs have been further upward. the spot market quotation has risen slightly compared with yesterday, and the spot price advantage has declined after the futures price has gone up, but there is still an offer, and the basis has not changed much, among which the base difference offer 09 contract-(350) in East China. South China 09 contract-(250), North 09 contract-(500-580), Southwest 09 contract-(450). The upward price of the two cities has alleviated the atmosphere of the spot market, but the purchasing enthusiasm of the lower reaches is generally low, some of them take a wait-and-see attitude in the face of rising prices, and the spot transaction is not good.

From the perspective of futures:The fluctuation range of the opening price of PVC2409 contract is narrowed, and the fluctuation of the futures price is mainly in the narrow range. After the start of morning trading, the futures price showed a small rise on the basis of night trading, and the afternoon price was the same as it closed higher late yesterday. 2409 contracts range from 6066 to 6126 throughout the day, with a spread of 60,009 and a reduction of 2822 positions, with 852300 positions so far, 2501 contracts closing at 6285 and 129047 positions.

PVC Future Forecast:

In terms of futures:PVC2409 contract futures price trend high further small breakthrough, futures price trend is basically the same as yesterday's closing high appeared the highest price, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening narrowed obviously, the all-day price closed in the lower shadow line longer Yang Pillar, and the high price rose through the middle track showed three small upward trend. The KD line at the daily line level shows a golden fork trend, and the distance between the two lines of the MACD line is shortened. In terms of transaction, the opening rate of more than 24.4% is higher than that of 22.1%, and the admission of hot money on the disk shows a situation of small and multi-opening. From the current operating trend of the futures price, it is expected that the futures price or high point will rise further slightly in the short term, and observe the performance of the range 6060-6160.

Spot aspect:The re-promotion of prices in the two cities has led to a slight recovery of market sentiment, but the transaction in the spot market has always been dominated by rigid demand, and there is no volume of a generation of contracts after the price increase of production enterprises. the procurement pace of downstream terminal enterprises is also maintained in the early stage, and the delivery rhythm of traders has not changed significantly, so it is difficult to change the rhythm of the overall spot market at present. At present, the fundamentals of supply and demand are still lacklustre, supply ports and demand ports are different, supply part of the enterprise maintenance, demand is still weak. However, with the recent decline in calcium carbide prices, the calcium carbide market has weakened again today, and the pressure on the cost port of the calcium carbide method has been alleviated. On the outer disk, oil prices rose 2 per cent to a two-month high on expectations of rising demand during the summer driving season in the northern hemisphere and fears that conflicts in the Middle East could spread and reduce global oil supplies. On the whole, the spot market may still be slightly stronger in the short term.