- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:June 25th V2409 contract opening price: 6032, highest price: 6087, lowest price: 6019, position: 843806, settlement price: 6048, yesterday settlement: 6068, down 20, daily trading volume: 857366 lots, precipitated capital: 3.594 billion, capital outflow: 37.56 million.

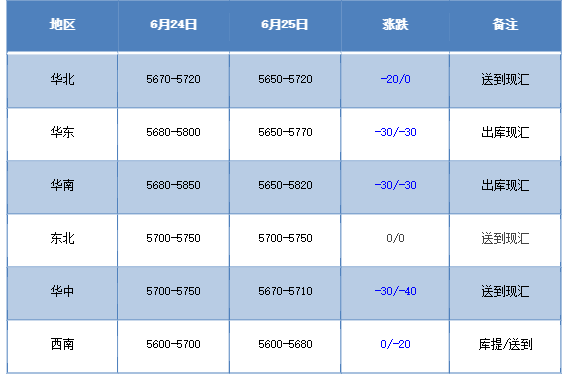

List of comprehensive prices by region: yuan / ton

PVC spot market:Domestic PVC market mainstream transaction price trend differentiation, morning session and afternoon trend is different. Compared with the valuation, it fell by 20 yuan / ton in North China, 30 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 30-40 yuan / ton in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprises mostly stable ex-factory prices, in the reduced prices on the basis of a stable offer, individual production enterprises to make up for a drop of 30 yuan / ton. Futures night trading and morning are weak, so the spot market in the morning is still slightly negative, the spot market offer fell slightly, but the corresponding point price has an advantage, the basis offer is not adjusted much. Among them, 09 contracts in East China-(300-350), 09 in South China-(250-280), 09 in North China-(530-580), 09 in Southwest China-(450). Afternoon futures prices rose, the spot market also stopped falling with the help of unexpected events, some merchants closed low prices, or even tentatively a small pull, but the downstream feedback is insipid.

From the perspective of futures:The opening price of PVC2409 contract was slightly weaker in night trading, and the low did not break through the prefix 6 and then rose slightly. After the start of morning trading, the whole morning session was arranged in a low and narrow range, and the price rose in the afternoon and closed higher in late trading. 2409 contracts fluctuated from 6019 to 6087 throughout the day, with a price difference of 68,099. the contract reduced its position by 16309 lots, with 843806 positions so far, 2501 contracts closing at 6240 and 121813 positions.

PVC Future Forecast:

In terms of futures:The fluctuation of the futures price of the PVC2409 contract shows an obvious low and weak trend in the night trading and in the morning, but it rises in the afternoon due to unexpected events, first of all, the fluctuation range of the futures price is the same as that of yesterday, or even the high point is lower than yesterday, the difference is that the futures price is running upward from low today. The technical level shows that the three tracks of the Bolin belt (13, 13, 2) are still all downward, and the KD lines at the daily level cross. The overall commodity closed at noon, the main domestic futures contracts were mixed, urea rose more than 3%, rubber rose more than 2%, and liquefied petroleum gas (LPG) rose nearly 2%. In terms of decline, industrial silicon fell by nearly 3%, soda ash fell by more than 2%, and the Container Index (European), apple and soybean oil fell by more than 1%. As a whole, the trend of the main contract price of PVC in the short term may still be low to observe the performance in the range of 6030-6120.

Spot aspect:First of all, at 10:20 on June 25th, 2024, a fire accident occurred at a chemical plant in Tianjin, and the related commodities rose in the afternoon, and the spot market began to enter a wait-and-see period during the overall afternoon price operation. The upward price of futures and unexpected events made the spot market stop falling, some even tentatively rose slightly, but the market feedback is not obvious, still dominated by low prices. Although the emergency has a certain stimulation to the PVC futures and cash markets, the upward price of futures did not excessively lead to the rise of the spot market, and we can also see the performance of the spot market. International crude oil futures prices rose in the outer disk on the back of strong gasoline demand during the summer driving season and supply concerns over tensions in the Middle East and drone attacks on Russian refineries. In addition, the decline in the dollar has also exacerbated the rise in crude oil prices. On the whole, PVC spot prices may continue the trend of low and narrow finishing in the short term.