- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC Futures Analysis:June 24th V2409 contract opening price: 6096, highest price: 6109, lowest price: 6031, position: 860115, settlement price: 6068, yesterday settlement: 6134, down 66, daily trading volume: 865504 lots, precipitated capital: 3.632 billion, capital inflow: 11.56 million.

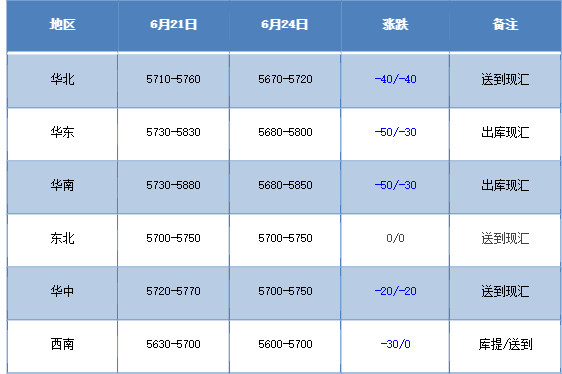

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market continues to decline, and the market performance is poor. Compared with the valuation, it fell by 40 yuan / ton in North China, 30-50 yuan / ton in East China, 30-50 yuan / ton in South China, stable in Northeast China, 20 yuan / ton in Central China and 30 yuan / ton in Southwest China. Upstream PVC production enterprises at the beginning of the factory price reduction of 30-40-50 yuan / ton, in exchange for better inventory digestion and contract signing, but the market wait-and-see atmosphere is heavier. The futures futures price further weakened and declined further, and the spot market quotation was significantly lower than last Friday, and the transaction was poor. After the futures price went down, the price advantage was relatively obvious, and the basis offer narrowed compared with the previous period. Among them, 09 contracts in East China-(300-350), 09 contracts in South China-(250-280), 09 contracts in North China-(530-580), 09 contracts in Southwest China-(450). After the advantage of the point price, the downside of the futures price led to a slight increase in the enthusiasm of downstream procurement, but the overall trading is still slightly light.

From the perspective of futures:The opening price of PVC2409 contract at night was slightly weaker, and the intraday price did not show a better performance. Prices continued to sort out in a small range after the start of morning trading on Monday, and prices fell further lower in the afternoon. 2409 contracts fluctuated in the range of 6031-6109 throughout the day, with a spread of 78. 009 contracts with an increase of 11738 positions, with 860115 positions so far, 2501 contracts closing at 6186 and 122299 positions.

PVC Future Forecast:

In terms of futures:The volatility low of the PVC2409 contract futures continues to refresh, and the low point breaks through the lower track support. The technical level shows that the three tracks of the Bollinger belt (13, 13, 2) all turn downward, the daily KD line and MACD line continue to show a dead-fork trend, the overall technical closing line shows an obvious short arrangement trend, and in terms of today's transaction, the short opening is 24.4% compared with 22.8%. The downside of increasing positions is also dominated by short positions. Commodity sentiment showed an obvious weak market, PVC is also difficult to have a better performance. At present, it comes from the lack of support and guidance from the policy port, and there are no positive factors in the market determined by the fundamentals, so as a whole, the trend of futures prices in the short term may still be low, and observe the performance in the range of 6000-6100.

Spot aspect:Commodity sentiment further weakened, closing at noon, the main domestic futures contracts were mixed, lithium carbonate, industrial silicon and soda ash fell by more than 5%, glass, iron ore and Shanghai silver fell by more than 3%, and coking coal, coke and ferrosilicon fell by more than 2%. The performance of agricultural products is OK, but the plasticizing plate where PVC is located is weak. At present, the fundamental port of PVC, the price of calcium carbide has declined, and the supply side increases slightly with the end of maintenance, but the demand side has never heard of better inventory digestion, but there is a certain deal in the spot market today, and the spot market maintains a state of buying down but not buying up. At present, there are few guidelines from the policy news port, especially when the PVC market returns to the market dominated by short sellers, and the spot market always faces the problem of high inventory. On the whole, PVC spot prices will continue to be low and narrow in the short term.