- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

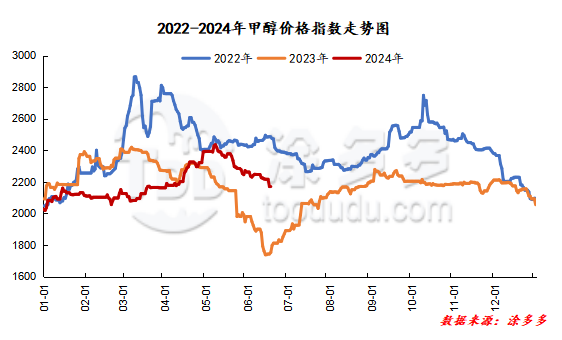

On June 19, the methanol market price index was 2193.49, up 24.83 from yesterday and 1.14% higher than yesterday.

Outer disk dynamics:

Methanol closed on June 18:

China CFR 295-297USD / ton, Ping

Us FOB 106-107 cents per gallon, down 2 cents per gallon

Us $357-358 per ton in Southeast Asia, Ping

European FOB 324.75-325.75 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2280-2300 (0), North Route: 2090-2100 (40), Lunan: 2410 (0), Henan: 2370-2395 (10), Shanxi: 2270-2330 (0), Port: 2525-2540 (20)

Freight:

North Route-Northern Shandong 265-310 (- 5gammer Mueller 20), Northern Route-Southern Shandong 350-390 (0amp 0), Southern Route-Northern Shandong 240-270 (- 20amp Mueller 20), Guanzhong-Southwestern Shandong 160-200 (0gammer 10)

Spot market: today, methanol futures stopped falling and rebounded, and the port spot market quotation was slightly supported, but the Chinese market continued to operate weakly under the influence of the contradiction between supply and demand, and the market trading atmosphere was limited. Specifically, the market prices in the main producing areas are arranged in a narrow range, with the quotation on the southern route around 2150 yuan / ton, the northern line around 2090-2100 yuan / ton, the low end raised by 40 yuan / ton, the futures market rebounding slightly, and the mentality of market operators slightly improved. some bidding enterprises are more smooth. Market prices in Shandong, the main consumer, have been raised narrowly, with 2410 yuan / ton in southern Shandong and 2390-2410 yuan / ton in northern Shandong. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2340-2350 yuan / ton today. The performance of downstream market demand is general. Some manufacturers in the region choose to reduce prices and ship goods, but the overall trading atmosphere in the market is limited. Shanxi quotes 2270-2330 yuan / ton today. Terminal downstream market demand performance is poor, business procurement enthusiasm is not high, more storage price reduction operation.

Port market: methanol futures rose slightly in the morning and consolidated in the afternoon. Within the month, rigid demand to fill the gap, selling every high delivery, the basis is strong; long-term arbitrage to pick up goods, appropriate price to follow up. Goods are exchanged frequently in recent months. The deal is active. Taicang main port transaction price: spot / 6: 2525-2535, basis 09-10 picturesque 5 position 6 deal: 2525-2540, basis 09-8 pound pound 0 transaction 7 transaction: 2535-2550, base difference 09 / 6 shock 10 market 8 transaction: 2550, basis + 25.

Future forecast: at present, the quotation of China's spot market continues to operate weakly under the influence of the contradiction between supply and demand, and it is difficult for the market to sell significantly in the short term, and it is difficult for some manufacturers in the region to push up their quotations under the influence of shipping demand. although the futures market has been raised today, it is difficult to significantly boost the mood of the Chinese market, and the arrival volume of methanol imports is still expected to increase in the later period. The price of the spot market in the port may have relatively limited room to push up. Generally speaking, the contradiction between supply and demand in the Chinese market is still not significantly improved, and it is expected that the methanol market will continue to operate weakly in the short term, but we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand in the later stage.