- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: June 19 V2409 contract opening price: 6120, highest price: 6179, lowest price: 6113, position: 814166, settlement price: 6154, yesterday settlement: 6155, down 1, daily trading volume: 846582 hands, precipitated capital: 3.518 billion, capital inflow: 32.69 million.

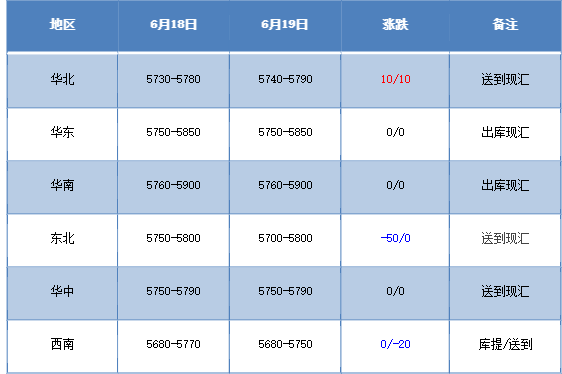

List of comprehensive prices by region: yuan / ton

PVC spot market: & nbsp; mainstream transaction prices in China's PVC market continue to be adjusted flexibly, with slight increases in some areas but still some downgrades. Compared with the valuation, the North China region rose by 10 yuan / ton, the East China region was stable, the South China region was stable, the Northeast region was down 50 yuan / ton, the Central China region was stable, and the southwest region was down 20 yuan / ton. Upstream PVC production enterprises factory prices mostly remain stable, very few enterprises in order to stimulate inventory digestion slightly reduced by 50 yuan / ton. Futures trend slightly upward, traders in various regions a tentative price offer slightly upward, downstream acceptance is limited, some areas continue to maintain stability and individual continue to make up for decline. At present, there are both spot price and spot price in the spot market, including 09 contract in East China (280-350-380), 09 contract in South China-(230-300), 09 contract in North China-(580-650), and 09 contract in Southwest China-(450). Under the current futures price changes, compared with the spot price, there are still advantages, the high price in the spot market is more difficult to close the transaction, the downstream purchasing enthusiasm is not high, some wait and see temporarily, the spot transaction is light.

Futures point of view: & nbsp;PVC2409 contract night trading opening price showed a relatively obvious rise, the overall night trading rise is better, after the start of morning trading in the night high on the basis of a narrow range of consolidation, in the afternoon still continue to shock mainly in a small range. 2409 contracts range from 6113 to 6179 throughout the day, with a spread of 66. 09 contracts with an increase of 713 positions, with 814166 positions so far, 2501 contracts closing at 6322 and 122279 positions.

PVC Future Forecast:

In terms of futures: The volatility of nbsp;PVC2409 contract futures is similar to that of yesterday, but the difference is that yesterday's futures prices fell from high to lower, and today's futures prices have formed a better upward repair from their lows. Judging from the current market, although bottoming out and rebound is relatively far-fetched, to a certain extent, we can see that the bottom range is formed in repeated confirmation. At the technical level, it shows that the lower track of the Bolin belt (13, 13, 2) means that the three tracks are shortened, and the KD lines at the daily level cross. Therefore, judging from the trend of the overall futures price, there may still be a certain expected performance in the medium term. In the short term, the trend of futures prices still needs to observe the performance of the bottom range of 6120-6220.

Spot aspect: & nbsp; from the current market trend, the technology collection is the first to have a certain change, and the trend of the futures price has a small rebound today, for the current market low or confirmation of the two cities. At present, there are still not many variable factors from the fundamentals, and those consensus factors are not enough to lead to major changes in the prices of the two cities, so price fluctuations or on the one hand, with the help of fluctuations in the overall market, on the other hand, it still lies in the stimulation of news policies. From a short-term point of view, the current two cities have a certain bottom performance, and there are still some expectations in the middle line of the two cities. In the outer disk, prices in the international crude oil futures market continued to rise as traders bet that strong oil demand in the summer would continue to support higher oil prices, while rising risk appetite, a weaker dollar and geopolitical tensions also boosted oil prices. As a whole, the PVC market may continue to fluctuate in the short term, waiting for the factors to break.