- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

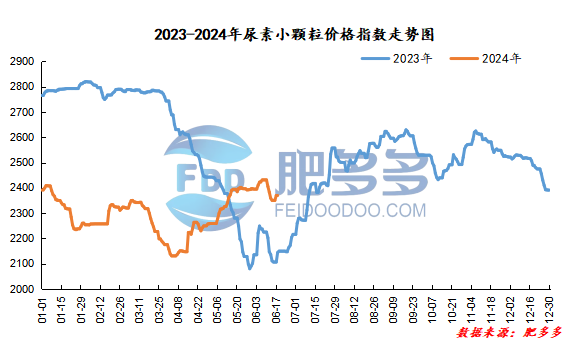

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on June 18 was 2,369.55, which was the same as yesterday and rose 10.53% year-on-year.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2100, the highest price is 2108, the lowest price is 2059, the settlement price is 2076, and the closing price is 13% lower than the settlement price of the previous trading day, down 0.62% month-on-month. The fluctuation range of the whole day is 2059-2108; the basis of the 09 contract in Shandong is 221; the 09 contract has reduced its position by 8269 lots today, and so far, the position is 213145 lots.

Today, urea futures prices opened higher and lower, with a slight month-on-month decline. Affected by the strong overall atmosphere of the commodity market at night yesterday, urea futures prices opened higher today. However, due to the gradual weakening of its own fundamentals and the relatively limited follow-up of agricultural demand in the near future, it was difficult for the market to form a strong driver, and the spot market weakened month-on-month. However, the current recovery in international prices has certain support for Chinese prices. In the short term, the urea market lacks new drivers or still uses the logic of weakening fundamentals as the main trading point.

Spot market analysis:

Today, China's urea market prices stabilized and fell slightly. Most of the company's quotations were stable and consolidated, execution was mainly pending, and prices were weak and stable.

Specifically, prices in Northeast China have stabilized at 2,440 - 2,470 yuan/ton. Prices in East China fell to 2,240 - 2,310 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,460 yuan/ton, and the price of large particles fell to 2,260 - 2,280 yuan/ton. Prices in North China have stabilized at 2,170 - 2,460 yuan/ton. Prices in South China are stable at 2,350 - 2,480 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China fell to 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to follow up on new orders, and pending orders accumulate. Today's report continues to be firm and narrow. Supported by pending orders, short-term sales pressure has eased, and shipping pressure has not been large. The factory mainly supplies stable prices. In terms of the market, the transaction activity of new orders in the market is average, and the support for the market is relatively limited. The current mentality of operators is mainly cautious and wait-and-see, market prices fluctuate within a narrow range, and the overall transaction atmosphere is average. In terms of supply, the start of industrial equipment continues to resume, supply continues to grow, and the current supply continues to be sufficient. On the demand side, the demand front for agricultural demand has been lengthened due to the impact of drought. Procurement has been appropriately carried out, and the overall concentration is insufficient. Some areas are affected by rainfall, so procurement has been appropriately followed up, forming a small amount of support for the market in a short period of time; the production of industrial compound fertilizer factories has basically ended, and the consumption of raw materials has declined. Currently, most of them are in need of procurement, and labor needs have weakened.

On the whole, the current supply of urea market is increasing, demand is in a gap period, supply and demand fundamentals are loose, and with the support of companies waiting to go, the market is deadlocked. It is expected that urea market prices will stabilize in a short period of time and then consolidate downward.