- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

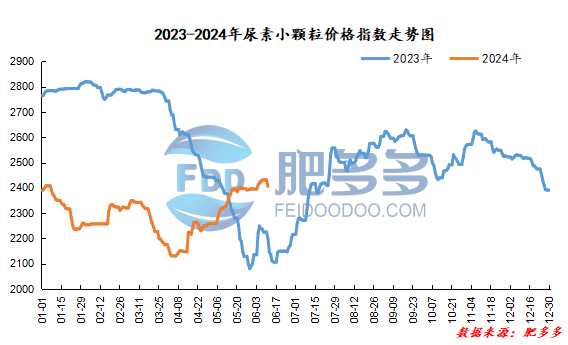

China Urea Price Index:

According to Feiduo data, the price index of urea small pellets on June 11 was 2,405.27, a decrease of 25.91 from the previous working day, a month-on-month decrease of 1.07% and a year-on-year increase of 9.23%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2090, the highest price is 2105, the lowest price is 2072, the settlement price is 2088, and the closing price is 2075. The closing price is 75 lower than the settlement price of the previous trading day, down 3.49% month-on-month. The fluctuation range of the whole day is 2072-2105; the basis of the 09 contract in Shandong is 255; the 09 contract has increased its position by 5091 lots today, and so far, it has held 229225 lots.

Today, urea futures prices opened sharply lower and then fell within a narrow range. The overall commodity market performance was weak today, mainly due to the weakening of overseas macro sentiment during the holidays, which led to the main short covering in the Chinese market. The same price of urea mainly fluctuates with the market environment. In addition, the expectation of a weakening of the fundamentals of urea itself has gradually been realized, and the spot price has also been lowered and consolidated. Subsequent urea futures prices are not optimistic, but it will still be difficult to get out of the independent market without strong drivers under the leadership of short-term macro sentiment.

Spot market analysis:

Today, the price of China's urea market was weak and downward, and the demand side was following up and weakening. Companies 'new orders were not receiving well, and prices were lowered.

Specifically, prices in Northeast China fell to 2,440 - 2,460 yuan/ton. Prices in East China fell to 2,320 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,300 - 2,480 yuan/ton, and the price of large particles fell to 2,310 - 2,360 yuan/ton. Prices in North China fell to 2,230 - 2,460 yuan/ton. Prices in South China fell to 2,430 - 2,500 yuan/ton. Prices in the northwest region are stable at 2,400 - 2,410 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,700 yuan/ton.

Market outlook forecast:

In terms of factories, the small number of new orders is limited, and manufacturers are under pressure for short-term shipments. The quotations after today's holiday are all lowered and consolidated. Some companies 'offers are stable, and the support for good results is weak. In terms of the market, driven by export news, the sentiment of the industry has been weak, the pace of follow-up transactions has slowed down, and the market has continued to fall. Currently, there are many transactions at low prices in the market, but the volume of transactions is limited. After the price adjustment, market transactions have not improved significantly. In terms of supply, the industry's supply has increased at a low level, and early maintenance equipment has been restored one after another. It is expected that the industry's supply will show an upward trend in the future. On the demand side, there is procurement demand in the agricultural market, but the actual follow-up situation is general, with a small amount of low-cost purchases mainly; the compound fertilizer production season has ended, factories 'willingness to buy fertilizers has declined, and demand follow-up has weakened.

On the whole, the current follow-up of new orders in the urea market is slowing down, the fundamentals are weak, and the atmosphere is deadlocked. It is expected that the price of the urea market will stabilize and consolidate in a short period of time.