- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

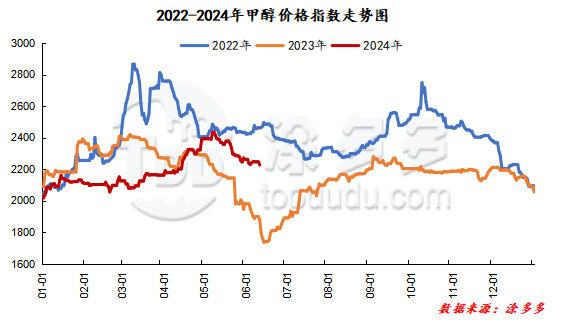

On June 11, the methanol market price index was 2226.48, down 20.38 from the previous working day, and 0.91% lower than the previous working day.

Outer disk dynamics:

Methanol closed on June 10:

China is closed.

Us FOB 103-104 cents per gallon, up 2 cents per gallon

Southeast Asia CFR 363.5-364.5 US dollars / ton, Ping

European FOB 325.75-326.75 euros / ton, down 2 euros / ton.

Summary of today's prices:

Guanzhong: 2310-2330 (- 30), North Route: 2120-2160 (- 30), Lunan: 2480 (0), Henan: 2410-2750 (0), Shanxi: 2270-2370 (20), Port: 2590-2610 (0)

Freight:

Northern route-240-340 (- 20 Uniqtel 30), northern route-southern Shandong 290-310 (0max 0), southern route-northern Shandong 260-300 (0max 0), Guanzhong-southwest Shandong 140-200 (0max 10)

Spot market: today, methanol market prices are adjusted in a narrow range, the futures market continues to fluctuate, the overall trading atmosphere in the market is limited, and low prices in some areas of the market are relatively smooth. Specifically, the market price in the main producing areas is arranged in a narrow range, the quotation on the southern line is around 2200 yuan / ton, stable, the quotation on the northern line is around 2120-2160 yuan / ton, and the lower end is reduced by 30 yuan / ton. after the festival, the downstream still maintains rigid demand for replenishment, and the overall trading atmosphere in the market is general. The market price in Shandong, the main consumer area, is weak, with 2480 yuan / ton in southern Shandong and 2440-2460 yuan / ton in northern Shandong. The recent futures trend is downward, the industry has a strong wait-and-see mood, and the market price in the region has fallen somewhat. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2360-2380 yuan / ton today, which is stable. at present, the performance of the downstream market demand is poor, and the operators in the market hold a wait-and-see mood towards the future. Shanxi quotes 2250-2360 yuan / ton today. With the end of the holiday, the terminal downstream and traders have a certain replenishment demand, and the market transaction is more smooth today, but with the end of replenishment, the trading volume may slow down.

Port market: methanol futures range fluctuated today. Near-end rigid demand replenishment, the basis is slightly stronger; paper part of the high shipment, arbitrage buying mainly, the basis is stable. The overall turnover is light. Taicang main port transaction price: 6, transaction price: 2590-2595, basis difference 09: 35, base difference: 2585-2605, basis difference: 2575-2580, basis difference: 09: 25.

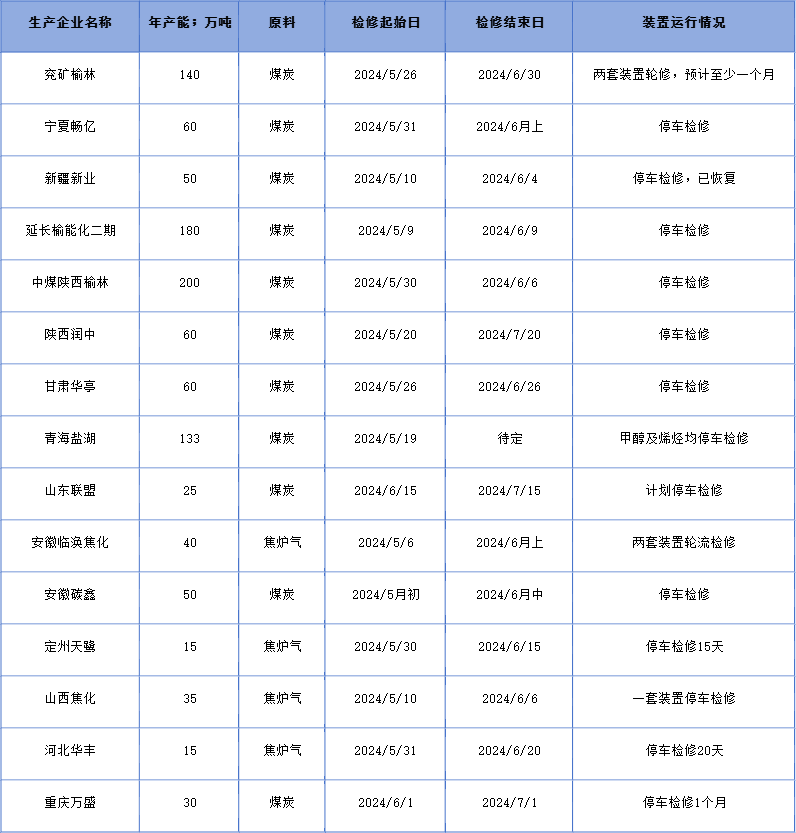

Future forecast: in the near future, with the gradual rise of temperature in various regions, the daily coal consumption of power plants is expected to increase, coal prices remain high, and the cost side gives some support to the methanol market, but at the same time, some traditional downstream markets have also entered the off-season of consumption, and the performance of terminal market demand is poor. Although the Dragon Boat Festival holiday has ended, the enthusiasm of downstream operators to enter the market is general, and some operators still have a small amount of rigid demand. 300000 tons of methanol in Manyang, Shanxi Province was stopped for maintenance on June 11. it is expected that the market supply in the region may be reduced in about 10 days, coupled with the relatively small inventory pressure of manufacturers at present, so the new prices of some manufacturers have tentatively increased, but affected by downstream demand, the increase in market prices is relatively limited. At present, the contradiction between supply and demand in the Chinese market still exists, and the short-term methanol market price range is expected to fluctuate mainly, but in the later stage, we still need to pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.

Recent operation of the plant