- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

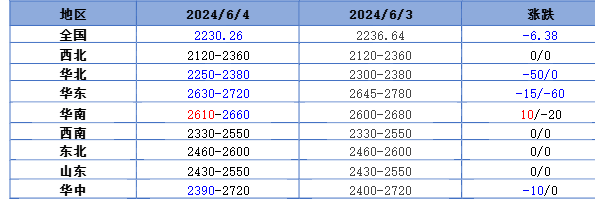

, methanol market price index 2230.26, down 6.37 from yesterday, down 0.28%.

Outer disk dynamics:

Methanol closed on June 3:

China CFR 300-310 US dollars / ton, down 9 US dollars / ton

Us FOB 98-99 cents per gallon, flat

Southeast Asia CFR 363.5-364.5 US dollars / ton, Ping

European FOB 310-311 euros / ton, up 1.50 euros / ton.

Summary of today's prices:

Guanzhong: 2340-2360 (0), North Route: 2120-2150 (0), Lunan: 2430-2450 (0), Henan: 2390-2400 (- 10), Shanxi: 2250-2350 (- 50), Port: 26302655 (- 15)

Freight:

North Route-North Shandong 280-340 (0amp 5), North Line-Southern Shandong 290-310 (0amp 0), South Line-Northern Shandong 270-310 (10ax 10), Guanzhong-Southwest Shandong 160-230 (0max 0)

Spot market: today, the methanol market price continues to decline, the futures market is wide, and the price in China's spot market is weak and difficult to change. At present, the bearish sentiment in the market is more obvious, and some of the traditional downstream has entered the off-season of consumption. Methanol demand performance is general, coupled with the recent methanol period continues to decline, the market industry fear of falling sentiment breeds, the overall trading atmosphere in the market is limited. Specifically, the market price in the main producing areas is weak, with the quotation on the south line around 2180 yuan / ton, stable, the price on the north line around 2120-2150 yuan / ton, and the high end down by 10 yuan / ton. The futures market continues the downward trend, and most operators in the market tend to wait and see cautiously. The overall trading atmosphere in the market is general. The market price in Shandong, the main consumer area, is weak, with 2430-2450 yuan / ton in southern Shandong and 2450-2470 yuan / ton in northern Shandong. Methanol futures are declining, auction prices in peripheral areas are down, and the overall trading atmosphere in the market is poor. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2360-2380 yuan / ton today, which is stable, the performance of terminal market demand is poor, and the market transaction atmosphere is light. Shanxi quotes 2250-2350 yuan / ton today. At present, the inventory of most methanol enterprises in the market is uncontrollable, and manufacturers have no demand for depots for the time being, but at present, the performance of downstream demand is poor, the transaction of new orders is slowing down, and downstream manufacturers are mainly purchasing goods with rigid demand.

Port market: methanol futures fluctuated today. Spot rigid demand replenishment. Near-end contract negotiations are the main, long-term part of unilateral delivery, the basis is slightly stronger; afternoon talks stalemate. The overall deal is OK. Taicang main port transaction price: spot transaction: 2650-2655, base difference 09 "85 surplus" 90 position 6 deal: 2630-2635, base spread 09 "70 swap" 75 position 6 deal: 2610-2620, basis 09 "50 pm 58 transaction 6: 2600-2615, basis 09: 45 margin 7: 2585, basis difference 09: 25.

Future forecast: in the near future, the methanol market price continues to be weak, which to a certain extent increases the bearish mood of the industry in the future, the overall trading atmosphere in the Chinese market is poor, and some olefin units in the main producing areas are stopped for overhaul. local market supply has increased, at present, part of the traditional downstream market has entered the off-season demand, the demand side of methanol support is general, coupled with the recent continuous decline of methanol prices. Under the influence of the mood of buying up or down, most operators in the market are not enthusiastic about entering the market to replenish goods, and the bearish mood of the operators is obvious. From the point of view of the port market, although the overall inventory pressure in the port market is not great, the futures market continues to decline, which affects the mentality of the industry to a certain extent. in addition, there is an expectation of an increase in the arrival of imported shipments in the later period, and the quotation in the region is lowered along with it. At present, the overall performance of methanol fundamentals is empty, the enthusiasm of operators to enter the market to replenish stock is limited, and the market transaction atmosphere is poor. It is expected that the short-term methanol market price may continue to be weak, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the downstream demand follow-up.

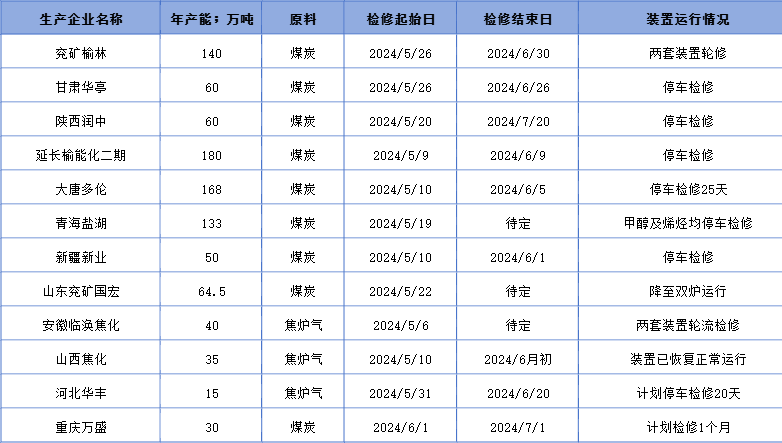

Recent operation of the plant