- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

China Urea Price Index:

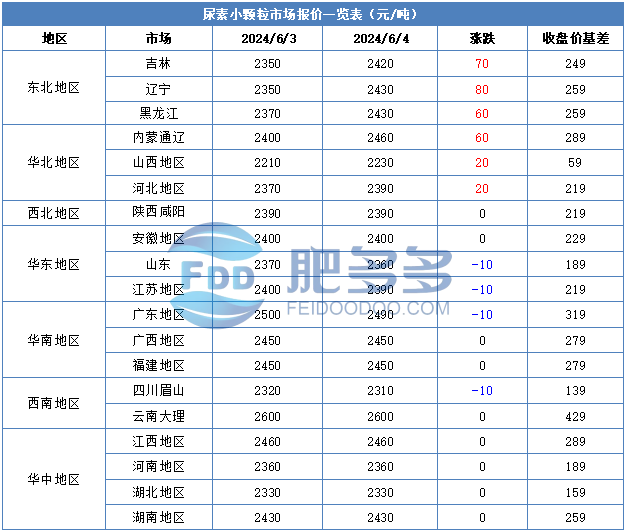

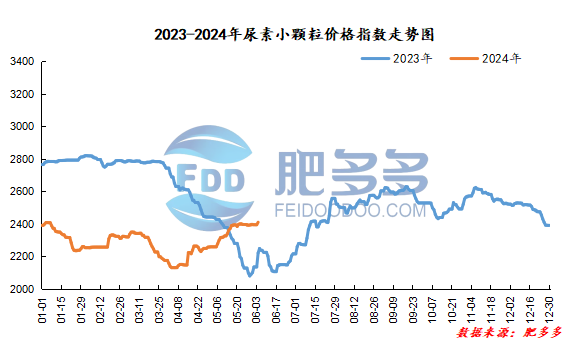

According to calculations from Feiduo data, the urea small pellet price index on June 4 was 2,410.27, an increase of 15.45 from yesterday, an increase of 0.65% month-on-month and an increase of 8.53% year-on-year.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2130, the highest price is 2189, the lowest price is 2122, the settlement price is 2159, and the closing price is 2171. The closing price has increased by 41 compared with the settlement price of the previous trading day, up 1.92% month-on-month. The fluctuation range of the whole day is 2122-2189; the basis of the 09 contract in Shandong is 189; the 09 contract has increased its position by 3378 lots today, and so far, the position is 212103 lots.

Today, the performance of urea futures prices is relatively strong. The fundamentals of urea itself still have strong support, and the spot market performs well. Although the overall commodity market performance is still weak today, it is difficult for urea to have strong fundamentals and discount spot prices. There is a sharp downward trend, with short-term or high shocks dominated.

Spot market analysis:

Today, China's urea market prices were consolidated upwards, reaching the highest value during the year. Demand for topdressing in the northern region followed suit, supporting the rise in market prices.

Specifically, prices in Northeast China rose to 2,410 - 2,450 yuan/ton. Prices in East China fell to 2,350 - 2,410 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,330 - 2,470 yuan/ton, and the price of large particles has stabilized at 2,320 - 2,370 yuan/ton. Prices in North China rose to 2,230 - 2,470 yuan/ton. Prices in South China are stable at 2,440 - 2,500 yuan/ton. Prices in the northwest region are stable at 2,390 - 2,400 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,700 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to process pending orders, and inventories continue to operate at a low level. Under the support of pending orders, offers remain firm and are shipping one after another, with a strong mentality of supporting prices. In terms of the market, quotes in Northeast China and North China rose today, while prices in other regions were stable and moderately loose. The overall market showed a strong trend in the north and weak in the south. New market orders continued to follow up, transactions increased significantly, and the market continued to strengthen in the short term. Prices were deadlocked and volatile. In terms of supply, although the industry's Nissan continues to improve slowly, the current market supply is relatively sufficient and the supply side has not changed much. On the demand side, the northern agricultural region is in the peak season of topdressing and is just in need of appropriate follow-up; downstream industrial factories are cautiously following up on demand, purchasing is slowing down, and purchasing at high prices is cautious.

On the whole, the current urea market is strong in the north and weak in the south, and topdressing and replenishment in the north are following up, supporting the firm operation of prices in peripheral areas. It is expected that urea prices will continue to be consolidated upwards in the short term.