- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

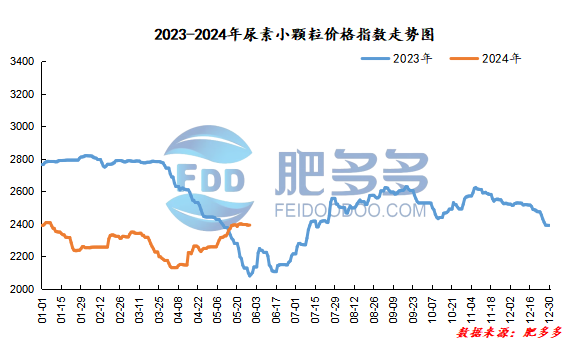

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on May 29 was 2,393.45, an increase of 0.86 from yesterday, a month-on-month increase of 0.04% and a year-on-year increase of 15.08%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2167, the highest price is 2209, the lowest price is 2162, the settlement price is 2186, and the closing price is 2201. The closing price has increased by 1.1 compared with the settlement price of the previous trading day, up 0.05% month-on-month. The fluctuation range of the whole day is 2162-2209; the basis of the 09 contract in Shandong is 179; the 09 contract has increased its position by 5793 lots today, and so far, it has held 240588 lots.

Today, urea futures prices opened lower and went higher, and the overall situation remained high and volatile with the market environment. At present, there is still support for the fundamentals of urea. Although the downstream is resistant to high-priced raw materials, under the support of actual demand, low-priced transactions are better, and the logic of weakening the margin of profit may be repeated, which is difficult to determine for the time being, and may remain high in the short term. The main reason for shocks.

Spot market analysis:

Today, the price of urea in China is low, and company quotations are mixed. Purchasing more and buying at low prices, and the market supply and demand relationship is still tight.

Specifically, prices in Northeast China rose to 2,330 - 2,380 yuan/ton. Prices in East China rose to 2,360 - 2,420 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,340 - 2,470 yuan/ton, and the price of large particles rose to 2,320 - 2,370 yuan/ton. Prices in North China rose to 2,220 - 2,410 yuan/ton. Prices in South China fell to 2,440 - 2,480 yuan/ton. Prices in the northwest region are stable at 2,390 - 2,400 yuan/ton. Prices in Southwest China fell to 2,300 - 2,700 yuan/ton.

Market outlook forecast:

In terms of factories, it is better for manufacturers to place orders at low prices, and the transaction volume of new orders has increased. The quotations of some companies in the market have been slightly lowered to accept orders. As they continue to ship advance orders, their mentality has continued to be firm, and some quotations have been slightly adjusted. In terms of the market, most transactions are sold at low prices, new orders are acceptable, and high-price transactions are weak. The market atmosphere is better under the support of short-term market conditions. The operators are cautious and watch the market more often. In terms of supply, some equipment have experienced sudden failures in operation recently, the industry has been slow to start and improve, and good supply remains for a short time. On the demand side, agricultural needs are followed up in stages, and low prices are just needed to make up for orders; the compound fertilizer market is okay to start, but the goods are better, and purchases are followed up.

On the whole, the fundamentals of the urea market will continue to show a strong trend in the short term, and supply will increase slowly. With the support of demand and waiting, it is expected that urea prices will continue to be stable and slightly fluctuate in the short term.