- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

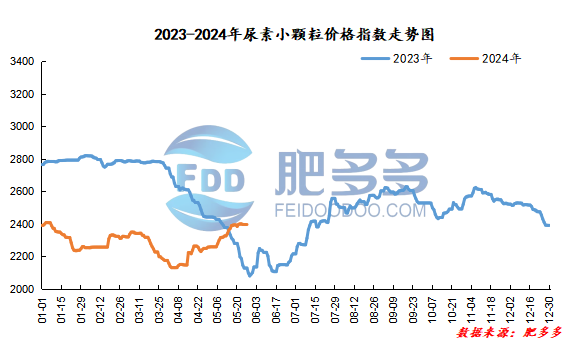

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on May 27 was 2,391.68, a decrease of 4.55 from last Friday, a month-on-month decrease of 0.19% and a year-on-year increase of 12.38%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2201, the highest price is 2204, the lowest price is 2175, the settlement price is 2189, and the closing price is 11% lower than the settlement price of the previous trading day, down 0.50% month-on-month. The fluctuation range of the whole day is 2175-2204; the basis of the 09 contract in Shandong is 182; the 09 contract has reduced its position by 2321 lots today, and so far, the position is 239464 lots.

Today, urea futures prices were dominated by weak fluctuations in a narrow range. The changes in its own fundamentals are relatively limited. The early bullish support gradually shows signs of weakening marginally, and manufacturers 'quotations have been lowered. However, due to the fact that some manufacturers still have pending orders and little inventory pressure, there is no condition for substantial price cuts. Moreover, the recent rise in international prices has further raised the level of support for China's prices. In the short term, urea futures prices may remain weak and volatile.

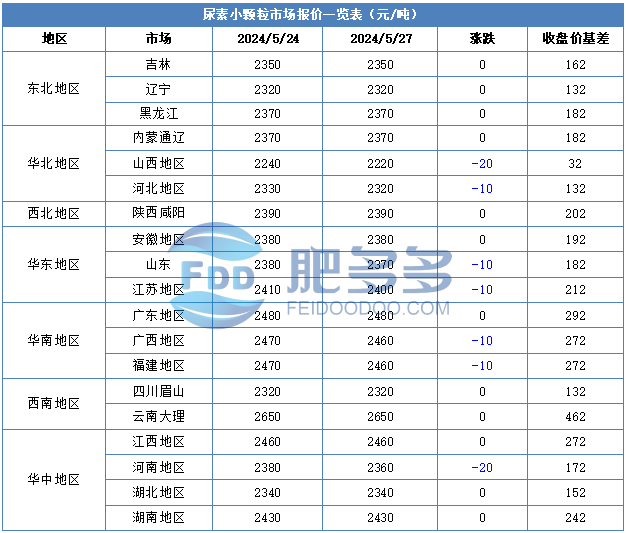

Spot market analysis:

Today, the price of urea in China's market has stabilized and slightly lowered. The follow-up of new downstream orders has slowed down, and some of them have been bought at low prices. The follow-up mentality has been cautious.

Specifically, prices in Northeast China have stabilized at 2,300 - 2,380 yuan/ton. Prices in East China fell to 2,350 - 2,410 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,340 - 2,470 yuan/ton, and the price of large particles stabilized at 2,320 - 2,380 yuan/ton. Prices in North China fell to 2,220 - 2,380 yuan/ton. Prices in South China fell to 2,450 - 2,500 yuan/ton. Prices in the northwest region are stable at 2,390 - 2,400 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,750 yuan/ton.

Market outlook forecast:

In terms of factories, the follow-up of new orders has slowed down. Manufacturers have a positive attitude towards shipment, and their quotations are flexible and loosened downward consolidation. With the continued support of pending orders, some manufacturers have maintained firm quotations for a short period of time, and market prices have stabilized and moved slightly. In terms of the market, most of the favorable factors in the early period have been exhausted, the transaction of new orders has slowed down significantly, the market has fluctuated and stabilized, and prices have been deadlocked at high levels. Operators are temporarily waiting and waiting, maintaining a cautious attitude towards the future outlook. On the supply side, there are plans to restore early maintenance equipment, and Nissan will slowly recover. Currently, the supply of goods in some regions is still tight, and short-term positive supply still exists. On the demand side, agricultural demand is in a gap period, and follow-up is gradually decreasing; summer fertilizer production in industrial downstream compound fertilizer factories has entered the final stage, and the demand for procurement and replenishment of raw materials has declined, and the overall demand-side follow-up efforts have weakened.

On the whole, the current follow-up of the urea market has slowed down significantly, the fundamental support of supply and demand has weakened, and companies are waiting to support price stability in the short term. It is expected that urea prices will remain stable and slightly consolidated in the short term, with limited changes.