- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

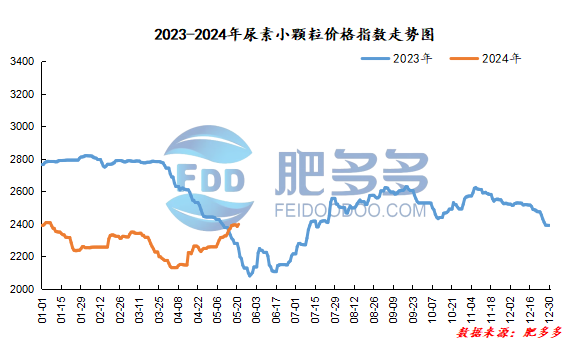

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on May 21 was 2,397.59, an increase of 13.18 from yesterday, a month-on-month increase of 0.55% and a year-on-year increase of 6.62%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2236, the highest price is 2250, the lowest price is 2167, the settlement price is 2201, and the closing price is 2186. Compared with the settlement price of the previous trading day, the month-on-month increase is 1.11%. The fluctuation range of the whole day is 2167-2250; the basis of the 09 contract in Shandong is 194; the 09 contract has reduced its position by 15048 lots today, and so far, it has held 239351 lots.

The sharp rise in urea futures prices yesterday led to positive feedback in the spot market. However, the high price was still suppressed from various levels, and there was limited upside. Today, the market opened higher and fell back. Subsequently, it is difficult to see the rise in urea under the general pattern of ensuring supply and stabilizing prices, and the fundamentals have been basically realized in terms of price. Beware of subsequent weakening of market margins and taking the lead in rushing prices.

Spot market analysis:

Today, China's urea market price increased again. After the company's quotation was lowered, low-price trading in the market followed up well, and the market was running firm for a short period of time.

Specifically, prices in Northeast China have stabilized at 2,300 - 2,380 yuan/ton. Prices in East China rose to 2,360 - 2,420 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,360 - 2,470 yuan/ton, and the price of large particles rose to 2,320 - 2,380 yuan/ton. Prices in North China rose to 2,200 - 2,380 yuan/ton. Prices in South China rose to 2,460 - 2,520 yuan/ton. Prices in the northwest region are stable at 2,390 - 2,400 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,750 yuan/ton.

Market outlook forecast:

In terms of factories, after manufacturers lowered prices and accepted orders, there were good signs of transactions at the low-end of the market. Today, most of the manufacturers 'offers were revised back within a narrow range. On the market side, after market prices loosened and lowered, the willingness of operators to follow up became stronger. Many transactions were sold at low prices in the market. Downstream operators followed up appropriately. Resistance still existed, and the market operated firmly for a short time. In terms of supply, the early maintenance equipment has not yet been fully restored, and the spot supply is still tight, and the short-term spot supply is tight. On the demand side, there is still market demand, downstream operators are cautious in chasing high prices, and their enthusiasm to buy goods at high prices has slowed down, and most of them adopt a cautious wait-and-see attitude to purchase.

On the whole, the current urea market price has rebounded again after being lowered at a high level. Although it is still needed, the industry is not willing to follow up with high prices, and they are often making up for orders at low prices. It is expected that the urea price will fluctuate at a high level in a short period of time.