- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

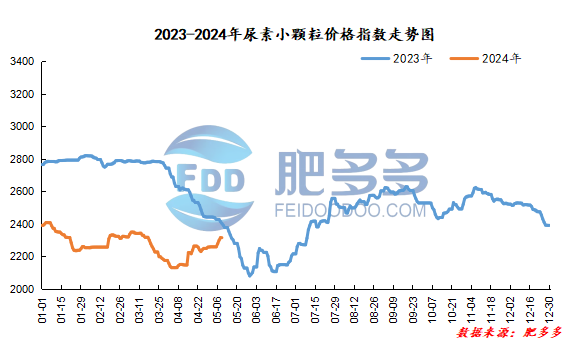

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on May 9 was 2,318.00, an increase of 2.73 from yesterday, a month-on-month increase of 0.12% and a year-on-year decrease of 3.54%.

Urea futures market:

Today, the opening price of the Urea UR409 contract: 2130, the highest price: 2144, the lowest price: 2105, the settlement price: 2122, and the closing price: 2118. The closing price increased by 6 compared with the settlement price of the previous trading day, up 0.28% month-on-month, and the fluctuation range throughout the day is 2105-2144; the basis of the 09 contract in Shandong region is 192; the 09 contract has increased its position by 1861 lots today, and so far, the position is 242484 lots.

Today's urea futures prices fluctuated mainly within a narrow range within the day. The current expectation of a contraction in basic urea supply and strong demand remains, which has strong support for prices. However, the high market price is also subject to policy control and downstream resistance. Further upward drive may need to be supported by the intensification of the contradiction between supply and demand. In the short term, the sentiment in the futures market may fall back or form a certain negative feedback on the spot market. Before that, the urea price or Maintain a narrow range of shocks.

Spot market analysis:

Today, China's urea market prices increased slightly, and company quotations were mostly stable. Under the influence of emotions, prices continued to be under upward pressure.

Specifically, prices in Northeast China have stabilized at 2,190 - 2,250 yuan/ton. Prices in East China have stabilized at 2,290 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,300 - 2,420 yuan/ton, and the price of large particles has stabilized at 2,260 - 2,310 yuan/ton. Prices in North China have stabilized at 2,170 - 2,320 yuan/ton. Prices in South China rose to 2,350 - 2,480 yuan/ton. Prices in Northwest China rose to 2,320 - 2,330 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction of new orders has slowed down today. Manufacturers continue to ship orders in advance in the early stage, but there is no shipping pressure. The quotation is stable and there is a strong willingness to support the price. In terms of the market, the market is cautious in chasing high prices, and the pace of follow-up purchases has slowed down. The overall atmosphere has dropped compared with the previous period, and the market is temporarily stable and wait-and-see. In terms of supply, maintenance equipment has been started one after another, and Nissan has shown a downward trend. Currently, corporate inventories are still at a low level. Some companies still have maintenance plans, and the market supply is tight. In terms of demand, it is still in the traditional peak season for China's agricultural demand, and fertilizer preparation just needed continues to advance steadily; the demand for raw materials and fertilizer preparation in downstream factories continues to follow up, and recently it is in the stage of centralized procurement. Compound fertilizers are in large demand, and the demand trend is relatively good.

Overall, the current urea market is in a state of high deadlock. Market prices continue to rise slowly, and there is room for price reduction. However, under the influence of successive repairs and repairs, the price reduction is limited. It is expected that the urea market price will stabilize and then decrease in a short period of time, but the reduction is small.