- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

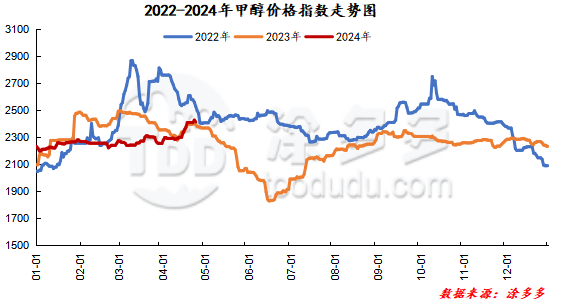

On May 7, the methanol market price index was 2509.53, up 20.27 from yesterday, and 0.81% higher than the previous day.

Outer disk dynamics:

Methanol closed on May 6:

China CFR 299-310 US dollars / ton, down 2 US dollars / ton

Us FOB 98-99 cents per gallon, flat

CFR in Southeast Asia: us $358-359 per ton, Ping

Markets are closed in Europe.

Summary of today's prices:

Guanzhong: 2400-2420 (0), North Route: 2440 (20), Lunan: 2670-2680 (10), Henan: 2550-2580 (30), Shanxi: 2500-2530 (160), Port: 2640-2660 (35)

Freight:

North Line-210-280 (0ax 0), North Line-South Shandong 320-350 (0ax 0), South Line-North Shandong 240-270 (0ax 0), Guanzhong-Southwest Shandong 220-260 (0ax 0)

Spot market: today, methanol futures market prices are rising synchronously, and Chinese market prices continue to operate at a high level. at present, the inventory pressure of manufacturers in the region is not great, coupled with the parking and maintenance of some devices, supported by good supply, the market price is on the strong side, and the lower operators mainly need replenishment. The spot quotation of the port is raised along with the market, and the spot circulation in the region is tight. Coupled with the upward volatility of the futures market, the market price remains relatively high. Specifically, the market price in the main producing areas has been raised along with it. The quotation on the southern line revolves around 2380 yuan / ton, the low end increases by 30 yuan / ton, and the price on the northern line revolves around 2440 yuan / ton, and the low end increases by 20 yuan / ton. The market price is maintained at a high level under the good support of the supply end. Some manufacturers offer a narrow increase in prices. Although there is a certain resistance to high-priced goods in the lower reaches, there is still a certain replenishment demand after the festival, and the overall shipment of methanol enterprises under rigid demand procurement is OK. Market prices in Shandong, the main consumer, are adjusted in a narrow range, with southern Shandong 2670-2680 yuan / ton, low-end 10 yuan / ton, and northern Shandong 2680-2700 yuan / ton. The futures market trend is firm and upward, leading to a warming of trading sentiment in the market. The market quotation in North China has been raised sharply. Hebei quotation is 2540-2690 yuan / ton today, which is 90 yuan / ton higher than that of yesterday. At present, the inventory pressure of manufacturers in the region is not great, which has a certain support for the mentality of operators. The price quoted in Shanxi today is 2500-2530 yuan / ton, and the market transaction atmosphere is positive. the transaction prices of all enterprises in the region are higher than those before the festival, with a range of 90-170yuan / ton, and the transaction volume is more objective, and the occurrence of failed auction is less.

Port market: methanol futures fluctuated higher today. Spot exchange for shipment; some high shipments in recent months, buying actively; long-term arbitrage buying follow-up. The basis is strong, and the deal is OK. (5) deal: 2635-2660, basis 09: 85, margin: 2635-2640, basis: 09: 75, basis: 2610-2640, basis: 09, 58: 65, deal: 2580-2610, basis: 09: 28: 35.

|

Area |

2024/5/7 |

2024/5/6 |

Rise and fall |

|

The whole country |

2509.53 |

2489.26 |

20.27 |

|

Northwest |

2355-2440 |

2350-2420 |

5/20 |

|

North China |

2500-2690 |

2480-2690 |

70/0 |

|

East China |

2640-2750 |

2605-2730 |

35/20 |

|

South China |

2620-2750 |

2625-2740 |

-5/10 |

|

Southwest |

2350-2550 |

2320-2550 |

30/0 |

|

Northeast China |

2550-2700 |

2500-2700 |

50/0 |

|

Shandong |

2670-2800 |

2680-2800 |

-10/0 |

|

Central China |

2550-2780 |

2520-2750 |

30/30 |

Future forecast: in the near future, the overall supply pressure in the Chinese market is not great, and Rongxin overhauls as scheduled, the Jiutai (Tuoxian) plant stops for a short time, the supply is good and the support is obvious, and at present, the rigid demand and replenishment demand in the downstream market still exist, under the influence of the favorable support of supply and demand, the manufacturer's quotation remains high, coupled with the upward shock of the futures market, which leads to an improvement in the mentality of the market operators. At present, the spot negotiable supply in the port area is tight. The market price in the region is high. At present, the methanol market price is running strongly under the support of low inventory in the short term, but considering the increasing cost pressure in the downstream market, some operators may hold a certain resistance to the high price, which may restrain the rising space of the spot price of methanol to a certain extent, but in the later stage, we should pay attention to the follow-up of downstream demand in order to wipe off sweat and the operation of the plant in the field.