- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: may 7 V2409 contract opening price: 5934, highest price: 6041, lowest price: 5933, position: 952664, settlement price: 5997, yesterday settlement: 5924, up: 20, daily trading volume: 462832 lots, precipitated capital: 4.741 billion, capital outflow: 113 million.

List of comprehensive prices by region: yuan / ton

|

Area |

May 6th |

May 7th |

Rise and fall |

Remarks |

|

North China |

5450-5510 |

5490-5550 |

40/50 |

Send to cash remittance |

|

East China |

5560-5640 |

5700-5760 |

70/60 |

Cash out of the warehouse |

|

South China |

5630-5680 |

5650-5750 |

20/70 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5450-5650 |

50/50 |

Send to cash remittance |

|

Central China |

5550-5600 |

5600-5670 |

50/70 |

Send to cash remittance |

|

Southwest |

5480-5600 |

5530-5650 |

50/50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are significantly upward, both ex-factory prices and market prices are up. Compared with the valuation, North China rose 40-50 yuan / ton, East China 60-70 yuan / ton, South China 20-70 yuan / ton, Northeast China 50 yuan / ton, Central China 50-70 yuan / ton, and Southwest China 50 yuan / ton. The factory prices of upstream PVC production enterprises are mostly raised by 30-50 yuan / ton, including the simultaneous upward quotation of remote storage, the strength of the futures market is obvious, and it is rare for production enterprises to adjust at a unified pace. And the spot market traders in all regions have raised their prices one after another, rising 20-30 yuan / ton in the morning. With the further upward of the futures price, the intraday price even rose twice, with a cumulative range of 50 yuan / ton. After the futures price went up, the basis advantage disappeared, but there were still offers, including 09 contracts in East China-(350-370), 09 contracts in South China-(250-270), 09 contracts in the North-(550-600). Southwest 09 contract-(400). Although the price has risen, there is still resistance to the completion of high-price offers in the spot market, and the supply of goods at low prices has decreased compared with the previous period.

From a futures point of view: & the night price of the nbsp; PVC2409 contract opened in a narrow range and then rose slightly. After the start of morning trading, the futures price rose further and successfully broke through the prefix of 6, and the afternoon price continued to be strong and high, which was running at the high level until the end of the day. 2409 contracts fluctuated in the range of 5933-6041 throughout the day, with a shortfall of 108. 09 contracts with an increase of 64969 positions, with 952664 positions so far, 05 contracts closing at 5840, and positions of 35698 hands.

PVC Future Forecast:

Futures: PVC2409 contract futures showed a significant upward trend. First of all, the fluctuation range of the futures price expanded and even reached 108 points. On the other hand, the futures price continued to move upward, successfully breaking through the highest point of the prefix 6 and reaching 6041, and the afternoon futures price stepped firmly above the prefix 6 and did not show a pullback. Futures trading opened 28.6% more than short opening 23.9%, which surprised the bulls in the short-dominated scene. At the technical level, it shows that the opening of the third track of the Bolin belt (13, 13, 2) is open, and the price continues to move upward from the middle rail, breaking through the upper rail position and continuing to move upward. In the short term, futures prices observe the persistence of the strong range of 6000-6050.

Spot: first of all emotional close at noon, most of the main Chinese futures contracts rose, eggs rose more than 4%, Container Index (European line), soybean meal rose more than 3%, bean 2, rapeseed meal, manganese silicon, palm oil, red jujube, vegetable oil, glass rose more than 2%. Secondly, the news level feedback on the May Day holiday period of the property market relaxation policy hype, "co-sale" and "acquisition type" coexist, the state-owned enterprise platform or developers directly buy old houses, the sale money is used to buy designated new housing projects. The largest scale of this round of trade-in policy is Zhengzhou, promoting "trade-in" or reducing the investment scale of indemnificatory housing. In this period, the upside of the two cities is more from the stimulation of the news, and less from the fundamentals of PVC. Therefore, the persistence of the strong operation of the two cities remains to be seen, and in the short term, the PVC spot market may consider narrow fluctuations in the new stage after the push.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

May 6th |

May 7th |

Rate of change |

|

V2409 collection |

5934 |

6032 |

98 |

|

|

Average spot price in East China |

5600 |

5730 |

130 |

|

|

Average spot price in South China |

5655 |

5700 |

45 |

|

|

PVC2409 basis difference |

-334 |

-302 |

32 |

|

|

V2501 collection |

6095 |

6185 |

90 |

|

|

V2409-2501 close |

-161 |

-153 |

8 |

|

|

PP2409 collection |

7529 |

7593 |

64 |

|

|

Plastic L2409 |

8405 |

8503 |

98 |

|

|

V--PP basis difference |

-1595 |

-1561 |

34 |

|

|

Vmure-L basis difference of plastics |

-2471 |

-2471 |

0 |

|

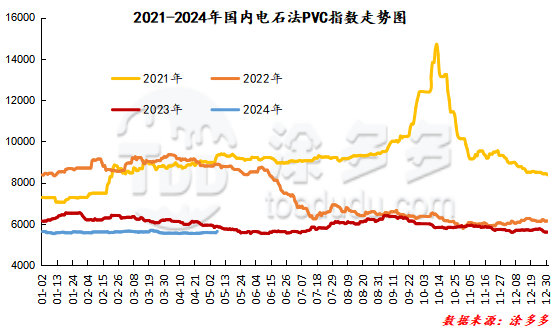

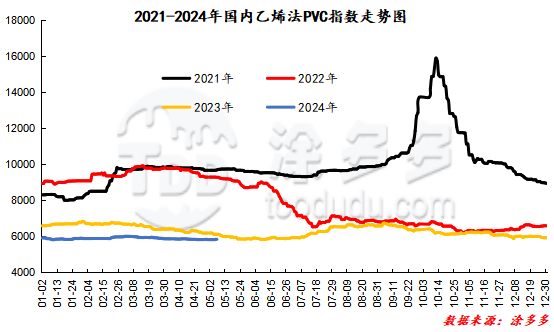

China PVC Index: according to Tudou data, China calcium Carbide PVC spot index rose 71.94% to 5644.63 on May 7, up 1.291%. The ethylene method PVC spot index was 5892.29, up 54.96, with a range of 0.942%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 247.66.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

5.6 warehouse order volume |

5.7 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,335 |

2,335 |

0 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

190 |

190 |

0 |

|

|

China Central Reserve Nanjing |

815 |

815 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,154 |

2,154 |

0 |

|

|

Zhenjiang Middle and far Sea |

561 |

561 |

0 |

|

|

Shanghai Zhongyuan Sea |

601 |

601 |

0 |

|

|

Middle and far sea in Jiangyin |

992 |

992 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,640 |

1,640 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

904 |

904 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

415 |

415 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

5,257 |

5,257 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,004 |

8,004 |

0 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,515 |

1,515 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

304 |

304 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

5,035 |

5,035 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

618 |

618 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

31,914 |

31,914 |

0 |

|

Total |

|

31,914 |

31,914 |

0 |

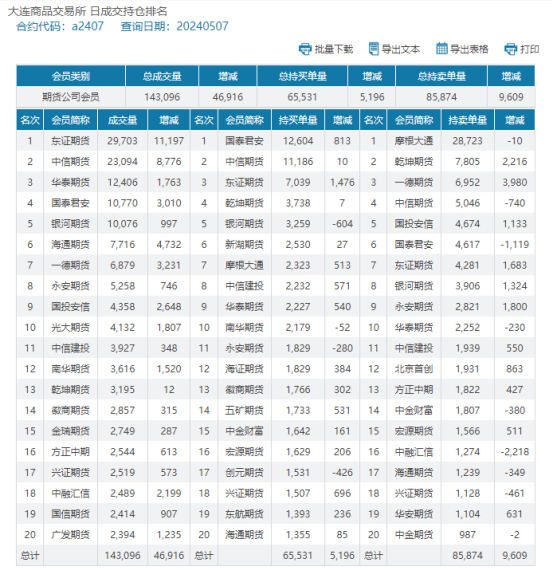

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.