- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

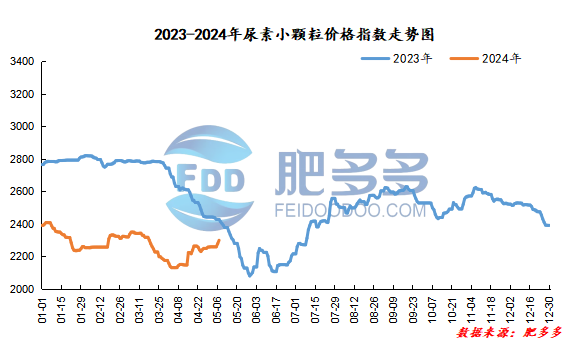

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on May 7 was 2,299.23, an increase of 21.36 from yesterday, a month-on-month increase of 0.94% and a year-on-year decrease of 5.28%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2147, the highest price is 2189, the lowest price is 2122, the settlement price is 2157, and the closing price is 17% higher than the settlement price of the previous trading day, up 0.81% month-on-month. The fluctuation range throughout the day is 2122-2189; the basis of the 09 contract in Shandong is 174; the 09 contract has reduced its position by 1646 lots today, and so far, the position is 238465 lots.

Spot market analysis:

Today, China's urea market prices continue to rise. After the holiday, factories are ready to support and have a good mentality. Today, the quotations of some factories continue to be adjusted upward.

Specifically, prices in Northeast China have stabilized at 2,160 - 2,230 yuan/ton. Prices in East China rose to 2,280 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,290 - 2,420 yuan/ton, and the price of large particles rose to 2,260 - 2,340 yuan/ton. Prices in North China rose to 2,160 - 2,290 yuan/ton. Prices in South China rose to 2,330 - 2,480 yuan/ton. Prices in Northwest China rose to 2,250 - 2,260 yuan/ton. Prices in Southwest China rose to 2,250 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to execute pending orders and maintain a price attitude. In addition, the sales of new orders from manufacturers continue to improve after the holiday, and factory quotations continue to be raised and consolidated today. In terms of the market, the market sentiment is oriented towards the good. However, under the influence of high prices, the industry continues to follow up and is slightly weak. The current sentiment is more wait-and-see, and the short-term market may be dominated by strong shocks. On the supply side, industry start-ups continue to show a downward trend, short-term spot supply is still tight, and the supply side continues to provide good support. On the demand side, agricultural demand replenishment sentiment is more wait-and-see, with small amounts of on-demand purchases; industrial compound fertilizer factories mainly need to purchase after the holiday, but the operating rate of compound fertilizer factories has increased, and the overall replenishment efforts are still strong.

On the whole, under the support of urea market companies, prices are mainly supported. However, companies are slightly resistant to high-priced purchasing sentiments, and their continued follow-up efforts have slowed down. It is expected that there is limited room for urea market prices to continue to rise in a short period of time, or remain high. Shock consolidation.