- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

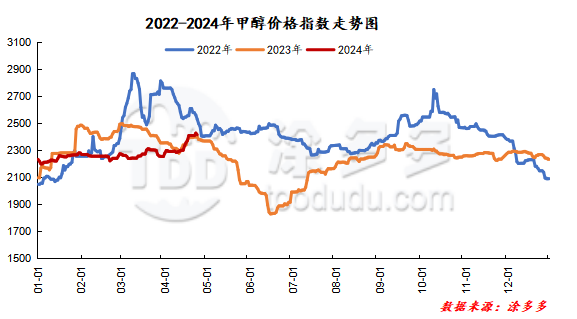

On May 6th, the methanol market price index was 2489.26, up 1.64 from the previous working day and 0.07% higher than the previous working day.

Outer disk dynamics:

Methanol closed on May 3:

China is closed.

Us FOB 98-99 cents per gallon, flat

CFR in Southeast Asia is $358-$359 / ton, up $13 / ton.

European FOB 302.25-303.25 euros / ton, down 0.75 euros / ton.

Summary of today's prices:

Guanzhong: 2400-2420 (30), North Route: 2420 (20), Lunan: 2660-2670 (- 20), Henan: 2520-2540 (- 60), Shanxi: 2340-2530 (0), Port: 2605-2630 (- 35)

Freight:

Northern Route-210-280 (- 20 Universe Mueller 30), Northern Route-Southern Shandong 320-350 (- 20 Maxime 20), Southern Route-Northern Shandong 240-270 (0 Maple Mueller 20), Guanzhong-Southwest Shandong 220-260 (0max 30)

Spot market: today, methanol market prices are mixed, and Chinese market prices are high. Although high-speed traffic restrictions during the holiday period affect transportation, resulting in a narrow range of enterprise inventory, the inventory level is still within a reasonable controllable range. There is a certain support for the Chinese market, and on the first day after the festival, some operators in the market hold a certain wait-and-see mood, and the enthusiasm of entering the market is not high. Specifically, the market price in the main producing areas has been raised narrowly, with the quotation on the southern route around 2350 yuan / ton, the low end asking, and the quotation on the northern line around 2420 yuan / ton, and the low end increasing by 30 yuan / ton. although enterprise inventory has increased during the holiday period, the overall inventory pressure is not great at present, and the manufacturers' price-raising mentality still exists. The market price in Shandong, the main consumer area, was adjusted in a narrow range, with 2660-2670 yuan / ton in southern Shandong, 20 yuan / ton in the low end, 2680-2720 yuan / ton in northern Shandong, and 10 yuan / ton in the low end. On the first day after the festival, the overall trading atmosphere in the market was light, and the wait-and-see mood of the industry remained. The market quotation in North China does not fluctuate much. today, Hebei quotes 2450-2690 yuan / ton, which is stable at the low end. at present, the inventory pressure of manufacturers in the region is not great, which has a certain support for the mentality of operators; Shanxi quotes today are 2340-2530 yuan / ton. at present, the inventory of methanol manufacturers is on the low side, and the willingness to lower the market quotation is not high.

Port market: today, methanol futures first suppress and then rise. Spot price shipping, rigid demand buying and selling; paper period current set of buying and selling negotiations, arbitrage buying and selling follow-up, the basis is strong, the deal is OK. Spot transaction: 2620-2630, basis 09: 85, basis: 2605-2615, basis: 09: 75, basis: 2605-2610, basis: 09: 65, transaction: 2580-2595, basis: 09: 50, margin: 53: 6: 2570, basis: 09: 28: 30.

|

Area |

2024/5/6 |

2024/4/30 |

Rise and fall |

|

The whole country |

2489.26 |

2487.62 |

1.64 |

|

Northwest |

2350-2420 |

2350-2420 |

0/0 |

|

North China |

2340-2690 |

2340-2690 |

0/0 |

|

East China |

2605-2730 |

2640-2740 |

-45/-10 |

|

South China |

2625-2740 |

2630-2750 |

-5/-10 |

|

Southwest |

2320-2550 |

2320-2480 |

0/70 |

|

Northeast China |

2500-2700 |

2500-2640 |

0/60 |

|

Shandong |

2680-2800 |

2680-2750 |

0/50 |

|

Central China |

2520-2750 |

2580-2750 |

-60/0 |

The future forecast: during the May Day holiday, due to the limited transportation, the inventory of manufacturers in some areas of China has increased, but due to the smoothness of the warehouse in front of the festival, the overall inventory of the market has maintained a controllable range, and the first phase of Rongxin equipment has been stopped on schedule. The supply side in the region has a certain favorable support, and when it comes back after the holiday, there may be some replenishment demand in the downstream market, and the market transaction may improve. However, we should also pay attention to the acceptance of downstream operators against the background of rising methanol prices. The spot quotation in the port market fell with the market, the number of Iranian shipments imported in May may increase, and individual olefin units are planned to be overhauled, and the market price trend of methanol in the port area is weak under the background of increasing demand and decreasing demand, and operators are more cautious and wait-and-see about the future. Generally speaking, under the supply and demand game, the short-term methanol market price is expected to fluctuate in a narrow range, but in the later stage, we should pay attention to the coal price, the downstream demand follow-up and the landing of the plant parking maintenance.