- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: may 6th V2409 contract opening price: 5906, highest price: 5947, lowest price: 5901, position: 887695, settlement price: 5924, yesterday settlement: 5944, down: 20, daily trading volume: 462832 lots, precipitated capital: 4.741 billion, capital outflow: 113 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 30th |

May 6th |

Rise and fall |

Remarks |

|

North China |

5450-5530 |

5450-5510 |

0/-20 |

Send to cash remittance |

|

East China |

5570-5670 |

5560-5640 |

-10/-30 |

Cash out of the warehouse |

|

South China |

5630-5680 |

5630-5680 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5400-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5550-5620 |

5550-5600 |

0/-20 |

Send to cash remittance |

|

Southwest |

5500-5620 |

5480-5600 |

-20/-20 |

Kuti / send to |

PVC spot market: Chinese PVC market mainstream transaction prices are mainly arranged in a narrow range, and the price adjustment on the first day after the festival is relatively cautious. Compared with the valuation, it fell by 20 yuan / ton in North China, 10-30 yuan / ton in East China, stable in South China, stable in Northeast China, 20 yuan / ton in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprises mostly maintain stable ex-factory prices, there is no obvious adjustment action, production enterprises wait and see the market. The fluctuation range of the narrow range arrangement of futures is small, the guidance to the spot market is not strong, and the futures price is relatively high, whether it is a single price or a point price inquiry, and the basis change is relatively small. Among them, East China basis offer 09 contract-(300-350), South China 09 contract-(250), North 09 contract-(550-600), Southwest 09 contract-(400). After the festival came back the spot market performance is relatively calm, the market, whether the production enterprises or middlemen and downstream all hold a certain wait-and-see mentality, the lower reaches of the goods are relatively cautious, trading continues to remain light today.

From the futures point of view: PVC2409 contract prices opened low and high, and the futures price showed a certain upward trend from the low point, but the highest point did not continue to break through after reaching 5947, but began to weaken slightly and rose slightly in the afternoon. 2409 contracts fluctuated in the range of 5901-5947 throughout the day, with a difference of 4609 contracts with an increase of 19744 positions, with 887695 positions so far, 05 contracts closing at 5746 and 35316 positions.

PVC Future Forecast:

Futures: & the operating range of nbsp; PVC2409 contract futures is relatively narrow, with only 46 points fluctuating throughout the day. In terms of transaction, the short opening of 24.2% is higher than that of 23.9%, and the number of long opening is about the same in the increase of more than 197,000 positions. The operation of the futures price shows a narrow candle chart, and the high point of the futures price shows three small declines since the festival. The technical level shows that the Bollinger belt (13, 13, 2) narrows, and the futures price runs through the middle track. The stimulation of the outer disk factors during the festival period was mentioned in the forecast before the festival, but there were no more directional factors as a whole, the first day after the festival opened smoothly, and the operation of the futures price continued to test the direction of the mid-track position in the short term. observe the fluctuations in the range of 5880-5980.

Spot aspect: spot market spot price and one-bite price coexist on the first day after the festival, but the performance of the transaction is light. On the one hand, the downstream wait-and-see mentality is strong, and the futures market on the first day after the festival does not see a more directional guidance, so the price base offer advantage is small, and the spot market with rigid demand has caused the current social inventory to remain high, delayed to get a good performance. At present, there are not many variables in the supply and demand level, the start-up load of PVC production enterprises is stable, and the rigid demand of downstream products enterprises is mainly purchasing, but the calcium carbide price has been slightly increased by 50 yuan / ton during the holiday period and today, but it has little impact on the overall period of the two cities, and the market still lacks sufficient guiding factors. In the outer disk, the price of the international crude oil futures market continued to fall as the US economic data was weak, the survey showed that the US service industry unexpectedly shrank in April, and the US April employment data was also weaker than expected, weakening the US economy and oil demand prospects. On the whole, in the short term, the spot market will continue to be mainly arranged in a narrow range.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 30th |

May 6th |

Rate of change |

|

V2409 collection |

5924 |

5934 |

10 |

|

|

Average spot price in East China |

5620 |

5600 |

-20 |

|

|

Average spot price in South China |

5655 |

5655 |

0 |

|

|

PVC2409 basis difference |

-304 |

-334 |

-30 |

|

|

V2501 collection |

6083 |

6095 |

12 |

|

|

V2409-2501 close |

-159 |

-161 |

-2 |

|

|

PP2409 collection |

7619 |

7529 |

-90 |

|

|

Plastic L2409 |

8494 |

8405 |

-89 |

|

|

V--PP basis difference |

-1695 |

-1595 |

100 |

|

|

Vmure-L basis difference of plastics |

-2570 |

-2471 |

99 |

|

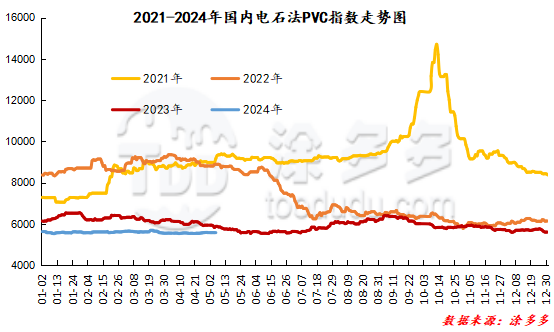

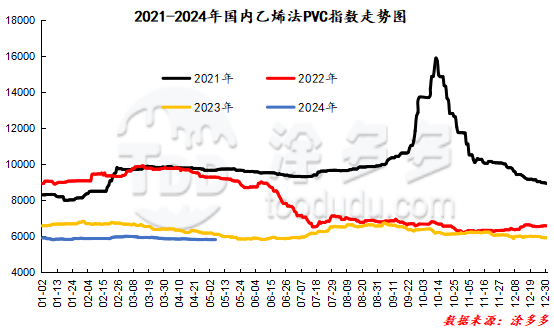

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 11.06% to 5572.69 on May 6, down 0.198%. The ethylene method PVC spot index was 5837.33, up 18.68%, with a range of 0.321%. The calcium carbide method index decreased, the ethylene method index rose, and the ethylene-calcium carbide index spread was 264.64.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.30 warehouse orders |

5.6 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,263 |

2,335 |

72 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

118 |

190 |

72 |

|

|

China Central Reserve Nanjing |

815 |

815 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,154 |

2,154 |

0 |

|

|

Zhenjiang Middle and far Sea |

561 |

561 |

0 |

|

|

Shanghai Zhongyuan Sea |

601 |

601 |

0 |

|

|

Middle and far sea in Jiangyin |

992 |

992 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,640 |

1,640 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

904 |

904 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

415 |

415 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

5,257 |

5,257 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,004 |

8,004 |

0 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,515 |

1,515 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

304 |

304 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

5,035 |

5,035 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

618 |

618 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

31,842 |

31,914 |

72 |

|

Total |

|

31,842 |

31,914 |

72 |

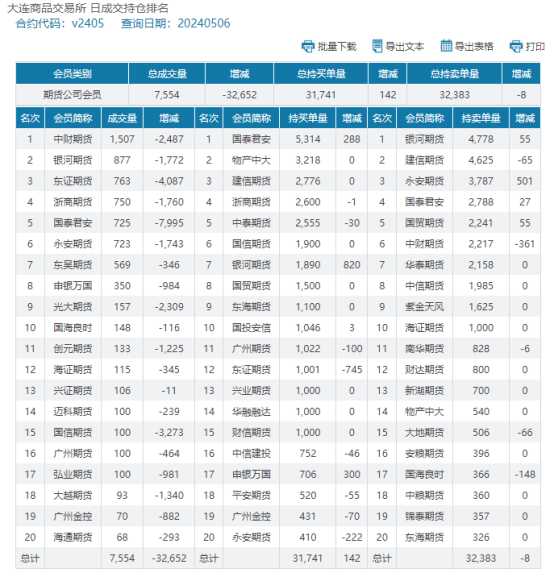

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.