- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

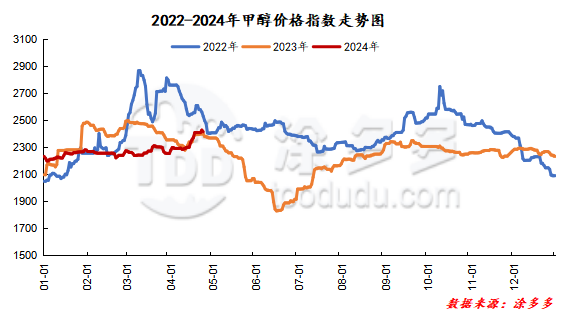

On April 30, the methanol market price index was 2487.62, up 17.31 from yesterday and 0.70 per cent month-on-month.

Outer disk dynamics:

Methanol closed on April 29:

China's CFR ranges from US $303 to US $313 per ton, up US $7 per ton

Us FOB 98-99 cents per gallon, flat

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 304.5-305.5 euros / ton, down 0.75 euros / ton.

Summary of today's prices:

Guanzhong: 2370-2420 (0), North Route: 2400-2420 (0), Lunan: 2680-2700 (30), Henan: 2580 (20), Shanxi: 2340-2520 (0), Port: 2640-2650 (20)

Freight:

North Route-Northern Shandong 240-320 (0ax 0), Northern Route-Southern Shandong 340-370 (0max 0), Southern Line-Northern Shandong 250-300 (0max 0), Guanzhong-Southwest Shandong 230-280 (0max 0)

Spot market: today, the methanol market price rose narrowly. Yesterday, some methanol enterprises in Shaanxi and Inner Mongolia were mainly auctioned at a premium, with a marked increase. At present, the inventory discharge process of manufacturers is smooth, and most of the pre-holiday inventory has fallen to a low level. Under the rise in the main producing areas, today, market prices in various regions have risen in different ranges. Specifically, the market price in the main producing areas is adjusted in a narrow range, with the quotation on the southern line around 2350 yuan / ton, the low end raised by 30 yuan / ton, and the quotation on the northern line around 2400-2420 yuan / ton. the recent load reduction operation of some devices in the main producing areas and subsequent maintenance expectations, the market supply side of the market is good support. The market price in Shandong, the main consumer, is adjusted in a narrow range, with southern Shandong 2680-2700 yuan / ton, low-end up 30 yuan / ton, northern Shandong 2690-2720 yuan / ton, and low-end down 10 yuan / ton. at present, the shipments of manufacturers in the region are good, mainly in low inventory. The market quotation in North China has been raised narrowly. Hebei quotation is 2450-2690 yuan / ton today, which is stable at the low end. at present, the inventory pressure of manufacturers in the region is not great, which has a certain support for the mentality of operators; Shanxi quotes today are 2340-2520 yuan / ton. at present, the inventory of methanol manufacturers is on the low side, and the willingness to lower the market quotation is not high.

Port market: methanol futures are highly volatile today. Spot rigid demand procurement; far month part of unilateral shipment, the basis is stable. The overall transaction throughout the day is not bad. Taicang main port transaction price: spot transaction: 2640-2650, base difference 09: 90: 5 transaction: 2620-2630, base difference 09: 65 swap: 70 transaction: 2595-2605, basis difference 09: 45: 6 transaction: 2570-2580, basis difference 09: 20.

|

Area |

2024/4/30 |

2024/4/29 |

Rise and fall |

|

The whole country |

2487.62 |

2470.31 |

17.31 |

|

Northwest |

2350-2420 |

2320-2420 |

30/0 |

|

North China |

2340-2690 |

2340-2600 |

0/90 |

|

East China |

2640-2740 |

2620-2730 |

30/10 |

|

South China |

2630-2750 |

2620-2730 |

10/20 |

|

Southwest |

2320-2480 |

2320-2480 |

0/0 |

|

Northeast China |

2500-2640 |

2500-2640 |

0/0 |

|

Shandong |

2680-2750 |

2650-2720 |

30/30 |

|

Central China |

2580-2750 |

2560-2750 |

20/0 |

Future forecast: at present, the pre-festival warehouse of the manufacturers in the Chinese market has been basically completed, the overall supply of negotiable goods in the main producing area is not much, and there is a maintenance plan for the market equipment in the later stage, and under the support of little supply pressure, the price in the Chinese market is up. The downstream market still maintains a rigid demand for replenishment, but methanol prices remain high, and the acceptance capacity of downstream high-priced goods is limited, coupled with the fact that pre-festival stock is coming to an end. The number of new orders in the market is limited, and the market operators have an obvious wait-and-see mood towards the future. At present, the quotation in the Chinese market is running high under the support of little supply pressure, and the consumption of rigid demand is mainly downstream. It is expected that the short-term methanol market price fluctuates in a narrow range, but in the later stage, we should pay attention to the coal price, the downstream demand follow-up and the landing of the plant parking maintenance.