- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC: futures have weakened from the high level, small positions have been reduced before the festival, and the spot market has weakened before the festival

PVC futures analysis: April 30th V2409 contract opening price: 5963, highest price: 5984, lowest price: 5911, position: 867951, settlement price: 5944, yesterday settlement: 5962, up: 18, daily trading volume: 710991 lots, precipitated capital: 4.628 billion, capital outflow: 204 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April twenty _ ninth |

April 30th |

Rise and fall |

Remarks |

|

North China |

5480-5560 |

5450-5530 |

-30/-30 |

Send to cash remittance |

|

East China |

5600-5690 |

5570-5670 |

-30/-20 |

Cash out of the warehouse |

|

South China |

5650-5700 |

5630-5680 |

-20/-20 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5400-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5580-5630 |

5550-5620 |

-30/-10 |

Send to cash remittance |

|

Southwest |

5500-5640 |

5500-5620 |

0/-20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices in various regions flexible small adjustment, and the emergence of pre-festival profit situation. Compared with the valuation, it fell by 30 yuan / ton in North China, 20-30 yuan / ton in East China, 20 yuan / ton in South China, stable in Northeast China, 10-30 yuan / ton in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprise factory price individual sporadic reduction of 20 yuan / ton, most enterprises stable price wait and see, immediately facing the May Day holiday, the price adjustment is not much, and the first generation of contracts are mainly based on basic quantity. Futures are relatively high and narrow, and merchants in various regions of the spot market adjust prices slightly according to their own conditions, and some areas make a small profit, but transactions in the spot market have not improved. Spot market price and one-mouth price coexist, and the basis changes little, including 09 contracts in East China-(330-390), 09 contracts in South China-(250), 09 contracts in North China-(600), and 09 contracts in Southwest China-(400). On the whole, there is room for negotiation in part of the spot market before the festival, the downstream purchasing enthusiasm is low, and the overall trading atmosphere is weak.

From a futures point of view: & the night futures price of the nbsp; PVC2409 contract rose slightly and fell after its peak of 5984. The trend of the price at the beginning of the morning trading is mainly volatile, but the overall trend of the futures price is slowly downward, and the afternoon price is further weaker. 2409 contracts range from 5911 to 5984 throughout the day, with a shortfall of 32321 positions in 73. 09 contracts. So far, 342481 positions have been held, 05 contracts closed at 5735, and positions are 36820 positions.

PVC Future Forecast:

Futures: & the futures price of nbsp; PVC2409 contract weakens slightly from the high point, but the overall fluctuation range is still running at a relatively high level. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) narrows, and the futures price breaks through the middle track from the high point to form a further small downward trend, showing a reduction of more than 32000 positions before the festival. Among them, in terms of transactions, the empty opening is 21.1% more than 19.0%, and the empty flat is 24.8% higher than Duoping 26.1%. The increase in Duoping has caused some downward pressure on the disk. Commodity sentiment closed at noon, with the main contracts of Chinese futures rising and falling each other. Pre-festival commodity trends vary, from the current operation of PVC, the short-term post-holiday market may show holiday price factors outside the market, but the return to fundamentals is expected to be narrowly sorted out.

Spot aspect: The performance of the spot market before the festival is light, although the price is adjusted frequently, but the downstream feedback of the spot market is relatively poor. On the one hand, there has always been no speculative demand for spot transactions, and the overall PVC social inventory in April has been at a high level. In addition, the demand constraints are relatively obvious, so the performance of the two cities has always been weak after the completion of the main contract changes. Approaching the May Day holiday, the spot market has not heard of small hoarding, so it can be seen that the downstream of the current narrow adjustment period of the two cities are not large feedback, China's PVC spot market lacks sufficient variable factors to stimulate. On the outer disk, the price of international crude oil futures market fell as the United States resumed diplomatic efforts to broker a ceasefire and hostage release agreement between Israel and Hamas. Hamas leaders have arrived in Cairo for a new round of talks with Egyptian and Qatari mediators. On the whole, the PVC spot market is waiting for the post-holiday market.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April twenty _ ninth |

April 30th |

Rate of change |

|

V2409 collection |

5980 |

5924 |

-56 |

|

|

Average spot price in East China |

5645 |

5620 |

-25 |

|

|

Average spot price in South China |

5675 |

5655 |

-20 |

|

|

PVC2409 basis difference |

-335 |

-304 |

31 |

|

|

V2501 collection |

6121 |

6083 |

-38 |

|

|

V2409-2501 close |

-141 |

-159 |

-18 |

|

|

PP2409 collection |

7636 |

7619 |

-17 |

|

|

Plastic L2409 |

8498 |

8494 |

-4 |

|

|

V--PP basis difference |

-1656 |

-1695 |

-39 |

|

|

Vmure-L basis difference of plastics |

-2518 |

-2570 |

-52 |

|

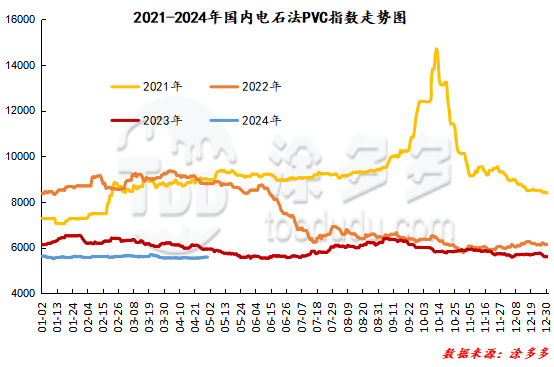

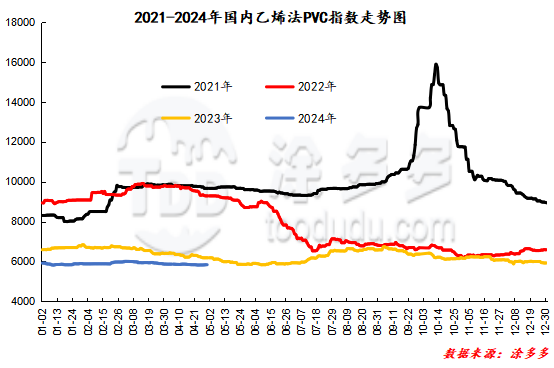

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 10.99, or 0.196%, to 5583.75 on April 30th. The ethylene method PVC spot index was 5818.65, down 16.62%, with a range of 0.285%. The calcium carbide index fell, the ethylene index dropped, and the ethylene-calcium carbide index spread was 234.9.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.29 warehouse orders |

4.30 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,159 |

2,263 |

104 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

118 |

118 |

0 |

|

|

China Central Reserve Nanjing |

711 |

815 |

104 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,859 |

2,154 |

295 |

|

|

Zhenjiang Middle and far Sea |

396 |

561 |

165 |

|

|

Shanghai Zhongyuan Sea |

471 |

601 |

130 |

|

|

Middle and far sea in Jiangyin |

992 |

992 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,640 |

144 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

904 |

120 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

415 |

415 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,905 |

5,257 |

352 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,094 |

8,004 |

1,910 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,298 |

1,515 |

217 |

|

Polyvinyl chloride |

Hangzhou port logistics |

184 |

304 |

120 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

4,975 |

5,035 |

60 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

618 |

618 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

300 |

600 |

300 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

300 |

150 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

28,070 |

31,842 |

3,772 |

|

Total |

|

28,070 |

31,842 |

3,772 |

The information provided in this report is for reference only.

Original: Pei Zhongxue