- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

Analysis of PVC futures: Futures will be closed on April 28.

Comprehensive price list by region: yuan/ton

|

areas |

April 26 |

April 28 |

rise and fall |

remarks |

|

North China |

5450-5540 |

5470-5550 |

20/10 |

Send it to cash transfer |

|

East China |

5580-5680 |

5600-5690 |

20/10 |

outbound cash exchange |

|

South China |

5610-5660 |

5630-5670 |

20/10 |

outbound cash exchange |

|

northeast |

5400-5600 |

5400-5600 |

0/0 |

Send it to cash transfer |

|

Huazhong |

5550-5600 |

5550-5600 |

0/0 |

Send it to cash transfer |

|

Southwest |

5470-5640 |

5470-5640 |

0/0 |

Kuti/delivered |

PVC spot market: Most mainstream transaction prices in China's PVC market are stable, with individual prices adjusting slightly. Comparison of valuations: Among them, North China is increased by 10-20 yuan/ton, East China is increased by 10-20 yuan/ton, and South China is increased by 10-20 yuan/ton. Northeast China is stable, Central China is stable, and Southwest China is stable. The ex-factory prices of most upstream PVC production companies have remained stable, and work is due to Sunday's replenishment. Most companies have not taken any action to adjust the ex-factory prices, and there are not many contract inquiries today. Futures are closed on Sundays and there are no guidelines for the spot market. Traders in various regions mostly make fine-tune quotations based on Friday's market conditions. In particular, there is a lack of guidance on futures. Most traders generally hold on to their one-price offers. The supply of low-priced goods in the spot market has decreased, and there is no basis for today's offers. However, downstream procurement enthusiasm is low, spot and real orders are rare, and there is still room for small discussions in some cases.

From the perspective of futures: Futures are closed.

PVC market outlook forecast:

Spot: Today's spot market lacks sufficient guiding guidance. First of all, the spot market has no basis for quotations. Although merchants choose to offer prices when there is no futures market, today's transaction was completed, and the part that just needs to be purchased will be taken downstream. Goods are not active, and although the May Day holiday is approaching, the spot market has not heard of hoarding behavior. High inventories caused by the game between supply and demand still exist and have become the norm. At present, the two markets are facing the May Day holiday immediately. It is expected that in the two working days before the festival, futures may have a market to reduce their positions and leave the market to avoid risks, while the spot market may gradually enter a light state before the festival. Overall, the PVC spot market before the holiday was in a narrow adjustment status.

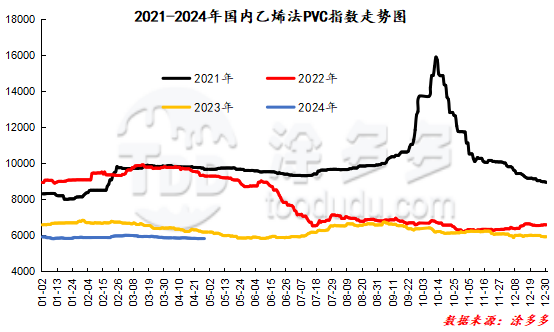

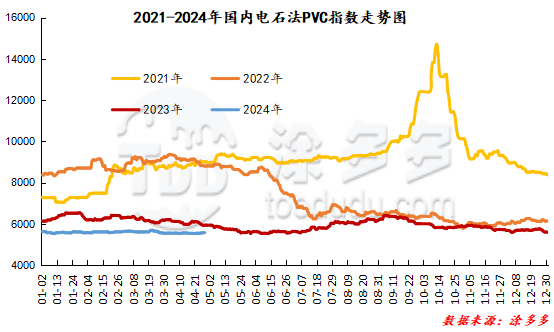

China's PVC Index: According to Tdd-global's data, China's calcium carbide PVC spot index on April 28 was 5,592.58, up 10.89, or 0.195%. The ethylene method PVC spot index was 5,832.19, down 10, or 0.172%. The calcium carbide method index rose, the ethylene method index rose, and the ethylene method index rose. The price difference between the ethylene method and calcium carbide method index was 239.61.

The information provided in this report is for reference only.