- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

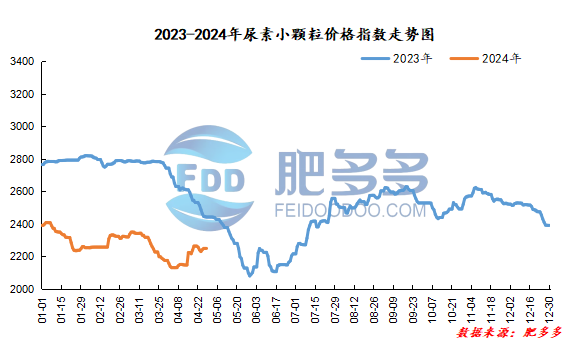

China Urea Price Index:

According to calculations from Feiduo data, the urea small pellet price index on April 28 was 2,250.14, an increase of 0.91 from the previous working day, a month-on-month increase of 0.04% and a year-on-year decrease of 7.87%.

Spot market analysis:

Today, China's urea market prices continued to rise, transactions slowed down slightly, and a large number of mainstream factories were ready to go. There was no sales pressure, and offers continued to be high and firm.

Specifically, prices in Northeast China have stabilized at 2,160 - 2,230 yuan/ton. Prices in East China rose to 2,240 - 2,280 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,250 - 2,350 yuan/ton, and the price of large particles rose to 2,260 - 2,280 yuan/ton. Prices in North China rose to 2,120 - 2,230 yuan/ton. Prices in South China rose to 2,300 - 2,400 yuan/ton. Prices in Northwest China fell to 2,030 - 2,120 yuan/ton. Prices in Southwest China are stable at 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, factories have received a large number of orders, and advance orders have gradually accumulated. With the support of waiting, although the May Day holiday is approaching, most manufacturers have little sales pressure in the short term, and the current high price fluctuations are mainly consolidated. In terms of the market, the number of new orders in the market has increased steadily recently, and the market trading atmosphere has been good. Under the influence of market sentiment, there is a strong bullish atmosphere among traders, and the market has sufficient motivation to hold prices. In terms of supply, early maintenance equipment has been restored one after another, and Nissan has improved within a narrow range. There are still planned maintenance of equipment stocks next month. The current industry supply is still relatively loose compared with the same period. In addition, corporate inventories continue to show a downward trend. On the demand side, during the summer fertilizer production period, the market's ability to consume raw material urea has increased, and downstream compound fertilizer factories are replenishing at low prices, and the follow-up atmosphere is better.

On the whole, the current sales pressure of urea plants has eased. With the support of a large amount of waiting, there is sufficient motivation to increase prices. Market demand just needs to be followed up by buying. It is expected that the urea market price will continue to remain high in the short term.