- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

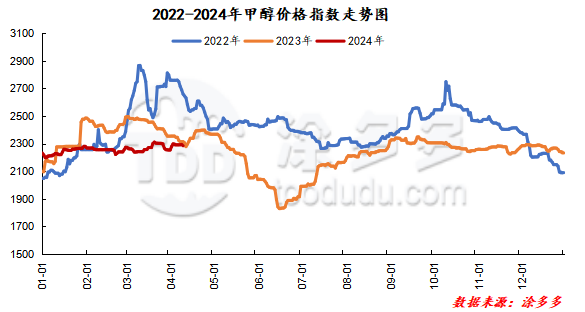

On April 22nd, the methanol market price index was 2407.63, which was 0.51 lower than the previous working day and 0.02% lower than the previous working day.

Outer disk dynamics:

On April 19, methanol closed:

China CFR 310-314 US dollars / ton, up 3 US dollars / ton

Us FOB 100-101cents per gallon, down 2 cents per gallon

Southeast Asian CFR 344-345 USD / ton, up 3 USD / tonne

European FOB 307-308 euros / ton, down 0.75 euros / ton.

Summary of today's prices:

Guanzhong: 2300-2340 (0), North Route: 2230-2270 (- 10), Lunan: 2620 (70), Henan: 2490-2535 (10), Shanxi: 2360-2470 (40), Port: 2670-2730 (- 20)

Freight:

Northern route-230-320 (10am 0), northern route-southern Shandong 340-370 (0amp 0), southern route-northern Shandong 240-290 (0amp Mui 10), Guanzhong-southwest Shandong 250-290 (10max 0)

Spot market: today, the methanol market price is adjusted in a narrow range, the futures market is rising and falling, the port spot market price is adjusted with the market, and the spot basis difference maintains a strong trend. at present, the overall supply pressure in the Chinese market is not great, and the manufacturers' quotation price mentality still exists. downstream rigid demand is mainly traded, and the market transaction atmosphere is good. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with the quotation on the southern line around 2210-2220 yuan / ton and the northern line around 2230-2270 yuan / ton. with the smooth delivery of goods, most of the factory inventory in the region has been reduced to a low level of operation. in addition, some downstream before the festival still has a certain reserve demand, the supply and demand side in the field performs well, and there is a certain support for the mentality of the operators. Market prices in Shandong, the main consumer, have been raised narrowly, with 2620 yuan / ton in southern Shandong and 2650 yuan / ton in northern Shandong. Recent factory shipments are good, boosting the mentality of operators and giving priority to higher prices under low inventory. The market quotation in North China has been raised narrowly. Hebei quotation is 2510-2540 yuan / ton today, which is 80 yuan / ton higher than that of the previous working day. Some of the downstream stocks are required before the festival, and the overall shipments of manufacturers are smooth. Shanxi quotes 2360-2470 yuan / ton today. Downstream manufacturers in the region have a high enthusiasm for pre-festival replenishment, and the market transaction atmosphere is positive.

Port market: methanol futures shock consolidation today. Spot on-demand procurement; forward part of the high shipments, arbitrage buy multi-contract negotiations, the basis of 05 stable, slightly stronger against 09. The overall transaction throughout the day is not bad. Taicang main port transaction price: spot transaction: 2705-2730, base difference 05: 90: 4 transaction: 2670-2695, base difference: 05: 55, margin: 60, transaction: 2640-2680, base difference: 05: 35, transaction price: 2620-2650, basis difference: 05: 12, basis: 2580-2610, basis difference: 09: 30.

|

Area |

2024/4/22 |

2024/4/19 |

Rise and fall |

|

The whole country |

2407.63 |

2408.14 |

-0.51 |

|

Northwest |

2210-2340 |

2240-2340 |

-30/0 |

|

North China |

2360-2540 |

2320-2480 |

40/60 |

|

East China |

2670-2790 |

2690-2780 |

-20/10 |

|

South China |

2660-2770 |

2670-2750 |

-10/20 |

|

Southwest |

2300-2460 |

2300-2460 |

0/0 |

|

Northeast China |

2500-2630 |

2440-2540 |

60/90 |

|

Shandong |

2550-2610 |

2550-2610 |

0/0 |

|

Central China |

2490-2680 |

2480-2680 |

10/0 |

Future forecast: this week is the last week before the May Day holiday, some downstream markets still have a certain reserve demand, coupled with the early main production areas manufacturers smooth shipments, inventory pressure is not great support, the Chinese market prices remain relatively high, but with methanol prices continue to rise, some downstream industry profits have been further compressed, and futures market high decline, some operators hold a certain wait-and-see mood. At present, it is expected that the short-term methanol market price will mainly be arranged in a narrow range, but in the later stage, we should pay attention to the operation of the unit meter in the Chinese market. At present, there are still plant maintenance plans in the Chinese market, but considering that the overall profit situation of coal-to-methanol is good, we should pay close attention to the parking and landing of the plant in the later stage.