Sinopec inventory: two-oil polyolefin inventory of 805000 tons, 5000 tons less than yesterday.

PP futures analysis: April 19 PP2405 opening price: 7610, highest price: 7720, lowest price: 7575, position: 407868 lots, settlement price: 7653, yesterday settlement: 7599, down: 2, daily trading volume: 691198 lots.

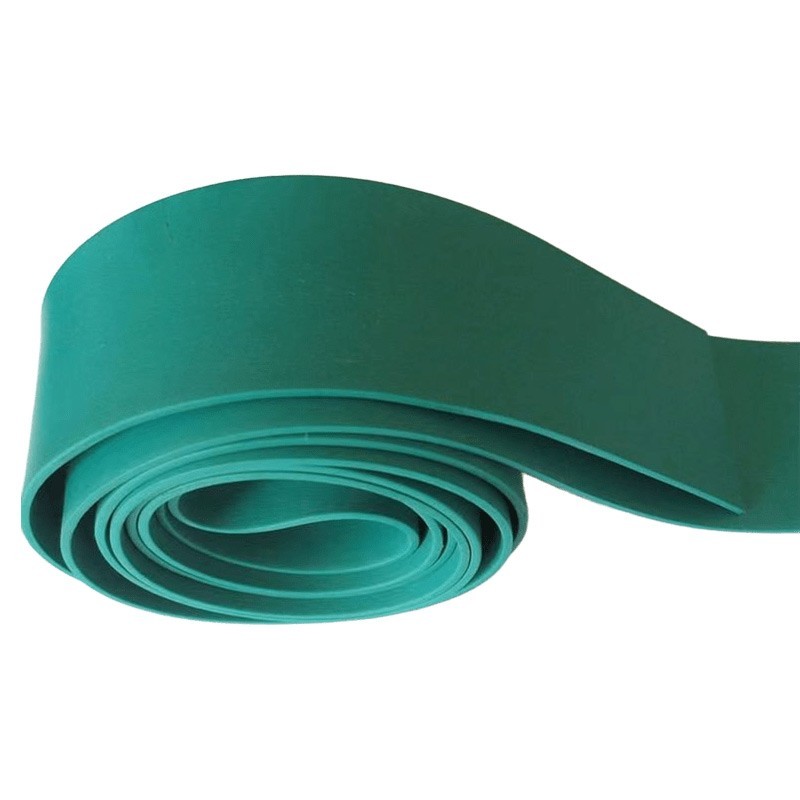

Mainstream quotation for wire drawing in PP market: yuan / ton

|

Region

|

April eighteenth

|

April nineteenth

|

Rise and fall

|

|

North China

|

7480-7600

|

7550-7650

|

70/50

|

|

East China

|

7530-7680

|

7570-7730

|

40/50

|

|

South China

|

7630-7670

|

7650-7730

|

20/60

|

PP China spot market analysis: today, China's PP market is significantly higher, China's mainstream wire drawing prices range from 7550 to 7730 yuan / ton, and daily increases range from 20 to 70 yuan / ton. On the face of the news, early Friday morning, explosions were heard in Isfahan in central Iran, Suwida province in southern Syria, and Baghdad and Babylon provinces in Iraq. WTI crude oil futures rose to 2 per cent at one point in Asian trading. At the same time, the PP futures market rose in a straight line after the opening of the day, and the disk set a recent stage high. For the spot market boost performance is obvious, traders take advantage of the opportunity to overreport, part of the day continuously raised quotations. At the same time, petrochemical and coal enterprises actively cooperate with the pull up, and the cost-side driving effect is strong. Downstream rigid demand to enter the market, catch up and take goods cautiously.

PP spot trend forecast: raw materials: crude oil disk continues to operate at a high level, pay attention to the geographical trend. Petrochemical policy: the two oil and coal enterprises began to increase, and the cost driver has become stronger. On the supply side: since late March, there has been an increase in equipment overhaul in China. In April, there are still many devices parking, including Zhejiang Sinopec, Shenhua Baotou and Datang. At the same time, the possibility of operating parking due to cost is not ruled out, and the market supply is expected to be reduced. On the demand side, the overall downstream demand is relatively stable, driving little in the short term. Under the comprehensive influence, it is expected that the short-term PP market is still high and strong.

China's PP index: according to Tudor data, China's PP spot index rose 45, or 0.59%, to 7647 on April 19.

China installation parking Summary:

|

Enterprise name

|

product line

|

Production capacity

|

Parking Duration

|

departure time

|

|

Dalian Petrochemical Corporation

|

Third line

|

5

|

August 2, 2006

|

To be determined

|

|

Wuhan Petrochemical Corporation

|

Old equipment

|

12

|

November 12, 2021

|

To be determined

|

|

Haiguolong oil

|

First line

|

20

|

February 8, 2022

|

To be determined

|

|

Haiguolong oil

|

Second line

|

35

|

April 3, 2022

|

To be determined

|

|

Tianjin Petrochemical Company

|

First line

|

6

|

August 1, 2022

|

To be determined

|

|

Jinxi Petrochemical

|

Single line

|

15

|

February 16, 2023

|

To be determined

|

|

Yanshan Petrochemical

|

Second line

|

7

|

September 18, 2023

|

To be determined

|

|

Shaoxing Sanyuan

|

New line

|

30

|

September 20, 2023

|

To be determined

|

|

Qinghai Salt Lake

|

Single line

|

16

|

October 27, 2023

|

To be determined

|

|

Changzhou Fude

|

Single line

|

30

|

November 1, 2023

|

To be determined

|

|

Jingbo polyolefin

|

First line

|

20

|

November 1, 2023

|

To be determined

|

|

Luoyang Petrochemical

|

First line

|

8

|

November 3, 2023

|

To be determined

|

|

Hongrun Petrochemical

|

Single line

|

45

|

December 6, 2023

|

To be determined

|

|

Qilu Petrochemical

|

Single line

|

7

|

December 23, 2023

|

To be determined

|

|

Lianhong Xinke

|

Second line

|

8

|

December 30, 2023

|

To be determined

|

|

Fujian Union

|

Old line

|

12

|

January 3, 2024

|

April 26, 2024

|

|

Gold energy chemistry

|

First line

|

45

|

March 8, 2024

|

To be determined

|

|

North China brocade

|

Old line

|

6

|

March 8, 2024

|

To be determined

|

|

Donghua Energy (Ningbo)

|

Second phase, second line.

|

40

|

March 20, 2024

|

April 20, 2024

|

|

Chinese Science Refining and Chemical Industry

|

First line

|

35

|

March 20, 2024

|

May 20, 2024

|

|

Chinese Science Refining and Chemical Industry

|

Second line

|

20

|

March 21, 2024

|

May 20, 2024

|

|

Dalian Petrochemical Corporation

|

Second line

|

7

|

March 31, 2024

|

May 10, 2024

|

|

Dalian Petrochemical Corporation

|

First line

|

20

|

March 31, 2024

|

May 10, 2024

|

|

Zhongyuan Petrochemical Company

|

First line

|

6

|

April 1, 2024

|

April 16, 2024

|

|

Zhejiang Petrochemical Corporation

|

First line

|

45

|

April 6, 2024

|

April 21, 2024

|

|

Fujian Union

|

Second line

|

22

|

April 14, 2024

|

April 17, 2024

|

|

Shenhua Baotou

|

Single line

|

30

|

April 16, 2024

|

May 15, 2024

|

|

Zhongjing Petrochemical

|

The second line of the first phase

|

50

|

April 16, 2024

|

To be determined

|

|

Haitian petrochemical

|

Single line

|

20

|

April 16, 2024

|

To be determined

|

|

Zhongyuan Petrochemical Company

|

Second line

|

10

|

April 17, 2024

|

To be determined

|

|

Donghua Energy (Ningbo)

|

The first phase

|

40

|

April 17, 2024

|

April 29, 2024

|

|

Sinopec

|

STPP

|

20

|

April 17, 2024

|

To be determined

|

Shenhua auction transaction: Shenhua Coal Chemical Industry today's auction volume of 2247 tons, an increase of 41.68% over yesterday; turnover of 2247 tons, an increase of 56.15% over yesterday, and a turnover rate of 100.00%, an increase of 9.27% over yesterday.