- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

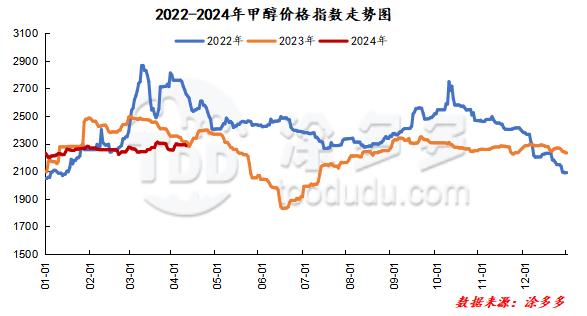

On April 16, the methanol market price index was 2355.54, up 23.31 from yesterday and 1 per cent higher than the previous month.

Outer disk dynamics:

Methanol closed on April 16:

China's CFR ranges from US $301 to US $306 per ton, up US $6 per ton.

Us FOB 99-100cents per gallon, flat

Southeast Asia CFR 341342USD / ton, Ping

European FOB 315.25-316.25 euros / ton, up 2.25 euros / ton.

Summary of today's prices:

Guanzhong: 2280-2290 (10), North Route: 2170-2200 (0), Lunan: 2500-2520 (0), Henan: 2430-2470 (30), Shanxi: 2320-2450 (10), Port: 26102645 (0)

Freight:

North Route-200-300 Northern Shandong (0Uniqure 10), Northern Route-Southern Shandong 340-370 (20amp 0), Southern Route-Northern Shandong 240-300 (10max 10), Guanzhong-Southwest Shandong 240-290 (20max 40)

Spot market: today, the price increase in the methanol market has slowed down, the futures market has fluctuated at a high level, the price of the spot market in the supporting port has been raised, and the basis continues to maintain a strong state, and the supply pressure of manufacturers in some areas of the Chinese market is not great. The price of supporting manufacturers is higher, and the trading situation of bidding enterprises in China is good today, with a large premium. Specifically, the market prices in the main producing areas have been raised in a narrow range, with the quotation on the southern route around 2220 yuan / ton and the northern line around 2170-2200 yuan / ton. the high volatility of the futures market has led to the market operators' quotation to maintain a high level, and the enthusiasm of the downstream market to enter the market for replenishment is OK. In the later stage, we need to pay attention to the maintenance of the equipment in the field. The market price in Shandong, the main consumer area, is adjusted in a narrow range, with southern Shandong 2500-2520 yuan / ton, northern Shandong 2440-2500 yuan / ton, low-end loosening 10 yuan / ton, methanol main futures market rising, coupled with the reduction of parking equipment in the region, in the short term, the supply is good to support, and the price in the support region has been raised. The market quotation in North China has been raised sharply. Hebei quotation is 2400 yuan / ton today, and the futures market trend is strong, which has a certain positive support for the Chinese market. Shanxi quotes 2320-2450 yuan / ton today, which is raised by 110yuan / ton at the low end. Methanol enterprise inventory mostly keeps low non-draining pressure, and methanol futures trend is strong, boosting the mentality of operators.

Port market: methanol futures were strong in the morning and fell in the afternoon. Spot purchase on demand, sellers are few. In the long term, a small amount of unilateral high selling and low suction, and the current basis is stable. The overall transaction throughout the day is not bad. Taicang main port transaction price:; spot / 4: 2625-2650, base difference 05: 80: 4 transaction: 2605-2630, basis difference 05: 55 pound 62: 5 transaction price: 2570-2590, basis difference 05: 20 shock 250960.

|

Area |

2024/4/16 |

2024/4/15 |

Rise and fall |

|

The whole country |

2355.54 |

2332.23 |

23.31 |

|

Northwest |

2170-2290 |

2170-2250 |

0/40 |

|

North China |

2320-2450 |

2210-2370 |

110/80 |

|

East China |

2610-2700 |

2610-2690 |

0/10 |

|

South China |

2630-2700 |

2620-2690 |

10/10 |

|

Southwest |

2300-2450 |

2310-2450 |

-10/0 |

|

Northeast China |

2440-2540 |

2350-2540 |

90/0 |

|

Shandong |

2440-2520 |

2450-2520 |

-10/0 |

|

Central China |

2430-2650 |

2400-2620 |

30/30 |

Future forecast: recently, the spring inspection of the Chinese market is steadily in progress. The 1.8 million-ton methanol plant in Shenhua Baotou was stopped for overhaul on April 15, and the methanol market supply is expected to shrink, and the overall inventory pressure of the manufacturers in the main producing areas is not great at present. To a certain extent, the market prices of the manufacturers have been raised, but due to the current rapid price increase, the profit margins of some downstream industries have been further compressed. Some downstream hold certain resistance to high prices. At present, it is less likely that the market price will continue to rise significantly, and it is expected that the methanol market price will be adjusted in a narrow range in the short term, but in the later stage, we should pay attention to the coal price, the landing of the spring inspection of various manufacturers and the follow-up of downstream demand.