- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

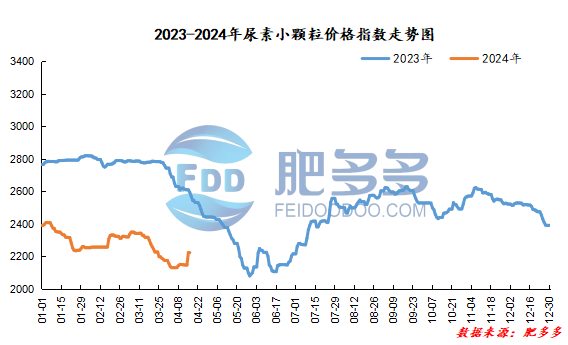

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on April 16 was 2,224.09, an increase of 0.91 from yesterday, a month-on-month increase of 0.04% and a year-on-year decrease of 14.27%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 1987, the highest price is 2002, the lowest price is 1962, the settlement price is 1979, and the closing price is 2001. The closing price is 7% higher than the settlement price of the previous trading day, and the month-on-month increase is 0.35%. The fluctuation range of the whole day is 1962-2002; the basis of the 09 contract in Shandong is 179; the 09 contract has increased its position by 12578 lots today, and so far, it has held 258796 lots.

Spot market analysis:

Today, China's urea market price increased slightly. After the company's quotation increase, the market's follow-up slowed down. The current quotation is mostly stable and consolidated, and the mentality is firm and wait and see.

Specifically, prices in Northeast China have stabilized at 2,200 - 2,260 yuan/ton. Prices in East China have stabilized at 2,170 - 2,220 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,140 - 2,300 yuan/ton, and the price of large particles stabilized at 2,180 - 2,220 yuan/ton. Prices in North China fell to 2020-2220 yuan/ton. Prices in South China fell to 2,300 - 2,360 yuan/ton. Prices in the northwest region are stable at 2,190 - 2,200 yuan/ton. Prices in Southwest China rose to 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, market transactions have increased recently, and manufacturers 'orders acquiring situation has improved again. Quotes are firm and stable under the current support of waiting. Ex-factory quotations of some manufacturers continue to increase, and market prices continue to rise. On the market side, recently stimulated by the export news policy, market trading activity has increased. However, with the continuous increase in Chinese quotations, the pace of chasing higher prices has slowed down, the follow-up of new orders in the market has become slightly weak, and the transaction atmosphere has weakened. On the supply side, the number of corporate troubleshooting has increased this week, and the industry's daily output has dropped within a narrow range. The decline in supply has had a certain positive impact on the market, and the decline in urea prices has been limited. On the demand side, the overall market demand is weak. As prices continue to rise, follow-up by downstream operators has slowed down. There are too many purchases that need to be followed up, and the purchase is maintained as soon as possible, and high-priced transactions are weak.

On the whole, after the current sharp increase in urea market prices, the market follow-up has slowed down. The downstream purchasing mentality is low and just needs to replenish, and the follow-up to high prices is weak. Under the influence of market sentiment, it is expected that urea prices will continue to rise in a short period of time. Make more arrangements and run.