- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

PVC futures analysis: April 8 V2405 contract opening price: 5765, highest price: 5816, lowest price: 5719, position: 715697, settlement price: 5782, yesterday settlement: 5798, down: 16, daily trading volume: 488785 lots, precipitated capital: 2.908 billion, capital outflow: 63.05 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 7th |

April 8th |

Rise and fall |

Remarks |

|

North China |

5470-5550 |

5450-5540 |

-20/-10 |

Send to cash remittance |

|

East China |

5540-5630 |

5520-5620 |

-20/-10 |

Cash out of the warehouse |

|

South China |

5610-5660 |

5590-5650 |

-20/-10 |

Cash out of the warehouse |

|

Northeast China |

5520-5640 |

5470-5620 |

-50/-20 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation, regional price adjustment. Compared with the valuation, it fell by 10-20 yuan / ton in North China, 10-20 yuan / ton in East China, 10-20 yuan / ton in South China, 20-50 yuan / ton in Northeast China, stable in Central China and stable in Southwest China. Upstream PVC production enterprises began to reduce the ex-factory price by 20-50 yuan / ton, but there are still some enterprises wait and see price stability. Futures are arranged in a narrow range and low before the low point is refreshed, the operation of the spot market is slightly weak, and the actual transaction is not good in the morning. At present, spot price and spot price coexist, including East China basis offer 05 contract-(250-280), South China 05 contract-(200), North 05 contract-(480-500), Southwest 05 contract-(250-370). Although the two quotation methods coexist, the transaction in the spot market is light, part of the price offer is slightly reduced, the high-price supply is difficult to close the transaction, the transaction is mainly concentrated in the low range, and the downstream purchasing enthusiasm is not high.

Futures point of view: PVC2405 contract after the start of early trading futures prices opened straight down, and the lowest point of 5719 refresh Prophase, the lowest point of futures repair, late afternoon futures prices back above 5800. 2405 contracts range from 5719 to 5816 throughout the day, with a spread of 97. 05. The contract reduced its position by 20206 hands and has held 715697 positions so far. The 2409 contract closed at 5950, with 441060 positions.

PVC Future Forecast:

Spot: period the weak operation of the two cities makes the spot market shipping rhythm is not good, today's offer upstream factory part of the reduction, and the enthusiasm of regional merchants is higher, but the transaction is light, downstream enterprises hang order position is generally low, even if there is a transaction is mainly rigid demand, PVC period is now the weakness of the two cities. PVC fundamentals VCM monomer, Taixing Xinpu VCM downgrade 50 today factory 5050-5100 acceptance, weekly pricing. At present, it is difficult to find various factors from the fundamentals, although the low valuation is the consensus of the current industrial chain, but the lack of guidance in the current two cities is not even as expected, the high point can not exceed the previous high position. The outer disk employment report released on Friday showed that the US labor market was strong: non-farm payrolls rose 303000 in March, the biggest monthly increase in nearly a year. Payrolls were revised up by 22000 in January and February. The unemployment rate fell slightly to 3.8% in March as expected, causing investors to expect the Fed to cut interest rates in June or July, driving the dollar stronger. On the whole, there are no obvious factors in the internal and external market, the PVC spot market is still dominated by low and narrow finishing.

Futures: & the low of the nbsp; PVC2405 contract futures price appeared before the refresh of the lowest point of 5719, first of all, from the transaction point of view, the short opening of 22.2% compared with 20.7% more, the disk showed a state of reducing positions, on the one hand, the 05 contract began to gradually change positions over time, on the other hand, the continued weak operation pattern led to the rapid disappearance of the rebound expectation of the 05 contract. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) all turn downward, and the trend of MACD dead forks at the daily level is obvious. At present, PVC fundamentals and macro factors are not enough to guide, so the current operation of the two cities may still maintain a horizontal state, and continue to observe the operating range of the low range between 5750 and 5850 in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 3rd |

April 8th |

Rate of change |

|

V2405 collection |

5768 |

5805 |

37 |

|

|

Average spot price in East China |

5570 |

5570 |

0 |

|

|

Average spot price in South China |

5610 |

5620 |

10 |

|

|

PVC2405 basis difference |

-198 |

-235 |

-37 |

|

|

V2409 collection |

5905 |

5950 |

45 |

|

|

V2405-2409 close |

-137 |

-145 |

-8 |

|

|

PP2405 collection |

7597 |

7589 |

-8 |

|

|

Plastic L2405 collection |

8319 |

8339 |

20 |

|

|

V--PP basis difference |

-1829 |

-1784 |

45 |

|

|

Vmure-L basis difference of plastics |

-2551 |

-2534 |

17 |

|

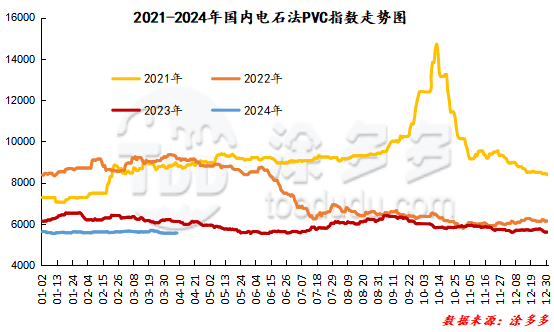

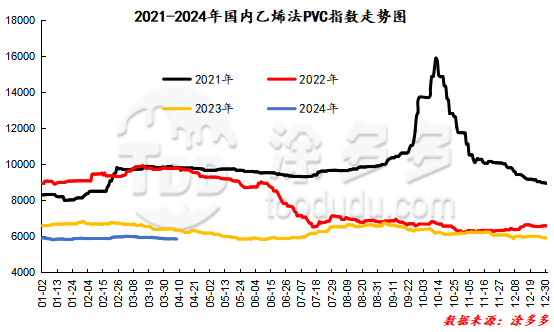

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 13.04 or 0.234% to 5553.34 on April 8. The ethylene PVC spot index was 5854.22, up 2.06, with a range of 0.035%, while the calcium carbide index decreased, the ethylene index rose, and the ethylene-calcium carbide index spread was 300.88.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.3 warehouse order volume |

4.8 warehouse order quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

276 |

276 |

0 |

|

|

China Central Reserve Nanjing |

276 |

276 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

490 |

919 |

429 |

|

|

Shanghai Zhongyuan Sea |

190 |

190 |

0 |

|

|

Middle and far sea in Jiangyin |

300 |

729 |

429 |

|

Polyvinyl chloride |

Zhejiang International Trade |

700 |

700 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

280 |

280 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

2,402 |

2,402 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

1,505 |

1,505 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

0 |

64 |

64 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,515 |

2,515 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

198 |

198 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

200 |

200 |

0 |

|

PVC subtotal |

|

8,650 |

9,143 |

493 |

|

Total |

|

8,650 |

9,143 |

493 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.