- Mall

- Supermarket

- Supplier

- Cross-Border Barter

- Industrial Data

- Warehouse Logistics

- Trade Assurance

- Expo Services

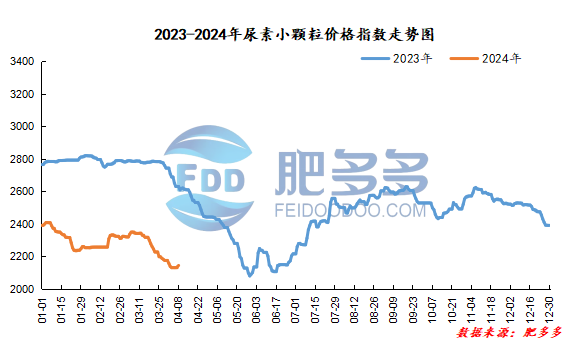

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on April 8 was 2,144.23, an increase of 8.18 from yesterday, a month-on-month increase of 0.38% and a year-on-year decrease of 18.48%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 1903, the highest price is 1918, the lowest price is 1883, the settlement price is 1901, and the closing price is 1899. Compared with the settlement price of the previous trading day, up 1.01% month-on-month. The fluctuation range of the whole day is 1883-1918; the basis of the 05 contract in Shandong region is 171; the 05 contract has increased its position by 4958 lots today, and so far, it has held 195319 lots.

Spot market analysis:

Today, China's urea market prices continued to increase slightly. After the holiday, companies received better orders, and prices rose slightly.

Specifically, prices in Northeast China have stabilized at 2,090 - 2,170 yuan/ton. Prices in East China rose to 2,050 - 2,130 yuan/ton. The price of small and medium-sized particles in Central China rose to 2010- 2,300 yuan/ton, and the price of large particles rose to 2,160 - 2,200 yuan/ton. Prices in North China rose to 1,950 - 2,140 yuan/ton. Prices in South China rose to 2,230 - 2,260 yuan/ton. Prices in the northwest region are stable at 2,090 - 2,100 yuan/ton. Prices in Southwest China are stable at 2,050 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, some factories received orders after the holiday. With the support of orders to be issued by manufacturers, the quotations were slightly increased and consolidated. During successive shipments, the company's inventory was in a state of removal. In terms of the market, market trading sentiment improved after the holiday, with more downstream follow-up and replenishment at low prices. However, the overall ability to catch up with high prices is limited, and purchases are expected to gradually weaken with the increase in prices. On the supply side, although some units have been overhauled and suspended in recent days, the industry's Nissan still maintains a high level of operation. Some units still have maintenance plans in the short term, and Nissan may continue to decline in a narrow range. On the demand side, downstream demand continues to advance, but the overall purchasing sentiment remains cautious. Agriculture is sporadic to cover up positions, with slight increases expected, but the pursuit is limited; industrial downstream compound fertilizer factories are cautious in preparing fertilizer, and the start of construction has declined, and the demand for raw material procurement has weakened. The mentality is temporarily waiting and see.

On the whole, the current urea market is following up on low-priced low-price orders after the holiday. The market sentiment has improved and the market has risen slightly. However, the overall downstream pursuit is limited. It is expected that the urea market price will rise slightly in a short period of time and then stabilize.